Liquidating trusts can be established in various circumstances. Among the more common are where business assets are placed in trust for the benefit of creditors of an insolvent business or where the sole owner of a going business dies leaving no heir capable or willing to continue it. If the primary purpose of the trust is to liquidate the business in orderly fashion by disposing of the assets as soon as is reasonably possible, the liquidating trust will be taxed as an ordinary trust and not as a corporation.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

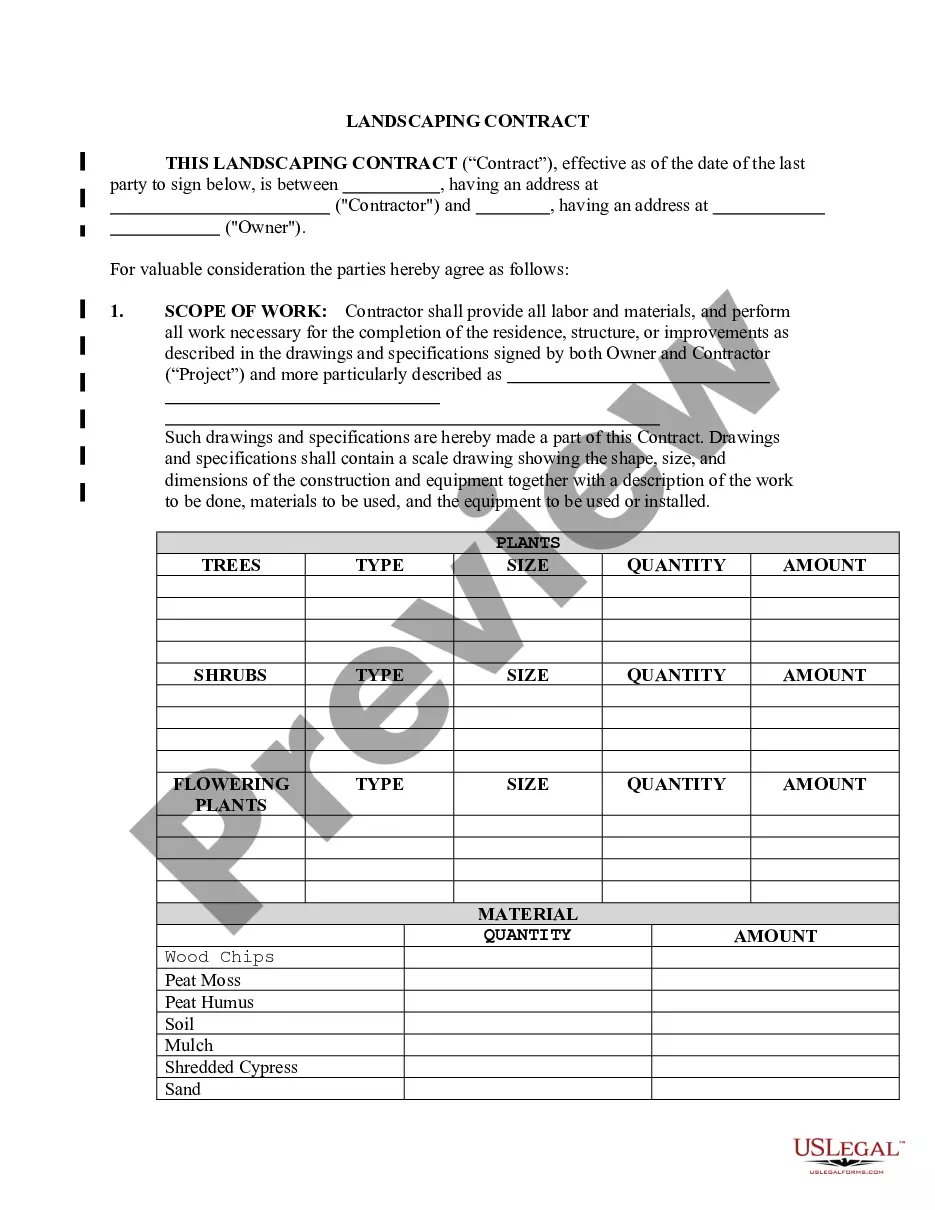

The Cook Illinois Liquidating Trust Agreement is a legally binding document that outlines the terms and conditions surrounding the liquidation process of Cook Illinois Corporation, a transportation company based in Illinois. This agreement serves as a roadmap for the dissolution and distribution of the company's assets to its creditors and shareholders. The primary objective of the Cook Illinois Liquidating Trust Agreement is to maximize the recovery value for the stakeholders involved in the liquidation proceedings. It ensures that the company's assets are fairly distributed among the parties with valid claims, in accordance with the applicable bankruptcy laws and regulations. The Cook Illinois Liquidating Trust Agreement establishes the Cook Illinois Liquidating Trust, which serves as a separate legal entity responsible for handling the liquidation process. The trust is primarily governed by a trustee, who is appointed to oversee the administration of the trust and ensure compliance with the terms outlined in the agreement. The agreement outlines the various types of claims that creditors can file against the trust, such as secured claims, unsecured claims, priority claims, and administrative expense claims. Each type of claim has its own priority and level of repayment, which is determined based on the bankruptcy code and the terms specified in the agreement. Additionally, the Cook Illinois Liquidating Trust Agreement may specify different classes of claims, each with its own level of priority and repayment terms. These classes typically include secured creditors, unsecured creditors, and shareholders. By categorizing claims into classes, the agreement ensures a fair and equitable distribution of assets among the various stakeholders. It is worth noting that there may be different versions or types of Cook Illinois Liquidating Trust Agreements, depending on the specific circumstances of the liquidation of Cook Illinois Corporation. These variations may arise from factors such as the nature and extent of the company's debts, the value of its assets, and the overall financial situation of the company. In conclusion, the Cook Illinois Liquidating Trust Agreement is a crucial legal document that governs the liquidation process of Cook Illinois Corporation. It provides a framework for the fair distribution