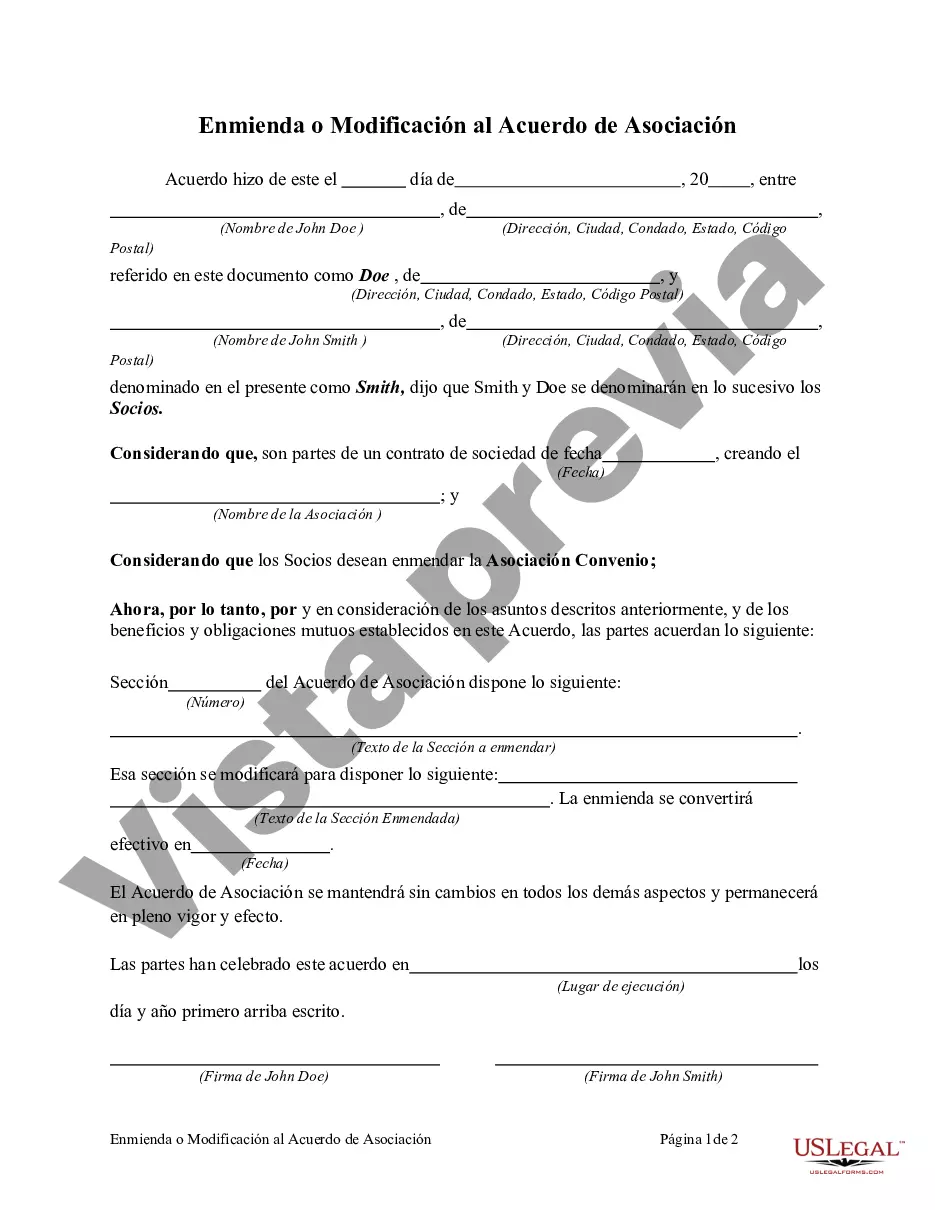

This form is an amendment or modification to a partnership agreement

Clark Nevada amendment or modification to partnership agreement refers to a legal provision that allows partners in a business partnership based in Clark County, Nevada, to change or update the terms and conditions of their partnership agreement. This amendment process is crucial when partners need to adapt to new circumstances, resolve disputes, or reflect changes in their business operations. There are various types of Clark Nevada amendment or modification to partnership agreement, each serving a specific purpose: 1. Name Change Amendment: This amendment focuses on altering the name of the partnership, whether it involves rebranding, updating legal requirements, or reflecting a change in ownership. 2. Capital Contribution Amendment: This type of amendment pertains to changes in partners' capital contributions, such as adjusting the initial financial contributions, increasing or decreasing capital shares, or addressing additional capital requirements. 3. Profit and Loss Sharing Amendment: Partners may use this amendment to modify how profits and losses are allocated among the partners. It can involve adjusting percentage shares, introducing new profit-sharing ratios, or changing the method of distribution. 4. Partnership Duration Amendment: Sometimes, partners may wish to extend or terminate the partnership's duration, necessitating an amendment to the original agreement. This may occur due to changes in partners' long-term goals, business plans, or external regulatory requirements. 5. Decision-Making Amendment: This type of amendment deals with modifying the decision-making process within the partnership. It may involve changes in voting rights, the introduction of new decision-making mechanisms, or altering the thresholds required for certain decisions. 6. Admission and Withdrawal Amendment: When new partners join or existing partners leave the partnership, this amendment ensures that the partnership agreement reflects the updated composition. It includes provisions for admission criteria, withdrawal processes, buyout terms, and the impact on capital shares. 7. Dissolution and Liquidation Amendment: If partners decide to dissolve the partnership or prepare for its liquidation, an amendment to the partnership agreement becomes necessary. This may address the distribution of assets, liabilities, winding-up processes, and the appointment of liquidators. It is crucial for partners in a Clark Nevada partnership to consult with legal professionals and draft a comprehensive amendment or modification to ensure the changes align with state laws, accurately reflect the partners' intentions, and