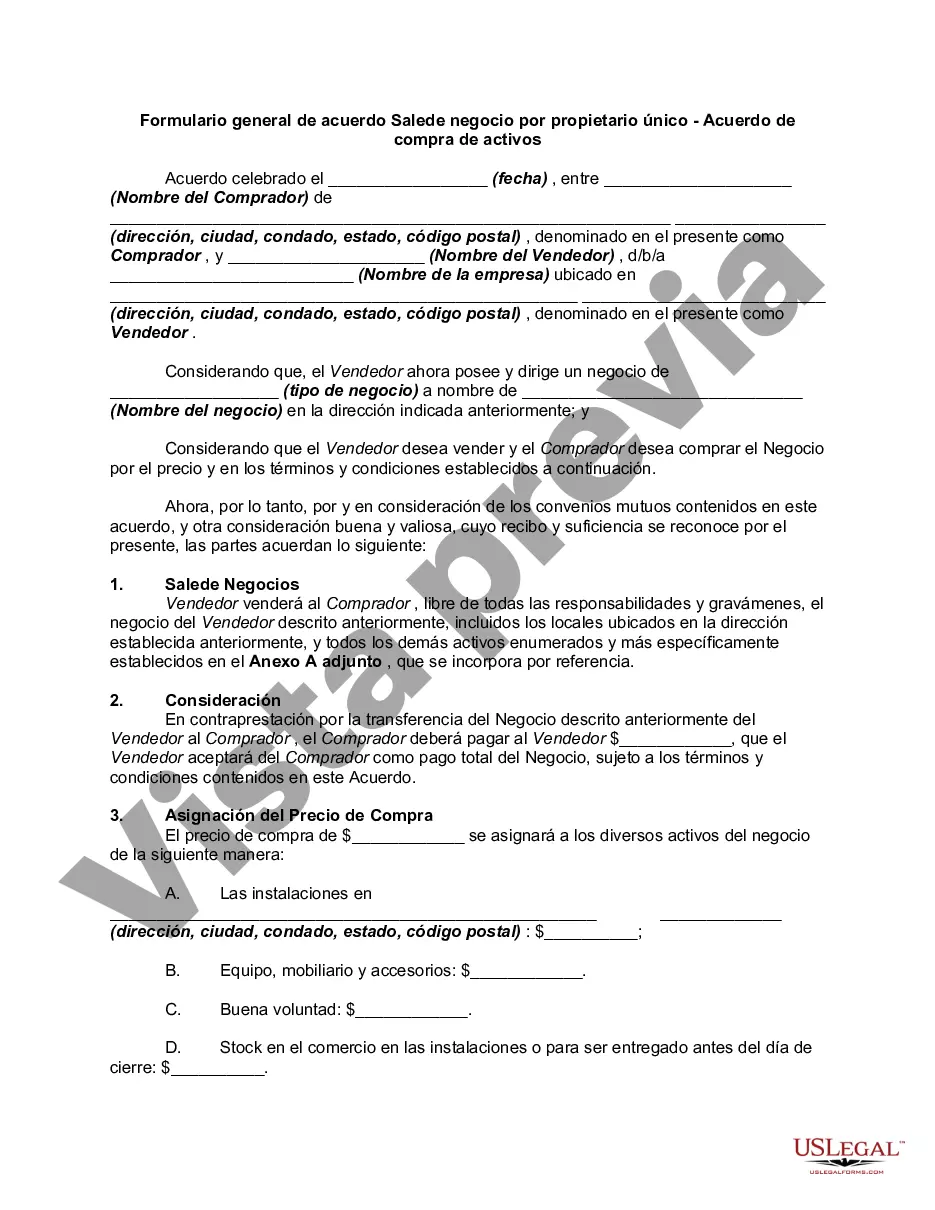

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement Explained Introduction: In this article, we will provide you with a detailed description of the Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement. This legal document is essential when transferring the ownership of a business from a sole proprietor to a buyer. We will outline the key elements, purpose, and potential variations you may encounter when dealing with this agreement in Phoenix, Arizona. Key Elements of the Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Parties Involved: The agreement identifies and clarifies the identities of the selling sole proprietor and the purchasing party. 2. Assets Included: The agreement lists the specific business assets being sold, such as inventory, equipment, trademarks, intellectual property, customer lists, leasehold rights, and more. 3. Purchase Price and Payment Terms: This section outlines the agreed-upon purchase price, the payment schedule, and any conditions or adjustments. 4. Representations and Warranties: Both parties make certain representations and warranties about the accuracy of the information provided during the sale process, ensuring transparency and validity. 5. Covenants: The agreement may include provisions related to non-competition, non-solicitation, transition assistance, or any other mutually agreed-upon terms. 6. Allocation of Purchase Price: This section provides a breakdown of how the purchase price will be allocated among the various assets being sold, allowing for tax considerations. 7. Indemnification: The agreement may include clauses detailing indemnification obligations to protect both parties from potential claims or undisclosed liabilities. 8. Confidentiality and Non-Disclosure: To maintain confidentiality, the agreement may contain provisions regarding the protection of sensitive business information. Types of Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Standard Asset Purchase Agreement: This is the most common version of the agreement and covers the basic elements mentioned above. 2. Customized Asset Purchase Agreement: Parties involved may modify or include additional provisions to suit their specific needs and conditions. 3. Bulk Sale Asset Purchase Agreement: If the sale involves substantially all the assets of the business, this specialized agreement type may be used. Conclusion: When engaging in the sale of a business by a sole proprietor in Phoenix, Arizona, a General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is crucial. It outlines the terms, conditions, and responsibilities of both parties involved in the transaction. Understanding the key elements and potential variations of this agreement will help ensure a smooth sale process and protect the interests of the parties