of assets to creditors and shareholders, aiming to maximize recovery value for stakeholders. The agreement may vary depending on the specific circumstances of the liquidation and encompasses different types or classes of claims, each with its own priority and repayment terms.The Cook Illinois Liquidating Trust Agreement is a legally binding document that outlines the terms and conditions surrounding the liquidation process of Cook Illinois Corporation, a transportation company based in Illinois. This agreement serves as a roadmap for the dissolution and distribution of the company's assets to its creditors and shareholders. The primary objective of the Cook Illinois Liquidating Trust Agreement is to maximize the recovery value for the stakeholders involved in the liquidation proceedings. It ensures that the company's assets are fairly distributed among the parties with valid claims, in accordance with the applicable bankruptcy laws and regulations. The Cook Illinois Liquidating Trust Agreement establishes the Cook Illinois Liquidating Trust, which serves as a separate legal entity responsible for handling the liquidation process. The trust is primarily governed by a trustee, who is appointed to oversee the administration of the trust and ensure compliance with the terms outlined in the agreement. The agreement outlines the various types of claims that creditors can file against the trust, such as secured claims, unsecured claims, priority claims, and administrative expense claims. Each type of claim has its own priority and level of repayment, which is determined based on the bankruptcy code and the terms specified in the agreement. Additionally, the Cook Illinois Liquidating Trust Agreement may specify different classes of claims, each with its own level of priority and repayment terms. These classes typically include secured creditors, unsecured creditors, and shareholders. By categorizing claims into classes, the agreement ensures a fair and equitable distribution of assets among the various stakeholders. It is worth noting that there may be different versions or types of Cook Illinois Liquidating Trust Agreements, depending on the specific circumstances of the liquidation of Cook Illinois Corporation. These variations may arise from factors such as the nature and extent of the company's debts, the value of its assets, and the overall financial situation of the company. In conclusion, the Cook Illinois Liquidating Trust Agreement is a crucial legal document that governs the liquidation process of Cook Illinois Corporation. It provides a framework for the fair distribution of assets to creditors and shareholders, aiming to maximize recovery value for stakeholders. The agreement may vary depending on the specific circumstances of the liquidation and encompasses different types or classes of claims, each with its own priority and repayment terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.