This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fulton Georgia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer in Fulton, Georgia. This agreement is specific to the purchase of assets rather than the entire business entity. The Asset Purchase Agreement typically includes essential details such as the identification of the parties involved, the business assets being transferred, the purchase price, payment terms, representations and warranties, non-compete clauses, confidentiality agreements, closing conditions, and any other pertinent provisions relevant to the sale. There are various types of Fulton Georgia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements that may exist: 1. Standard or Generic Asset Purchase Agreement: This is a commonly used template that can be adapted to suit most types of businesses and industries. It provides a basic framework for outlining the terms of the sale. 2. Industry-Specific Asset Purchase Agreement: Certain industries may require specific clauses or provisions unique to their operations. For example, a restaurant may have additional provisions regarding liquor licenses or health code compliance. 3. Confidentiality and Non-Disclosure Agreement (NDA): Sometimes, before entering into a formal asset purchase agreement, parties may sign an NDA to protect the confidentiality of sensitive business information and trade secrets. 4. Letter of Intent (LOI): A letter of intent is a non-binding agreement that serves as a precursor to the asset purchase agreement. It outlines the parties' intentions to negotiate and engage in due diligence before finalizing the sale. 5. Seller Financing Asset Purchase Agreement: In some cases, the sole proprietor may agree to finance a portion of the purchase price, allowing the buyer to make installment payments over a specified period. 6. Bulk Sale Asset Purchase Agreement: This type of agreement is specific to the sale of inventory or stock in bulk, typically in businesses like retail stores or distribution companies. It is important for both buyer and seller to review and understand the content of the Fulton Georgia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement before signing. Seeking legal advice to ensure compliance with state laws and protection of rights is highly recommended.Fulton Georgia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer in Fulton, Georgia. This agreement is specific to the purchase of assets rather than the entire business entity. The Asset Purchase Agreement typically includes essential details such as the identification of the parties involved, the business assets being transferred, the purchase price, payment terms, representations and warranties, non-compete clauses, confidentiality agreements, closing conditions, and any other pertinent provisions relevant to the sale. There are various types of Fulton Georgia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements that may exist: 1. Standard or Generic Asset Purchase Agreement: This is a commonly used template that can be adapted to suit most types of businesses and industries. It provides a basic framework for outlining the terms of the sale. 2. Industry-Specific Asset Purchase Agreement: Certain industries may require specific clauses or provisions unique to their operations. For example, a restaurant may have additional provisions regarding liquor licenses or health code compliance. 3. Confidentiality and Non-Disclosure Agreement (NDA): Sometimes, before entering into a formal asset purchase agreement, parties may sign an NDA to protect the confidentiality of sensitive business information and trade secrets. 4. Letter of Intent (LOI): A letter of intent is a non-binding agreement that serves as a precursor to the asset purchase agreement. It outlines the parties' intentions to negotiate and engage in due diligence before finalizing the sale. 5. Seller Financing Asset Purchase Agreement: In some cases, the sole proprietor may agree to finance a portion of the purchase price, allowing the buyer to make installment payments over a specified period. 6. Bulk Sale Asset Purchase Agreement: This type of agreement is specific to the sale of inventory or stock in bulk, typically in businesses like retail stores or distribution companies. It is important for both buyer and seller to review and understand the content of the Fulton Georgia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement before signing. Seeking legal advice to ensure compliance with state laws and protection of rights is highly recommended.

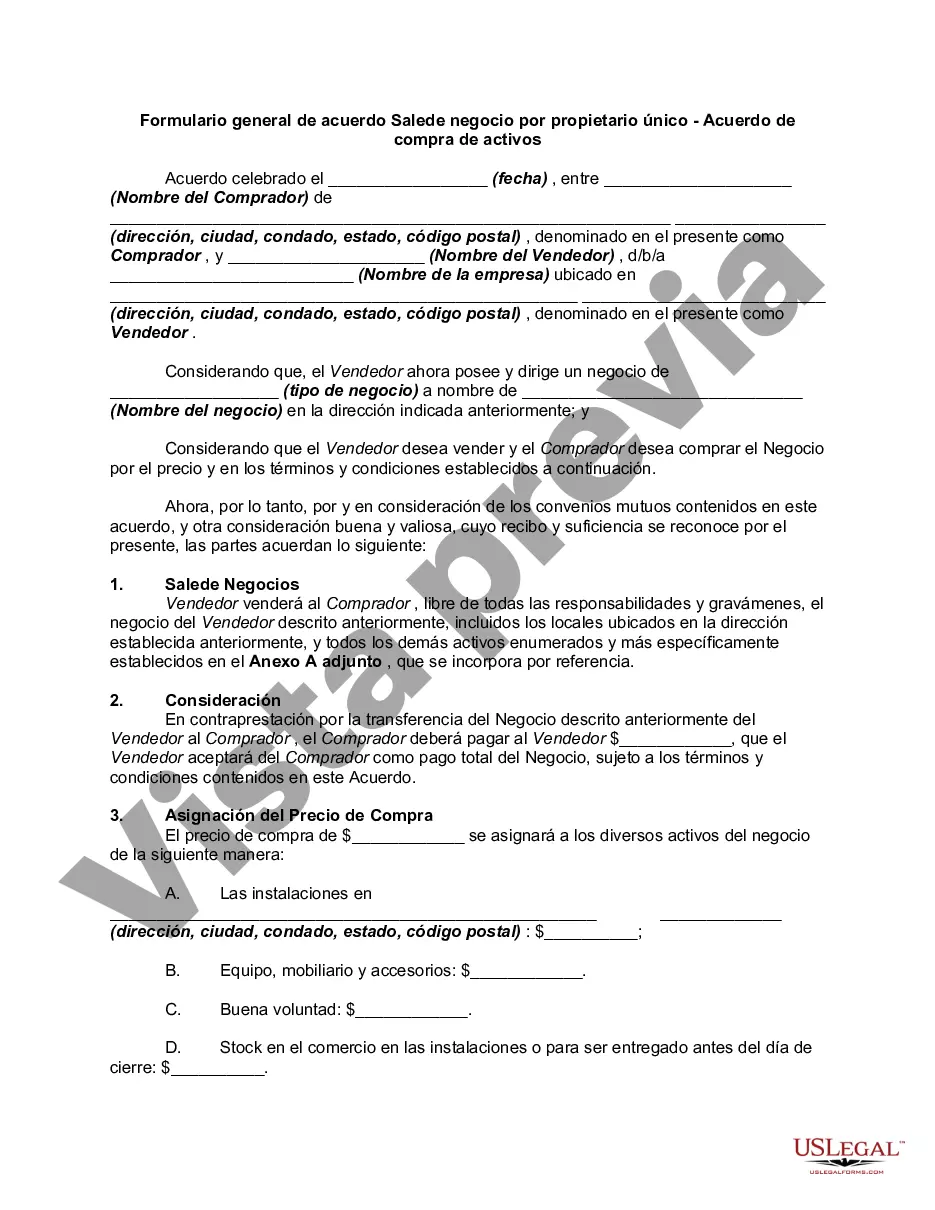

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.