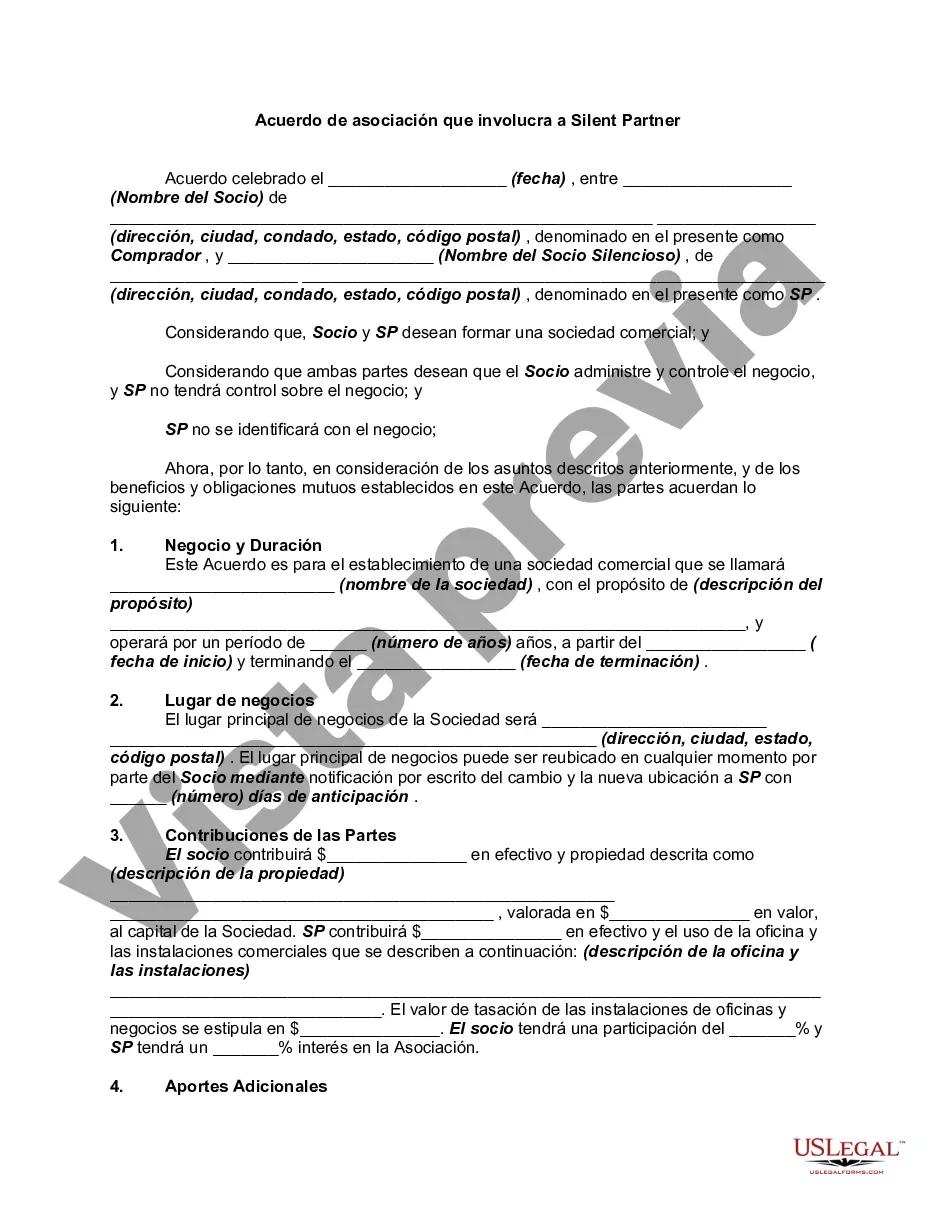

Cuyahoga Ohio Partnership Agreement Involving Silent Partner: A Comprehensive Overview Introduction: A Cuyahoga Ohio Partnership Agreement Involving Silent Partner is a legally binding document that outlines the terms, conditions, and obligations governing a business partnership in Cuyahoga County, Ohio, in which one party assumes the role of a silent partner. The silent partner, also known as a sleeping partner, contributes capital into the partnership but does not actively participate in the day-to-day operations or decision-making process. Instead, they enjoy limited liability while sharing in the profits and losses based on the agreed-upon terms. Here, we will explore the details of this agreement, its benefits, and different types if applicable. Key Components of a Cuyahoga Ohio Partnership Agreement: 1. Identification: The agreement begins with the identification of all parties involved, including the general partner(s) responsible for managing the partnership and the silent partner(s) contributing capital without active involvement. 2. Capital Contribution: The agreement specifies the amount and mode of capital contribution made by the silent partner(s) towards the partnership, whether in monetary form or other assets. It also outlines any limitations or conditions associated with future contributions. 3. Profit and Loss Distribution: The agreement defines the method for distributing profits and losses among the partners, whether based on capital contribution or through different ratios agreed upon. 4. Decision-Making Authority: As the silent partner does not actively participate in the partnership's operations, the agreement outlines the decision-making authority of the general partner(s), specifying areas where the silent partner's consent may be required, such as major financial decisions or business expansion. 5. Limited Liability: A significant advantage of being a silent partner is limited liability. The agreement clearly establishes the extent to which the silent partner's liability is restricted, enabling them to shield personal assets from business-related obligations. 6. Dispute Resolution: In the event of disagreements or disputes, the agreement provides a mechanism for resolving conflicts, such as mediation or arbitration, to avoid costly legal proceedings. 7. Dissolution and Exit Strategy: The Cuyahoga Ohio Partnership Agreement Involving Silent Partner also covers provisions for partnership dissolution, including procedures for exiting the partnership, selling interests, or admitting new silent partners if desired. Types of Cuyahoga Ohio Partnership Agreement Involving Silent Partner: While it is not uncommon for variations to exist, one notable type of Cuyahoga Ohio Partnership Agreement involving a silent partner is: 1. Limited Partnership (LP): This type of partnership consists of at least one general partner who is actively involved in the business's operations and is personally liable for the partnership's debts and obligations. The silent partner, in contrast, maintains limited liability and is not responsible for the partnership's day-to-day management or any debts beyond their initial investment. Conclusion: A Cuyahoga Ohio Partnership Agreement Involving Silent Partner is a crucial legal instrument that regulates the partnership dynamics between the active and silent partners, ensuring clarity, transparency, and protection for all parties involved. By outlining the terms of capital contribution, profit distribution, liability, decision-making authority, and dispute resolution, this agreement enables a fair and mutually beneficial partnership, fostering successful business ventures in Cuyahoga County, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo de asociación que involucra a Silent Partner - Partnership Agreement Involving Silent Partner

Description

How to fill out Cuyahoga Ohio Acuerdo De Asociación Que Involucra A Silent Partner?

Draftwing forms, like Cuyahoga Partnership Agreement Involving Silent Partner, to manage your legal affairs is a challenging and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents crafted for different cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Cuyahoga Partnership Agreement Involving Silent Partner form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Cuyahoga Partnership Agreement Involving Silent Partner:

- Ensure that your document is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Cuyahoga Partnership Agreement Involving Silent Partner isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and get the document.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!