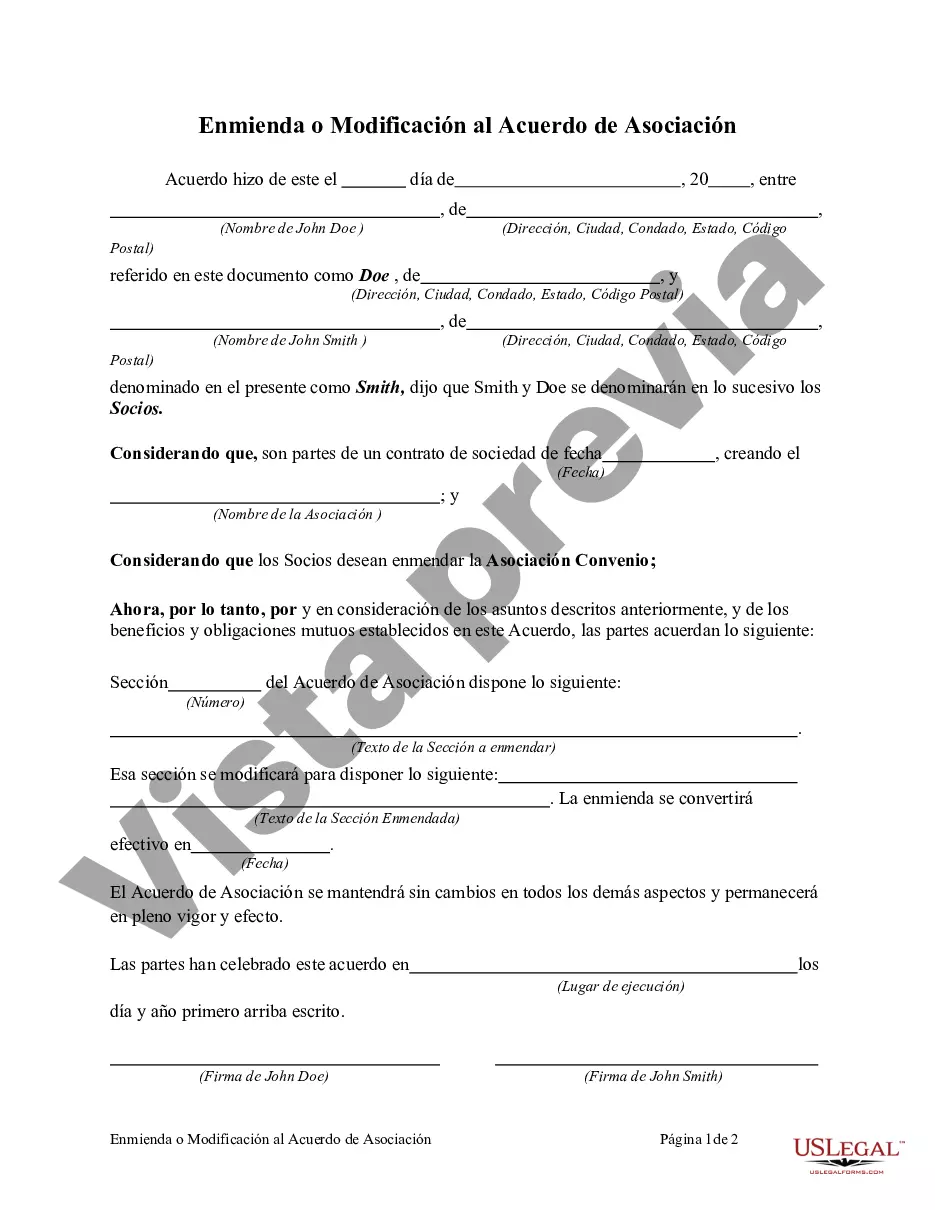

This form is an amendment or modification to a partnership agreement

Cook Illinois Amendment or Modification to Partnership Agreement refers to a legal process that allows partners within a partnership agreement to make changes or modifications to the original agreement. This amendment or modification ensures that the partnership can adapt to new circumstances or address any concerns that may arise during the course of the partnership. Several types of Cook Illinois Amendment or Modification to Partnership Agreement can be categorized based on the nature of changes made, including: 1. Capital Contribution Amendment: This type of amendment or modification involves changing the capital contributions that partners make to the partnership. It may include increasing or decreasing the amount of capital contributed by partners as agreed upon. 2. Profit and Loss Sharing Amendment: Partners can make modifications to the way profits and losses are shared among them. This may include altering the percentage of profits or losses allocated to each partner or modifying the method of distribution. 3. Admission of New Partners Amendment: When a partnership desires to include new partners, an amendment to the partnership agreement is necessary. This type of amendment outlines the terms and conditions associated with admitting new partners into the partnership. 4. Withdrawal or Removal of Partners Amendment: If a partner wishes to withdraw from the partnership or if a partner needs to be removed due to certain circumstances, an amendment is needed to detail the process, consequences, and any financial arrangements involved. 5. Dissolution or Termination Amendment: In case partners decide to dissolve or terminate the partnership, an amendment to the partnership agreement is required to outline the procedure, distribution of assets, and any remaining liabilities. 6. Management and Decision-Making Amendment: Some amendments focus on changing the management structure, decision-making processes, or voting rights within the partnership. This type of amendment ensures that the partnership can adapt to evolving needs or address any issues related to governance. 7. Duration or Term Amendment: In certain cases, partners may wish to extend or shorten the duration of the partnership. This type of amendment outlines the revised duration or term of the partnership. By implementing a Cook Illinois Amendment or Modification to Partnership Agreement, partners can maintain a dynamic and flexible partnership that aligns with their evolving needs and circumstances. Professional legal advice is essential when considering or executing any amendment or modification to ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.