protect the rights and interests of all parties involved.Clark Nevada amendment or modification to partnership agreement refers to a legal provision that allows partners in a business partnership based in Clark County, Nevada, to change or update the terms and conditions of their partnership agreement. This amendment process is crucial when partners need to adapt to new circumstances, resolve disputes, or reflect changes in their business operations. There are various types of Clark Nevada amendment or modification to partnership agreement, each serving a specific purpose: 1. Name Change Amendment: This amendment focuses on altering the name of the partnership, whether it involves rebranding, updating legal requirements, or reflecting a change in ownership. 2. Capital Contribution Amendment: This type of amendment pertains to changes in partners' capital contributions, such as adjusting the initial financial contributions, increasing or decreasing capital shares, or addressing additional capital requirements. 3. Profit and Loss Sharing Amendment: Partners may use this amendment to modify how profits and losses are allocated among the partners. It can involve adjusting percentage shares, introducing new profit-sharing ratios, or changing the method of distribution. 4. Partnership Duration Amendment: Sometimes, partners may wish to extend or terminate the partnership's duration, necessitating an amendment to the original agreement. This may occur due to changes in partners' long-term goals, business plans, or external regulatory requirements. 5. Decision-Making Amendment: This type of amendment deals with modifying the decision-making process within the partnership. It may involve changes in voting rights, the introduction of new decision-making mechanisms, or altering the thresholds required for certain decisions. 6. Admission and Withdrawal Amendment: When new partners join or existing partners leave the partnership, this amendment ensures that the partnership agreement reflects the updated composition. It includes provisions for admission criteria, withdrawal processes, buyout terms, and the impact on capital shares. 7. Dissolution and Liquidation Amendment: If partners decide to dissolve the partnership or prepare for its liquidation, an amendment to the partnership agreement becomes necessary. This may address the distribution of assets, liabilities, winding-up processes, and the appointment of liquidators. It is crucial for partners in a Clark Nevada partnership to consult with legal professionals and draft a comprehensive amendment or modification to ensure the changes align with state laws, accurately reflect the partners' intentions, and protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.