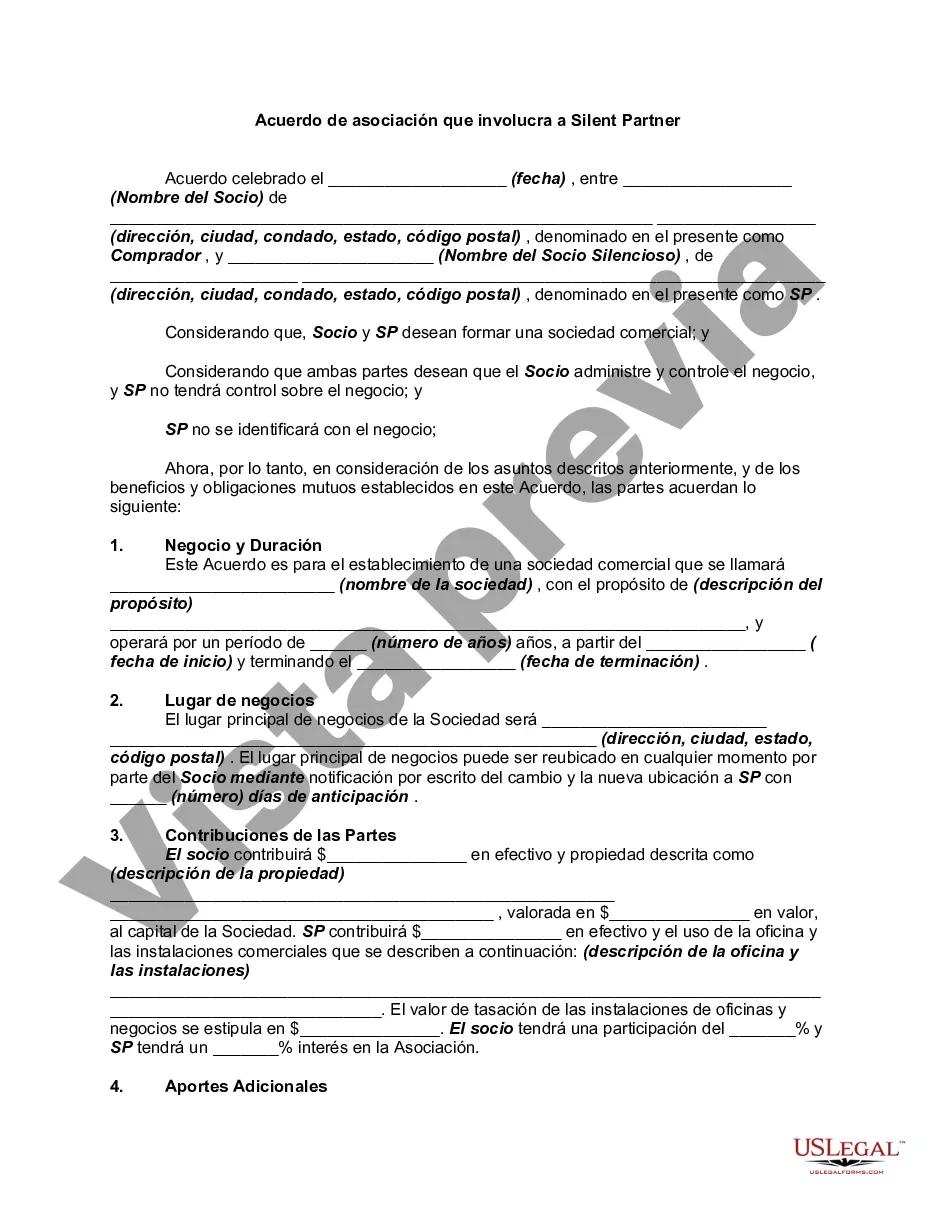

Chicago Illinois Partnership Agreement Involving Silent Partner is a legally binding contract that outlines the terms and conditions between two or more parties who intend to establish a partnership in Chicago, Illinois. In this agreement, there is a provision for a silent partner, also known as a sleeping partner or minority partner, who contributes capital to the partnership but does not actively participate in the day-to-day operations or management of the business. This type of partnership agreement is commonly used in various industries, including real estate, investment firms, and startups, where one party wants to provide financial support without being involved in the decision-making process. The agreement governs the rights, responsibilities, and obligations of all partners, including the silent partner. The Chicago Illinois Partnership Agreement Involving Silent Partner typically includes key elements such as: 1. Name and Purpose: The legal entity name of the partnership and a clear description of the purpose or objectives for which the partnership is formed. 2. Contributions: The initial capital contribution made by each partner, including the monetary value provided by the silent partner. This section also outlines the distribution of profits and losses among partners. 3. Roles and Responsibilities: The division of duties and responsibilities between active partners and the silent partner. It specifies that the silent partner will not be involved in managing day-to-day operations, decision-making, or representing the partnership without prior consent. 4. Decision-Making: The process for making key decisions in the partnership, including voting rights, consensus requirements, or specific matters that require consultation with the silent partner. 5. Profit Sharing and Losses: The allocation of profits and losses among partners, including how profits will be distributed and losses will be shared. It may specify a preferred return for the silent partner before profit distribution to active partners. 6. Capital Accounts: This section outlines how capital accounts will be maintained, updated, and adjusted for any additional contributions or withdrawals by partners. 7. Exit Strategies: Procedures for dissolution, withdrawal, or exit of any partner, including the silent partner, and the impact of such exits on the partnership's operations and finances. Different types or variations of Chicago Illinois Partnership Agreement Involving Silent Partner may include: 1. Limited Partnership Agreement: This agreement involves a general partner who actively manages the partnership and is responsible for its liabilities, while the silent partner acts as a limited partner, contributing capital but not participating in management. 2. Real Estate Partnership Agreement: This type of agreement is specifically tailored for partnerships involved in real estate investment, development, or property management, where the silent partner provides capital for the ventures. 3. Strategic Partnership Agreement: This involves a collaboration between two businesses, where one party acts as the silent partner and provides financial support to further mutual business objectives. In summary, a Chicago Illinois Partnership Agreement Involving Silent Partner establishes the terms, rights, and responsibilities between partners in a partnership where one party contributes capital without active participation. The agreement safeguards the interests of all partners and ensures a clear understanding of the partnership's operations and expectations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de asociación que involucra a Silent Partner - Partnership Agreement Involving Silent Partner

Description

How to fill out Chicago Illinois Acuerdo De Asociación Que Involucra A Silent Partner?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life scenario, finding a Chicago Partnership Agreement Involving Silent Partner suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Apart from the Chicago Partnership Agreement Involving Silent Partner, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Chicago Partnership Agreement Involving Silent Partner:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Partnership Agreement Involving Silent Partner.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!