Title: Understanding Harris Texas Partnership Agreement Involving Silent Partner Introduction: A Harris Texas Partnership Agreement Involving Silent Partner is a legally binding document that outlines the terms and conditions governing a partnership involving at least one active partner and one silent partner. This arrangement is commonly used in businesses seeking additional capital or expertise without the silent partner participating in the day-to-day management or decision-making processes. This article aims to provide a comprehensive overview of the various aspects and types of Harris Texas Partnership Agreement Involving Silent Partners. Key Points: 1. Definition and Role of a Silent Partner: — A silent partner, also known as a sleeping partner or limited partner, is an individual or entity that provides financial investment to a partnership. — Unlike active partners, silent partners typically have no involvement in the daily business operations or decision-making processes. 2. Types of Harris Texas Partnership Agreement Involving Silent Partner: a) General Partnership with Silent Partner: — In this partnership agreement, the silent partner is not personally liable for the partnership's debts. — The silent partner enjoys a share of profits based on the agreed-upon profit-sharing ratio. — The active partner(s) have complete authority in managing the business. b) Limited Partnership: — A limited partnership typically consists of one or more general partners (active partners) and one or more limited partners (silent partners). — General partners are liable for the partnership's debts, while limited partners bear limited liability up to their investment amount. — Limited partners generally do not participate in managing the business but enjoy a share of profits. c) Limited Liability Partnership (LLP) with Silent Partner: — An LLP offers limited liability protection to all partners involved. — Silent partners contribute financially but have no involvement in the day-to-day management of the partnership. — Profits and losses are typically shared in accordance with the partnership agreement. 3. Key Elements of a Partnership Agreement Involving Silent Partner: a) Contribution: Clearly define the capital contribution of each partner, specifying the silent partner's financial commitment. b) Management Authority: Explicitly outline the authority and decision-making power of active partners. c) Profit-Sharing: Define how profits and losses will be distributed among partners, especially the silent partner. d) Withdrawal and Dissolution: Include provisions to address situations where a partner wishes to withdraw or dissolve the partnership. Conclusion: In a Harris Texas Partnership Agreement Involving Silent Partner, the silent partner provides crucial financial support while remaining non-participatory in the operational aspects. Clarifying the roles, liabilities, profit-sharing ratios, and management authority are vital components of such agreements. Whether it's a general partnership, limited partnership, or limited liability partnership, entering into a well-structured partnership agreement ensures clarity, transparency, and protection for all parties involved.

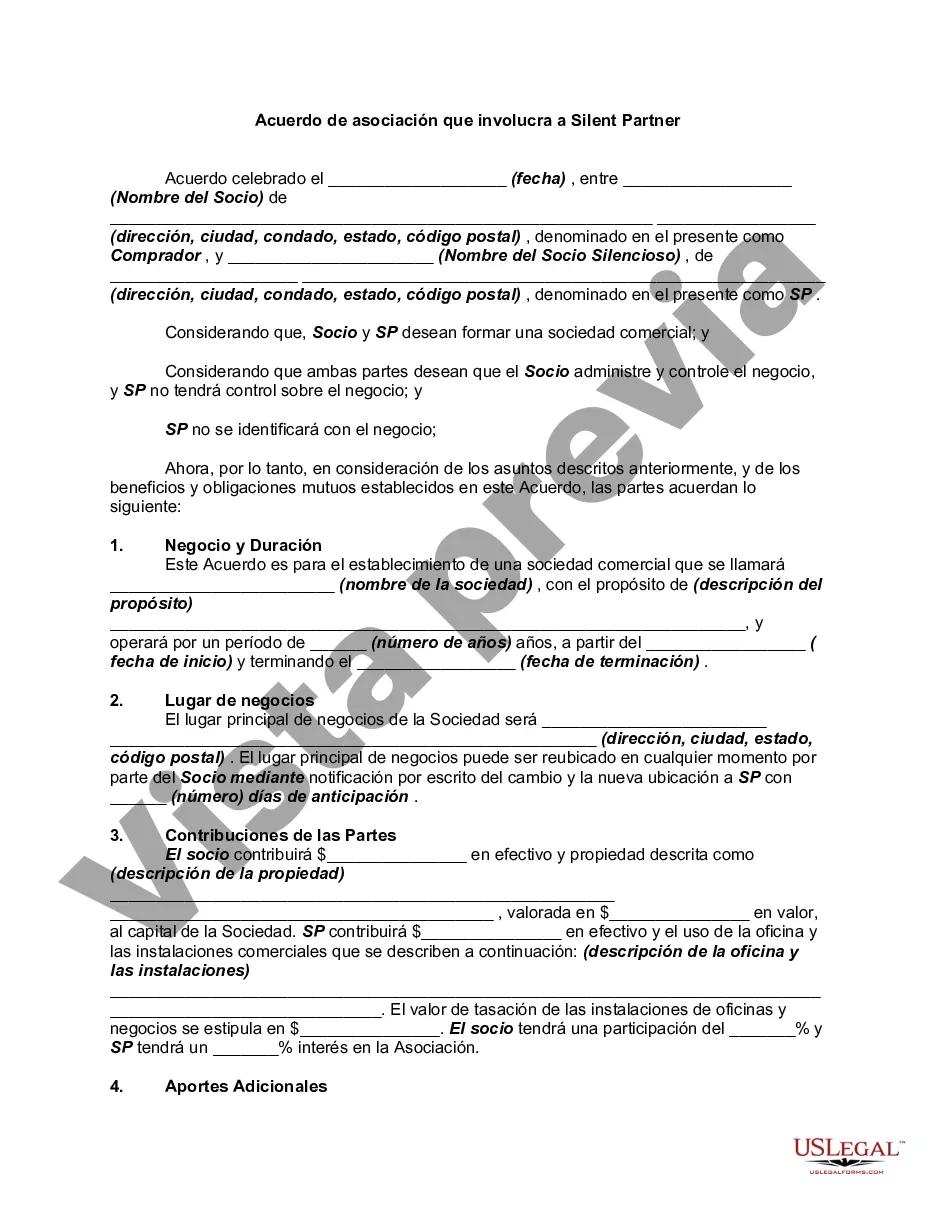

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de asociación que involucra a Silent Partner - Partnership Agreement Involving Silent Partner

Description

How to fill out Harris Texas Acuerdo De Asociación Que Involucra A Silent Partner?

If you need to get a reliable legal form supplier to obtain the Harris Partnership Agreement Involving Silent Partner, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support team make it simple to get and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Harris Partnership Agreement Involving Silent Partner, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Harris Partnership Agreement Involving Silent Partner template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Harris Partnership Agreement Involving Silent Partner - all from the comfort of your home.

Sign up for US Legal Forms now!