This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Collin Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale of a business by its sole proprietor in Collin County, Texas. This agreement serves as a binding contract between the buyer and the seller, ensuring a smooth transaction of business assets. Key elements covered in the Collin Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement include: 1. Parties involved: Clearly identifies the buyer (acquirer) and the seller (sole proprietor) involved in the transaction. 2. Purchase price: Specifies the agreed-upon monetary value at which the assets are being sold. 3. Assets included: Lists all the assets being transferred, such as tangible assets (equipment, inventory, real estate) and intangible assets (trademarks, customer lists, patents). 4. Liabilities and obligations: Determines which liabilities will be assumed by the buyer and which will be retained by the seller. 5. Terms of payment: Outlines the payment method, whether it is a lump sum or installment payments, and the schedule of these payments. 6. Conditions of sale: Describes any specific conditions that must be met before the sale is finalized, such as obtaining necessary permits or licenses. 7. Non-compete agreement: May include a non-compete clause, which restricts the seller from starting a similar business within a defined geographical area and for a specified duration. 8. Representations and warranties: Both parties make representations and warranties about the accuracy and completeness of information provided and their authority to enter into the agreement. 9. Confidentiality: Ensures that sensitive business information remains confidential and is not disclosed to third parties. 10. Dispute resolution: Establishes the process by which any disputes or disagreements related to the agreement will be resolved, such as through mediation or arbitration. Different variations of the Collin Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may exist based on specific business types, sizes, or additional clauses included. Some common variations may include: 1. Collin Texas General Form of Agreement for Sale of Retail Business by Sole Proprietor — Asset Purchase Agreement. 2. Collin Texas General Form of Agreement for Sale of Service Business by Sole Proprietor — Asset Purchase Agreement. 3. Collin Texas General Form of Agreement for Sale of Restaurant by Sole Proprietor — Asset Purchase Agreement. These variations address the unique aspects and considerations related to different types of businesses being sold by a sole proprietor in Collin County, Texas.The Collin Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale of a business by its sole proprietor in Collin County, Texas. This agreement serves as a binding contract between the buyer and the seller, ensuring a smooth transaction of business assets. Key elements covered in the Collin Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement include: 1. Parties involved: Clearly identifies the buyer (acquirer) and the seller (sole proprietor) involved in the transaction. 2. Purchase price: Specifies the agreed-upon monetary value at which the assets are being sold. 3. Assets included: Lists all the assets being transferred, such as tangible assets (equipment, inventory, real estate) and intangible assets (trademarks, customer lists, patents). 4. Liabilities and obligations: Determines which liabilities will be assumed by the buyer and which will be retained by the seller. 5. Terms of payment: Outlines the payment method, whether it is a lump sum or installment payments, and the schedule of these payments. 6. Conditions of sale: Describes any specific conditions that must be met before the sale is finalized, such as obtaining necessary permits or licenses. 7. Non-compete agreement: May include a non-compete clause, which restricts the seller from starting a similar business within a defined geographical area and for a specified duration. 8. Representations and warranties: Both parties make representations and warranties about the accuracy and completeness of information provided and their authority to enter into the agreement. 9. Confidentiality: Ensures that sensitive business information remains confidential and is not disclosed to third parties. 10. Dispute resolution: Establishes the process by which any disputes or disagreements related to the agreement will be resolved, such as through mediation or arbitration. Different variations of the Collin Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may exist based on specific business types, sizes, or additional clauses included. Some common variations may include: 1. Collin Texas General Form of Agreement for Sale of Retail Business by Sole Proprietor — Asset Purchase Agreement. 2. Collin Texas General Form of Agreement for Sale of Service Business by Sole Proprietor — Asset Purchase Agreement. 3. Collin Texas General Form of Agreement for Sale of Restaurant by Sole Proprietor — Asset Purchase Agreement. These variations address the unique aspects and considerations related to different types of businesses being sold by a sole proprietor in Collin County, Texas.

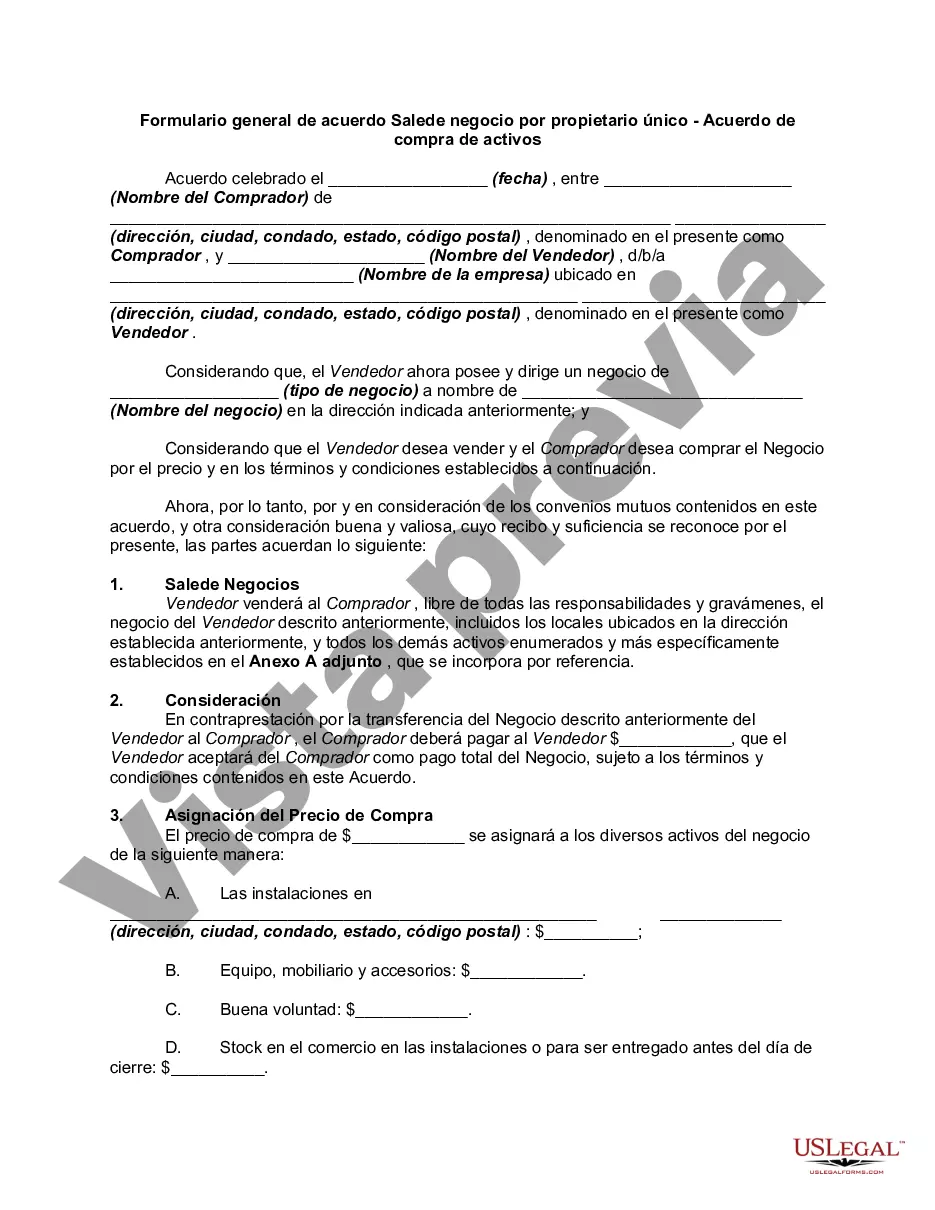

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.