This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Oakland, Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale and purchase of a business by a sole proprietor. This agreement is specifically tailored for transactions occurring in Oakland, Michigan, and serves as a binding contract between the seller and the buyer. Keywords: Oakland, Michigan, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. This agreement covers various aspects of the business sale process, including the identification and description of the assets being sold, purchase price and payment terms, representations and warranties of both parties, conditions for closing the transaction, and any ongoing obligations and non-compete clauses. Different types of Oakland, Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include: 1. Standard Asset Purchase Agreement: This is the most common type of agreement used for the sale of a business by a sole proprietor. It covers the transfer of all or some of the assets owned by the seller, such as inventory, equipment, goodwill, customer lists, etc. 2. Partial Asset Purchase Agreement: In some cases, the sale may only involve a specific portion of the business assets. This agreement type is designed to address such partial sales and includes provisions for identifying and segregating the specific assets being sold. 3. Real Estate Asset Purchase Agreement: If the sole proprietor owns the business premises or any real estate related to the business, a separate agreement may be required to cover the sale of these assets. This agreement would include details specific to the property, such as legal descriptions, title transfer, and any related contingencies. 4. Intellectual Property Asset Purchase Agreement: In situations where the business's value primarily lies in intangible assets like patents, trademarks, copyrights, or trade secrets, an additional agreement may be necessary to address the transfer and ownership of these intellectual property rights. It is important to note that specific business sales may require customization or additional provisions based on the unique circumstances and requirements of the parties involved. Therefore, seeking legal advice or consulting an attorney is highly recommended ensuring the accuracy and validity of the agreement.The Oakland, Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document that outlines the terms and conditions for the sale and purchase of a business by a sole proprietor. This agreement is specifically tailored for transactions occurring in Oakland, Michigan, and serves as a binding contract between the seller and the buyer. Keywords: Oakland, Michigan, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. This agreement covers various aspects of the business sale process, including the identification and description of the assets being sold, purchase price and payment terms, representations and warranties of both parties, conditions for closing the transaction, and any ongoing obligations and non-compete clauses. Different types of Oakland, Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include: 1. Standard Asset Purchase Agreement: This is the most common type of agreement used for the sale of a business by a sole proprietor. It covers the transfer of all or some of the assets owned by the seller, such as inventory, equipment, goodwill, customer lists, etc. 2. Partial Asset Purchase Agreement: In some cases, the sale may only involve a specific portion of the business assets. This agreement type is designed to address such partial sales and includes provisions for identifying and segregating the specific assets being sold. 3. Real Estate Asset Purchase Agreement: If the sole proprietor owns the business premises or any real estate related to the business, a separate agreement may be required to cover the sale of these assets. This agreement would include details specific to the property, such as legal descriptions, title transfer, and any related contingencies. 4. Intellectual Property Asset Purchase Agreement: In situations where the business's value primarily lies in intangible assets like patents, trademarks, copyrights, or trade secrets, an additional agreement may be necessary to address the transfer and ownership of these intellectual property rights. It is important to note that specific business sales may require customization or additional provisions based on the unique circumstances and requirements of the parties involved. Therefore, seeking legal advice or consulting an attorney is highly recommended ensuring the accuracy and validity of the agreement.

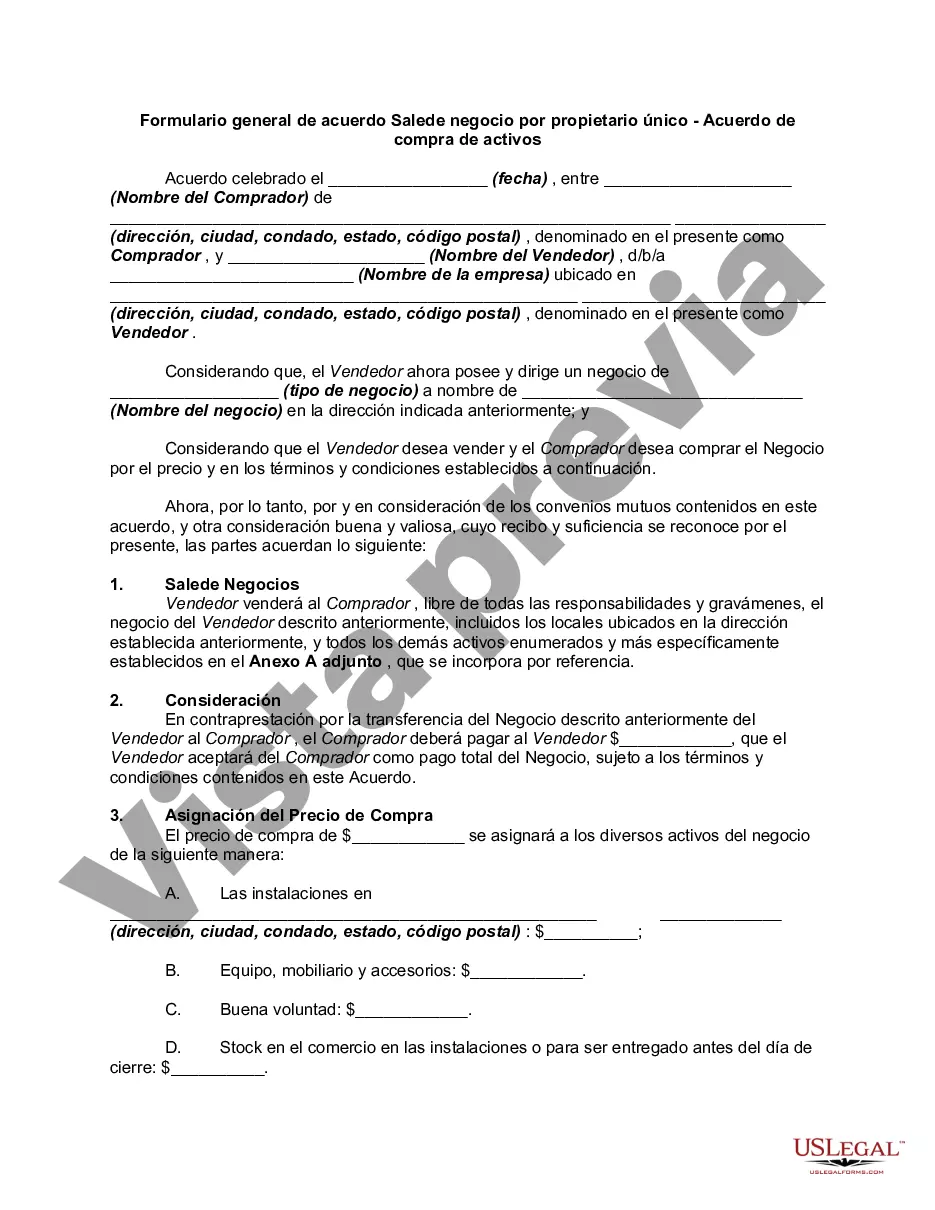

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.