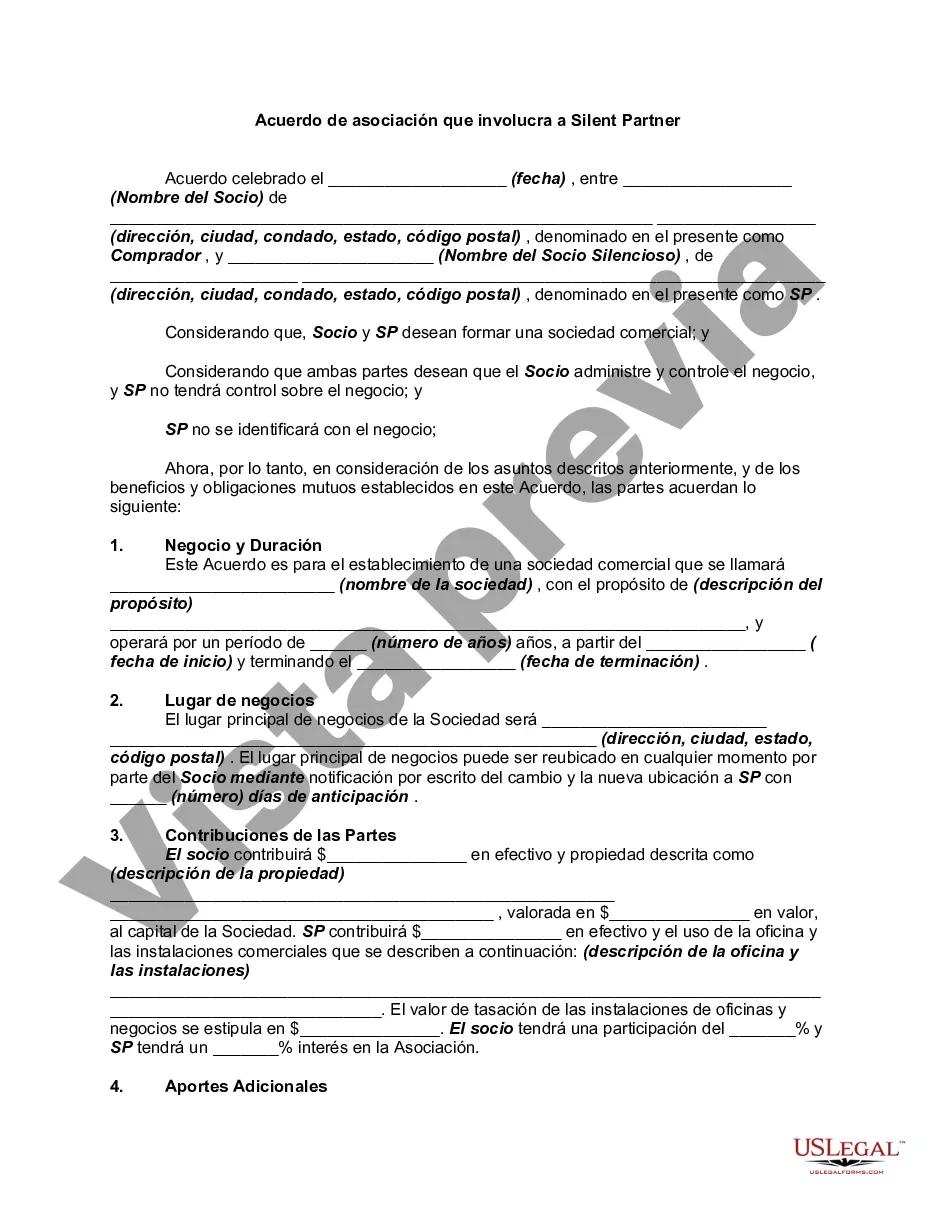

Riverside California Partnership Agreement Involving Silent Partner A Riverside California Partnership Agreement involving a silent partner refers to a legally binding document that outlines the terms and conditions of a business partnership in the Riverside area, where one partner, known as the silent partner, provides capital or resources to a partnership but does not participate in the day-to-day operations or decision-making process. This kind of partnership allows for the allocation of financial resources while minimizing the involvement and liability of the silent partner. Types of Riverside California Partnership Agreement Involving Silent Partner: 1. General Partnership Agreement: This agreement refers to a partnership where two or more individuals come together to initiate and run a business collectively. In this type of partnership, the silent partner does not actively participate in managing the business but contributes financially to its operations. 2. Limited Partnership Agreement: This agreement involves two types of partners, general partners and limited partners. General partners take on the responsibility of managing the business and can be personally liable for its debts and obligations, while limited partners act as silent partners, providing capital and sharing profits but having limited liability. 3. Limited Liability Partnership Agreement (LLP): This agreement provides a combination of features from general and limited partnerships. It allows all partners to have limited liability, which means their personal assets are protected from the business's debts or liabilities. The silent partner in an LLP is not directly involved in running the partnership but provides financial support. Key elements found in a Riverside California Partnership Agreement Involving Silent Partner: 1. Partnership Name and Purpose: Clearly define the name of the partnership and its primary purpose or business objective. 2. Contributions: Specify the capital, assets, or resources that the silent partner will provide to the partnership. 3. Profit and Loss Distribution: Outline the distribution of profits and losses among partners, including the proportionate share the silent partner is entitled to receive. 4. Decision Making and Management: Define the roles and responsibilities of the active partner(s) in managing the business and any limitations on the involvement of the silent partner. 5. Liability and Indemnification: Clarify the extent of liability for each partner, ensuring the silent partner's limited liability status is acknowledged and understood. 6. Dispute Resolution: Establish methods for resolving disputes, such as through mediation or arbitration, to avoid potential conflicts that might arise during the partnership. 7. Dissolution: Outline the process for dissolving the partnership, including how assets and liabilities will be divided among the partners. In summary, a Riverside California Partnership Agreement involving a silent partner is a legal document that allows a silent partner to invest capital or resources in a partnership without being actively involved in its management. Different types of partnership agreements, such as general partnerships, limited partnerships, and limited liability partnerships, can be adapted to accommodate a silent partner's involvement and liability preferences. Such agreements are crucial for establishing clear guidelines and protecting the interests of all partners involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Acuerdo de asociación que involucra a Silent Partner - Partnership Agreement Involving Silent Partner

Description

How to fill out Riverside California Acuerdo De Asociación Que Involucra A Silent Partner?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Riverside Partnership Agreement Involving Silent Partner without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Riverside Partnership Agreement Involving Silent Partner on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Riverside Partnership Agreement Involving Silent Partner:

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!