This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Franklin Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer. This agreement is specific to the state of Ohio and provides a framework for the transfer of business assets. Key elements included in this agreement consist of the identification of both the seller (sole proprietor) and the buyer, a detailed description of the business being sold, the assets included in the sale, and the purchase price. Additionally, the agreement covers provisions related to warranties and representations, covenants, closing conditions, and potential disputes. There may be variations of the Franklin Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, such as: 1. Asset Purchase Agreement for a Specific Industry: This type of agreement is tailored to the particular industry of the business being sold, addressing specific regulations, licenses, or equipment that may be exclusive to that industry. 2. Agreement with Financing Terms: In some cases, the buyer may require financing options to complete the purchase. A specialized version of the asset purchase agreement can be created to include provisions for seller financing or third-party loans. 3. Asset Purchase Agreement with Non-Compete Clause: If the seller is concerned about future competition from the buyer, a separate clause can be added to the agreement to restrict the buyer's ability to compete in the same market. 4. Agreement for Disposition of Intellectual Property: If the sale involves the transfer of intellectual property rights, such as trademarks, patents, or copyrights, a specific clause addressing these assets can be incorporated into the agreement. It is important to consult with a legal professional to ensure a Franklin Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement meets the specific needs and requirements of both the seller and the buyer.The Franklin Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer. This agreement is specific to the state of Ohio and provides a framework for the transfer of business assets. Key elements included in this agreement consist of the identification of both the seller (sole proprietor) and the buyer, a detailed description of the business being sold, the assets included in the sale, and the purchase price. Additionally, the agreement covers provisions related to warranties and representations, covenants, closing conditions, and potential disputes. There may be variations of the Franklin Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, such as: 1. Asset Purchase Agreement for a Specific Industry: This type of agreement is tailored to the particular industry of the business being sold, addressing specific regulations, licenses, or equipment that may be exclusive to that industry. 2. Agreement with Financing Terms: In some cases, the buyer may require financing options to complete the purchase. A specialized version of the asset purchase agreement can be created to include provisions for seller financing or third-party loans. 3. Asset Purchase Agreement with Non-Compete Clause: If the seller is concerned about future competition from the buyer, a separate clause can be added to the agreement to restrict the buyer's ability to compete in the same market. 4. Agreement for Disposition of Intellectual Property: If the sale involves the transfer of intellectual property rights, such as trademarks, patents, or copyrights, a specific clause addressing these assets can be incorporated into the agreement. It is important to consult with a legal professional to ensure a Franklin Ohio General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement meets the specific needs and requirements of both the seller and the buyer.

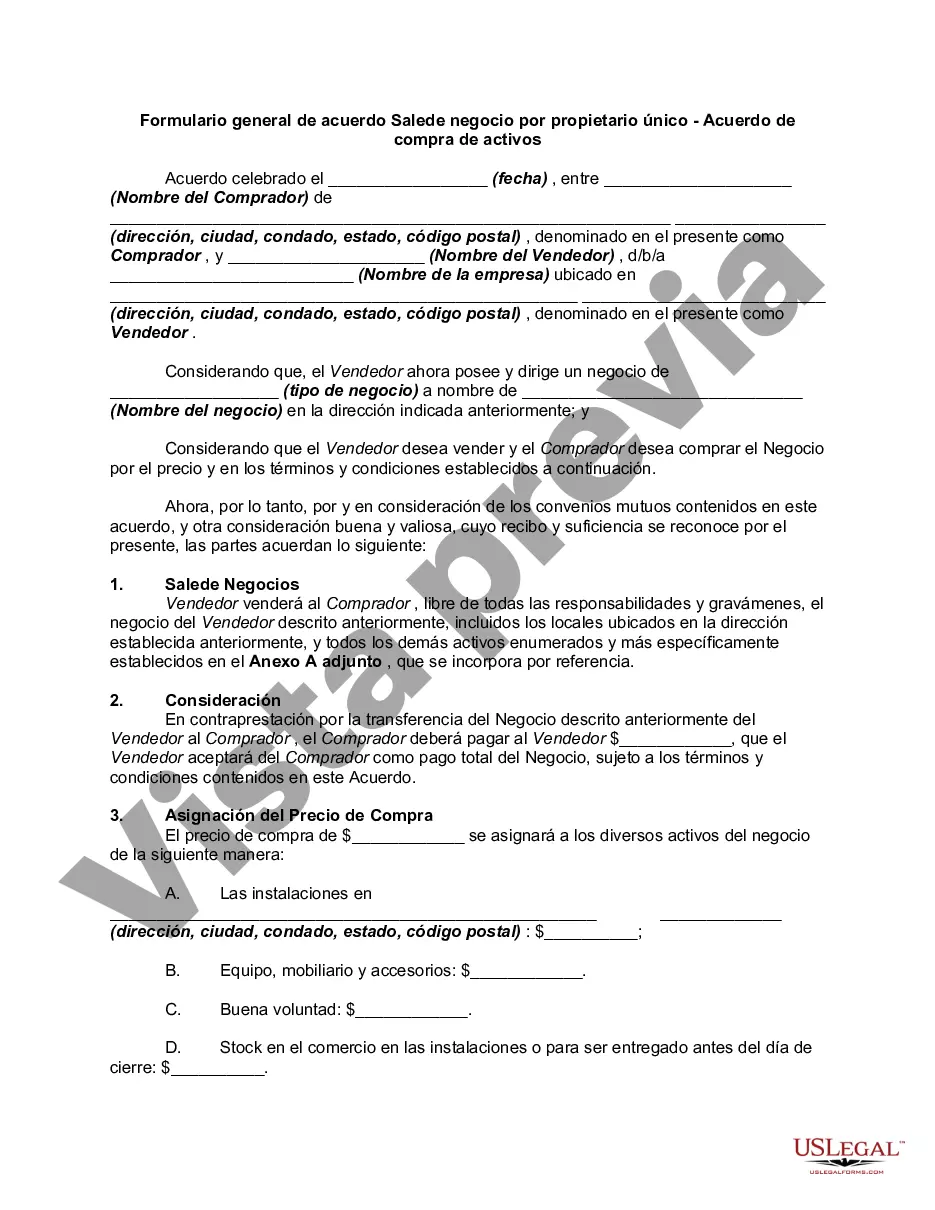

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.