involved.Title: Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement Explained Introduction: In this article, we will provide you with a detailed description of the Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement. This legal document is essential when transferring the ownership of a business from a sole proprietor to a buyer. We will outline the key elements, purpose, and potential variations you may encounter when dealing with this agreement in Phoenix, Arizona. Key Elements of the Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Parties Involved: The agreement identifies and clarifies the identities of the selling sole proprietor and the purchasing party. 2. Assets Included: The agreement lists the specific business assets being sold, such as inventory, equipment, trademarks, intellectual property, customer lists, leasehold rights, and more. 3. Purchase Price and Payment Terms: This section outlines the agreed-upon purchase price, the payment schedule, and any conditions or adjustments. 4. Representations and Warranties: Both parties make certain representations and warranties about the accuracy of the information provided during the sale process, ensuring transparency and validity. 5. Covenants: The agreement may include provisions related to non-competition, non-solicitation, transition assistance, or any other mutually agreed-upon terms. 6. Allocation of Purchase Price: This section provides a breakdown of how the purchase price will be allocated among the various assets being sold, allowing for tax considerations. 7. Indemnification: The agreement may include clauses detailing indemnification obligations to protect both parties from potential claims or undisclosed liabilities. 8. Confidentiality and Non-Disclosure: To maintain confidentiality, the agreement may contain provisions regarding the protection of sensitive business information. Types of Phoenix Arizona General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Standard Asset Purchase Agreement: This is the most common version of the agreement and covers the basic elements mentioned above. 2. Customized Asset Purchase Agreement: Parties involved may modify or include additional provisions to suit their specific needs and conditions. 3. Bulk Sale Asset Purchase Agreement: If the sale involves substantially all the assets of the business, this specialized agreement type may be used. Conclusion: When engaging in the sale of a business by a sole proprietor in Phoenix, Arizona, a General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is crucial. It outlines the terms, conditions, and responsibilities of both parties involved in the transaction. Understanding the key elements and potential variations of this agreement will help ensure a smooth sale process and protect the interests of the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.