A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Travis Texas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property: A Comprehensive Guide In the state of Texas, married couples are subject to community property laws, which essentially categorize all assets acquired during the marriage as jointly owned. However, there are instances where spouses may wish to convert this community property into separate property, generally to provide protection or clarify ownership rights. This is where a Travis Texas Transmutation or Postnuptial Agreement comes into play. A Transmutation or Postnuptial Agreement refers to a legal document that allows couples to alter the status of their assets from community property to separate property. This agreement ensures that specific assets, income, or future acquisitions can be designated as separate, allowing spouses to maintain individual ownership and control. In Travis County, Texas, there are a few different types of Transmutation or Postnuptial Agreements available: 1. Transmutation to Separate Property Agreement: This type of agreement is utilized when one spouse wants to convert their community property interest in a certain asset or assets into separate property. For example, a spouse may want to convert a business they solely operate into separate property. 2. Income Conversion Agreement: This agreement aims to convert income, derived from community property sources, into separate property. It enables individuals to retain earnings from a business, royalties, or investments as separate property, rather than being subjected to community property laws. 3. Partial Transmutation Agreement: This agreement allows spouses to designate specific assets or income as separate property while retaining other assets as community property. For instance, a couple may decide to convert a vacation home they individually owned before marriage into separate property, while keeping their jointly acquired residence as community property. 4. Full Transmutation Agreement: As the name implies, this agreement converts the entire community property estate into separate property. It effectively terminates all community property rights and allows both spouses to own their assets separately going forward. When considering a Travis Texas Transmutation or Postnuptial Agreement, it is crucial to consult with an experienced family law attorney. They can provide guidance in drafting the agreement, ensuring compliance with Texas law, and addressing any unique circumstances and concerns that may arise. In conclusion, a Travis Texas Transmutation or Postnuptial Agreement is a valuable legal tool that enables spouses to convert community property into separate property according to their needs. Whether it involves a specific asset, income, or the entire estate, these agreements provide clarity and protection for both individuals involved. To ensure the agreement is valid and enforceable, seeking qualified legal advice is essential.Travis Texas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property: A Comprehensive Guide In the state of Texas, married couples are subject to community property laws, which essentially categorize all assets acquired during the marriage as jointly owned. However, there are instances where spouses may wish to convert this community property into separate property, generally to provide protection or clarify ownership rights. This is where a Travis Texas Transmutation or Postnuptial Agreement comes into play. A Transmutation or Postnuptial Agreement refers to a legal document that allows couples to alter the status of their assets from community property to separate property. This agreement ensures that specific assets, income, or future acquisitions can be designated as separate, allowing spouses to maintain individual ownership and control. In Travis County, Texas, there are a few different types of Transmutation or Postnuptial Agreements available: 1. Transmutation to Separate Property Agreement: This type of agreement is utilized when one spouse wants to convert their community property interest in a certain asset or assets into separate property. For example, a spouse may want to convert a business they solely operate into separate property. 2. Income Conversion Agreement: This agreement aims to convert income, derived from community property sources, into separate property. It enables individuals to retain earnings from a business, royalties, or investments as separate property, rather than being subjected to community property laws. 3. Partial Transmutation Agreement: This agreement allows spouses to designate specific assets or income as separate property while retaining other assets as community property. For instance, a couple may decide to convert a vacation home they individually owned before marriage into separate property, while keeping their jointly acquired residence as community property. 4. Full Transmutation Agreement: As the name implies, this agreement converts the entire community property estate into separate property. It effectively terminates all community property rights and allows both spouses to own their assets separately going forward. When considering a Travis Texas Transmutation or Postnuptial Agreement, it is crucial to consult with an experienced family law attorney. They can provide guidance in drafting the agreement, ensuring compliance with Texas law, and addressing any unique circumstances and concerns that may arise. In conclusion, a Travis Texas Transmutation or Postnuptial Agreement is a valuable legal tool that enables spouses to convert community property into separate property according to their needs. Whether it involves a specific asset, income, or the entire estate, these agreements provide clarity and protection for both individuals involved. To ensure the agreement is valid and enforceable, seeking qualified legal advice is essential.

