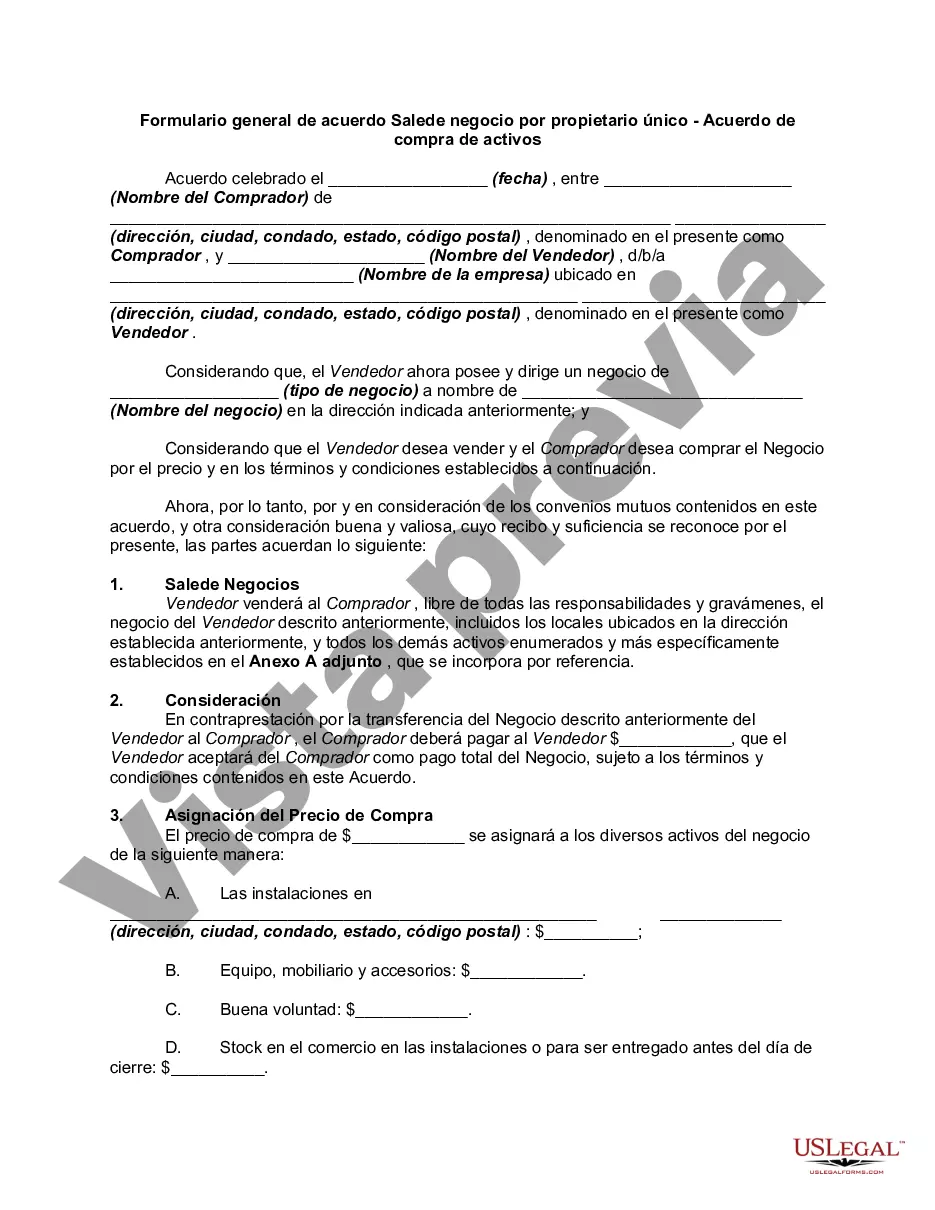

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Orange, California is a vibrant city located in Orange County, Southern California. Known for its rich history, beautiful architecture, and thriving art scene, Orange is a desirable place to live and work. As such, it hosts various types of agreements for the sale of businesses by sole proprietors, including the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement. This General Form of Agreement serves as a legal document outlining the terms and conditions between the buyer and seller in an asset purchase transaction. It governs the sale of a business owned by a sole proprietor in Orange, California, ensuring a smooth and transparent process. The Asset Purchase Agreement typically encompasses several key elements, including: 1. Parties: Identifies the buyer and seller involved in the transaction, including their legal names and contact information. 2. Purchase Price: States the agreed-upon amount for which the business assets will be sold, along with any additional terms such as payment structure and methods. 3. Assets: Outlines the specific assets included in the sale, such as equipment, inventory, intellectual property rights, customer lists, and goodwill. 4. Liabilities: Clarifies which liabilities will be assumed by the buyer, if any, and which will remain the responsibility of the seller. 5. Conditions: Describes any conditions that must be met before the sale can be completed, such as obtaining necessary approvals or licenses. 6. Representations and Warranties: Specifies the promises made by both the buyer and seller regarding the accuracy of the information provided, the legality of the transaction, and any potential risks or liabilities. 7. Confidentiality and Non-Competition: Addresses any confidentiality clauses or non-compete agreements that the parties may wish to include to protect their interests. 8. Closing and Escrow: Outlines the process for completing the sale, including the closing date and any escrow services being utilized. It is important to note that while there may be different variations or specialized agreements within the Orange California General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, they generally follow a similar structure and cover the essential aspects mentioned above. The parties involved can customize the agreement based on their specific needs and circumstances. If you are considering buying or selling a business in Orange, California, consulting with a qualified attorney is advised to ensure that the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement meets all legal requirements and adequately protects your interests.Orange, California is a vibrant city located in Orange County, Southern California. Known for its rich history, beautiful architecture, and thriving art scene, Orange is a desirable place to live and work. As such, it hosts various types of agreements for the sale of businesses by sole proprietors, including the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement. This General Form of Agreement serves as a legal document outlining the terms and conditions between the buyer and seller in an asset purchase transaction. It governs the sale of a business owned by a sole proprietor in Orange, California, ensuring a smooth and transparent process. The Asset Purchase Agreement typically encompasses several key elements, including: 1. Parties: Identifies the buyer and seller involved in the transaction, including their legal names and contact information. 2. Purchase Price: States the agreed-upon amount for which the business assets will be sold, along with any additional terms such as payment structure and methods. 3. Assets: Outlines the specific assets included in the sale, such as equipment, inventory, intellectual property rights, customer lists, and goodwill. 4. Liabilities: Clarifies which liabilities will be assumed by the buyer, if any, and which will remain the responsibility of the seller. 5. Conditions: Describes any conditions that must be met before the sale can be completed, such as obtaining necessary approvals or licenses. 6. Representations and Warranties: Specifies the promises made by both the buyer and seller regarding the accuracy of the information provided, the legality of the transaction, and any potential risks or liabilities. 7. Confidentiality and Non-Competition: Addresses any confidentiality clauses or non-compete agreements that the parties may wish to include to protect their interests. 8. Closing and Escrow: Outlines the process for completing the sale, including the closing date and any escrow services being utilized. It is important to note that while there may be different variations or specialized agreements within the Orange California General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement, they generally follow a similar structure and cover the essential aspects mentioned above. The parties involved can customize the agreement based on their specific needs and circumstances. If you are considering buying or selling a business in Orange, California, consulting with a qualified attorney is advised to ensure that the General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement meets all legal requirements and adequately protects your interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.