This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

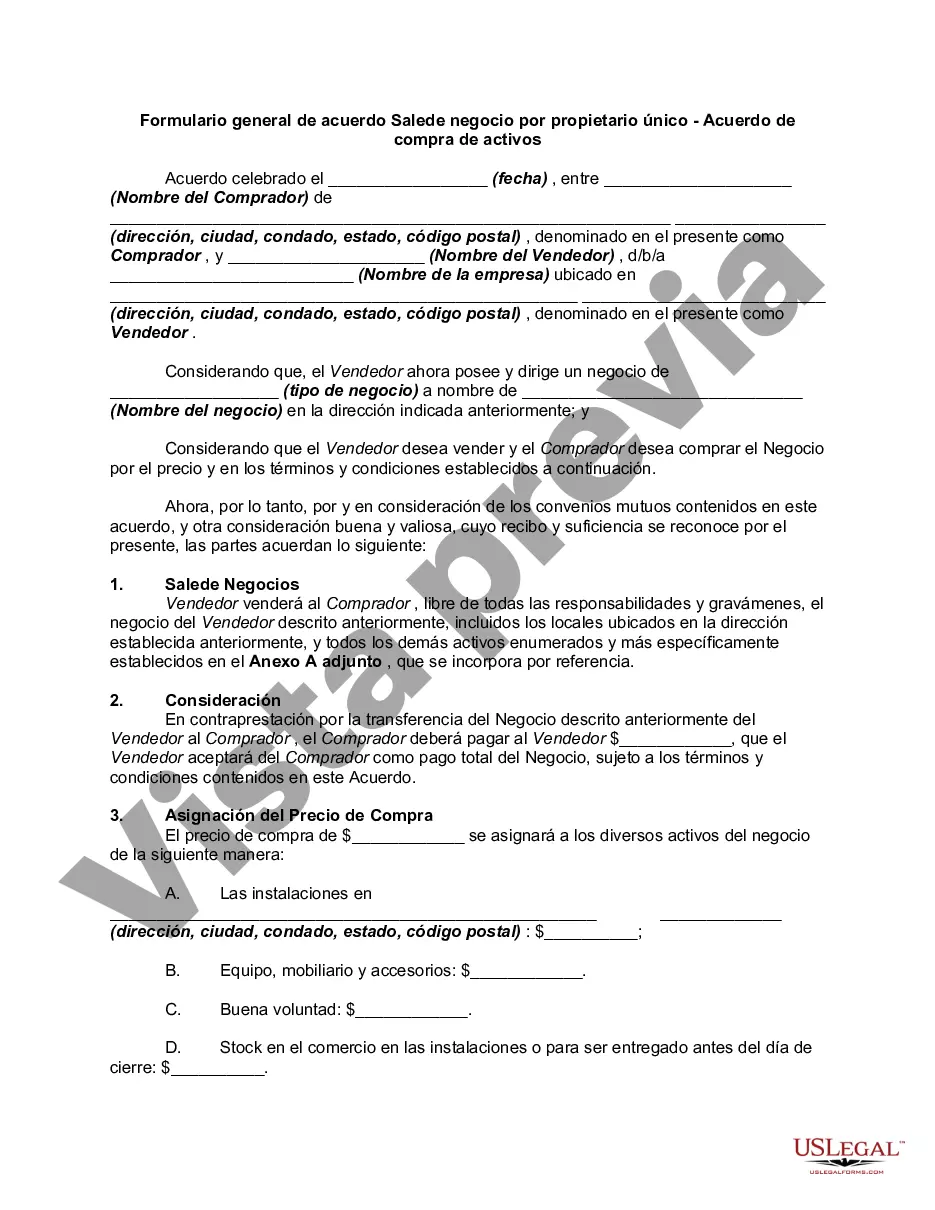

Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: The Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of a business owned by a sole proprietor in Miami-Dade County, Florida. This agreement is designed to protect the interests of both the seller and the buyer and ensure a smooth and transparent transaction. Some key provisions typically included in the Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement are: 1. Parties Involved: — The agreement identifies the sole proprietor (seller) and the buyer as the primary parties involved. — It may also include the names and contact information of any additional parties or representatives involved in the transaction, including brokers or attorneys. 2. Purchase Price and Payment Terms: — This section specifies the total purchase price agreed upon by the parties. — It outlines the payment terms, including any down payment, installment payments, or financing arrangements. — The agreement may also discuss any adjustments to the purchase price based on certain conditions, such as post-closing adjustments or contingencies. 3. Assets Included in the Sale: — The agreement lists the specific assets being sold as part of the business. — This can include tangible assets (equipment, inventory, furniture) as well as intangible assets (business name, goodwill, trademarks). — Intellectual property rights, licenses, permits, and leases may also be included in this section. 4. Seller's Representations and Warranties: — The seller provides assurances to the buyer that the information provided about the business and its assets is accurate and complete. — These representations and warranties protect the buyer from any potential undisclosed liabilities or misrepresentations by the seller. 5. Closing and Transfer of Ownership: — This section outlines the procedures and timeline for the closing of the transaction. — It specifies the responsibilities of each party leading up to the closing, such as obtaining necessary approvals, licenses, or permits. — The transfer of ownership and possession of assets is clearly defined, ensuring a smooth transition from the seller to the buyer. 6. Confidentiality and Non-Competition: — This clause may restrict the seller from revealing proprietary information or competing with the business being sold for a specified period. — It aims to protect the buyer's investment and prevent the seller from negatively impacting the value of the business after the sale. Types of Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Basic Asset Purchase Agreement: — This is the standard form used for most asset purchase transactions involving a sole proprietor in Miami-Dade County, Florida. 2. Industry-Specific Asset Purchase Agreement: — In certain industries, there may be unique considerations and regulatory requirements that need to be addressed in the agreement. — Examples include healthcare, real estate, or technology-related businesses. 3. Confidential Asset Purchase Agreement: — This type of agreement includes additional confidentiality provisions to protect any trade secrets or sensitive information involved in the transaction. 4. Seller-Financing Asset Purchase Agreement: — If the sole proprietor agrees to finance a portion of the purchase price, this agreement will include provisions related to seller financing terms and repayment schedules. The Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement provides a comprehensive framework for the purchase and sale of a business, allowing both parties to negotiate and document the terms of the transaction in a clear and legally enforceable manner.Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: The Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of a business owned by a sole proprietor in Miami-Dade County, Florida. This agreement is designed to protect the interests of both the seller and the buyer and ensure a smooth and transparent transaction. Some key provisions typically included in the Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement are: 1. Parties Involved: — The agreement identifies the sole proprietor (seller) and the buyer as the primary parties involved. — It may also include the names and contact information of any additional parties or representatives involved in the transaction, including brokers or attorneys. 2. Purchase Price and Payment Terms: — This section specifies the total purchase price agreed upon by the parties. — It outlines the payment terms, including any down payment, installment payments, or financing arrangements. — The agreement may also discuss any adjustments to the purchase price based on certain conditions, such as post-closing adjustments or contingencies. 3. Assets Included in the Sale: — The agreement lists the specific assets being sold as part of the business. — This can include tangible assets (equipment, inventory, furniture) as well as intangible assets (business name, goodwill, trademarks). — Intellectual property rights, licenses, permits, and leases may also be included in this section. 4. Seller's Representations and Warranties: — The seller provides assurances to the buyer that the information provided about the business and its assets is accurate and complete. — These representations and warranties protect the buyer from any potential undisclosed liabilities or misrepresentations by the seller. 5. Closing and Transfer of Ownership: — This section outlines the procedures and timeline for the closing of the transaction. — It specifies the responsibilities of each party leading up to the closing, such as obtaining necessary approvals, licenses, or permits. — The transfer of ownership and possession of assets is clearly defined, ensuring a smooth transition from the seller to the buyer. 6. Confidentiality and Non-Competition: — This clause may restrict the seller from revealing proprietary information or competing with the business being sold for a specified period. — It aims to protect the buyer's investment and prevent the seller from negatively impacting the value of the business after the sale. Types of Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Basic Asset Purchase Agreement: — This is the standard form used for most asset purchase transactions involving a sole proprietor in Miami-Dade County, Florida. 2. Industry-Specific Asset Purchase Agreement: — In certain industries, there may be unique considerations and regulatory requirements that need to be addressed in the agreement. — Examples include healthcare, real estate, or technology-related businesses. 3. Confidential Asset Purchase Agreement: — This type of agreement includes additional confidentiality provisions to protect any trade secrets or sensitive information involved in the transaction. 4. Seller-Financing Asset Purchase Agreement: — If the sole proprietor agrees to finance a portion of the purchase price, this agreement will include provisions related to seller financing terms and repayment schedules. The Miami-Dade Florida General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement provides a comprehensive framework for the purchase and sale of a business, allowing both parties to negotiate and document the terms of the transaction in a clear and legally enforceable manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.