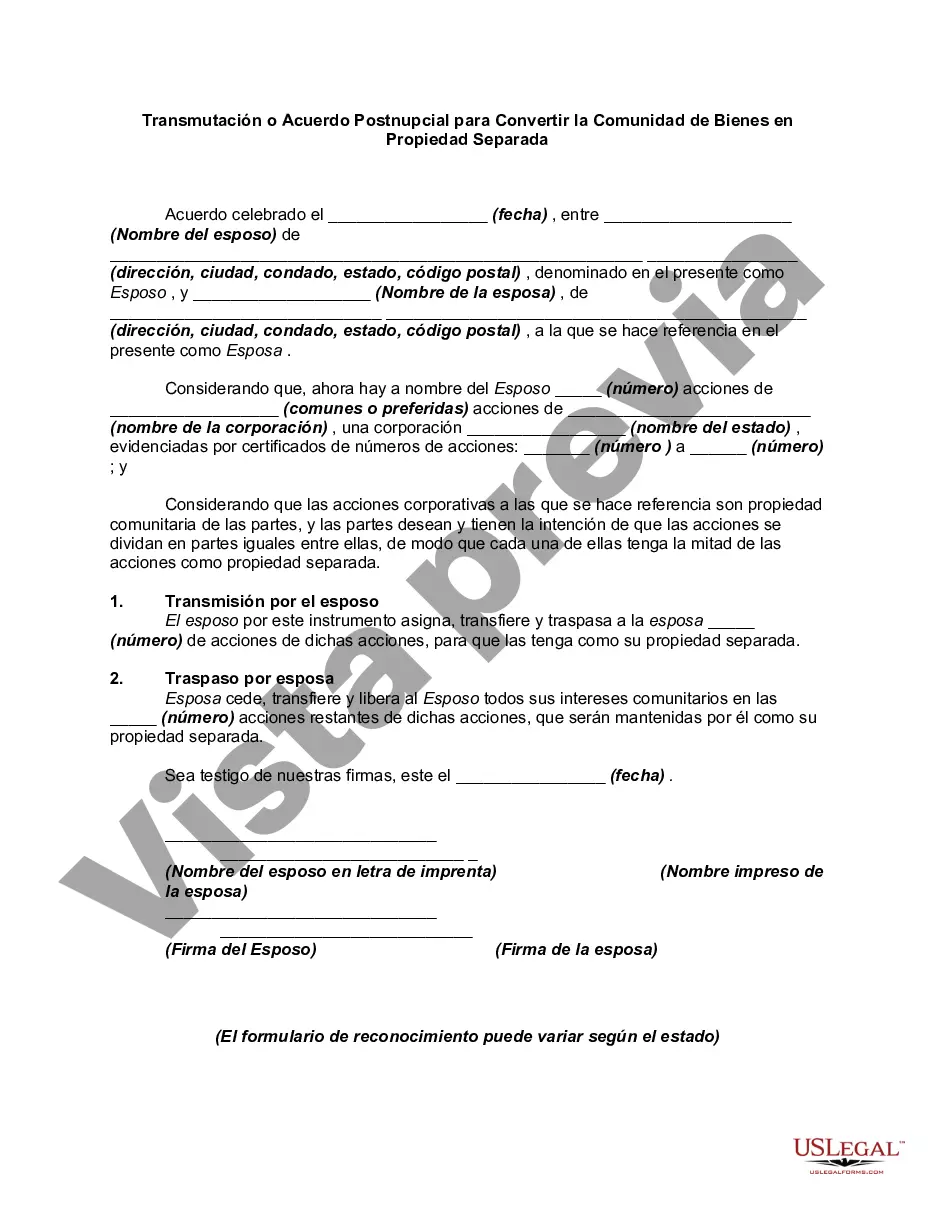

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.