This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Queens, New York, is a vibrant and diverse borough located in the heart of New York City. Known for its rich history, culture, and bustling neighborhoods, Queens offers a promising landscape for entrepreneurs looking to sell their business. A General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a crucial legal document that outlines the terms and conditions of such a transaction. This agreement serves as a legally binding contract between the sole proprietor, who is selling their business, and the buyer who wishes to acquire the business assets. It includes detailed provisions regarding the sale, purchase price, payment terms, assets included, liabilities excluded, and any other relevant terms for the transaction. Keywords: Queens, New York, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. Different types of Queens, New York General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may vary based on specific industries or businesses. Here are a few examples: 1. Restaurant Asset Purchase Agreement: This agreement would cater to the sale of a restaurant business, including kitchen equipment, furniture, inventory, licenses, and any existing lease agreements. 2. Retail Store Asset Purchase Agreement: Designed for the sale of a retail business, such as a boutique or convenience store, the agreement would discuss the transfer of assets like inventory, fixtures, leasehold improvements, and customer lists. 3. Professional Services Asset Purchase Agreement: This type of agreement would be tailored towards the sale of a professional service-oriented business, such as a law firm, medical practice, or accounting firm. It would include the transfer of client lists, contracts, intellectual property rights, and any applicable licenses. 4. Manufacturing Company Asset Purchase Agreement: This agreement would be specific to the sale of a manufacturing business, outlining the transfer of machinery, equipment, inventory, contracts, supplier relationships, and intellectual property. These are just a few examples of the different types of General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements that can be used in Queens, New York. It is crucial to customize the agreement according to the unique needs and nature of the business being sold, seeking legal advice if necessary, to ensure a smooth and legally sound transaction.Queens, New York, is a vibrant and diverse borough located in the heart of New York City. Known for its rich history, culture, and bustling neighborhoods, Queens offers a promising landscape for entrepreneurs looking to sell their business. A General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a crucial legal document that outlines the terms and conditions of such a transaction. This agreement serves as a legally binding contract between the sole proprietor, who is selling their business, and the buyer who wishes to acquire the business assets. It includes detailed provisions regarding the sale, purchase price, payment terms, assets included, liabilities excluded, and any other relevant terms for the transaction. Keywords: Queens, New York, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement. Different types of Queens, New York General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may vary based on specific industries or businesses. Here are a few examples: 1. Restaurant Asset Purchase Agreement: This agreement would cater to the sale of a restaurant business, including kitchen equipment, furniture, inventory, licenses, and any existing lease agreements. 2. Retail Store Asset Purchase Agreement: Designed for the sale of a retail business, such as a boutique or convenience store, the agreement would discuss the transfer of assets like inventory, fixtures, leasehold improvements, and customer lists. 3. Professional Services Asset Purchase Agreement: This type of agreement would be tailored towards the sale of a professional service-oriented business, such as a law firm, medical practice, or accounting firm. It would include the transfer of client lists, contracts, intellectual property rights, and any applicable licenses. 4. Manufacturing Company Asset Purchase Agreement: This agreement would be specific to the sale of a manufacturing business, outlining the transfer of machinery, equipment, inventory, contracts, supplier relationships, and intellectual property. These are just a few examples of the different types of General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements that can be used in Queens, New York. It is crucial to customize the agreement according to the unique needs and nature of the business being sold, seeking legal advice if necessary, to ensure a smooth and legally sound transaction.

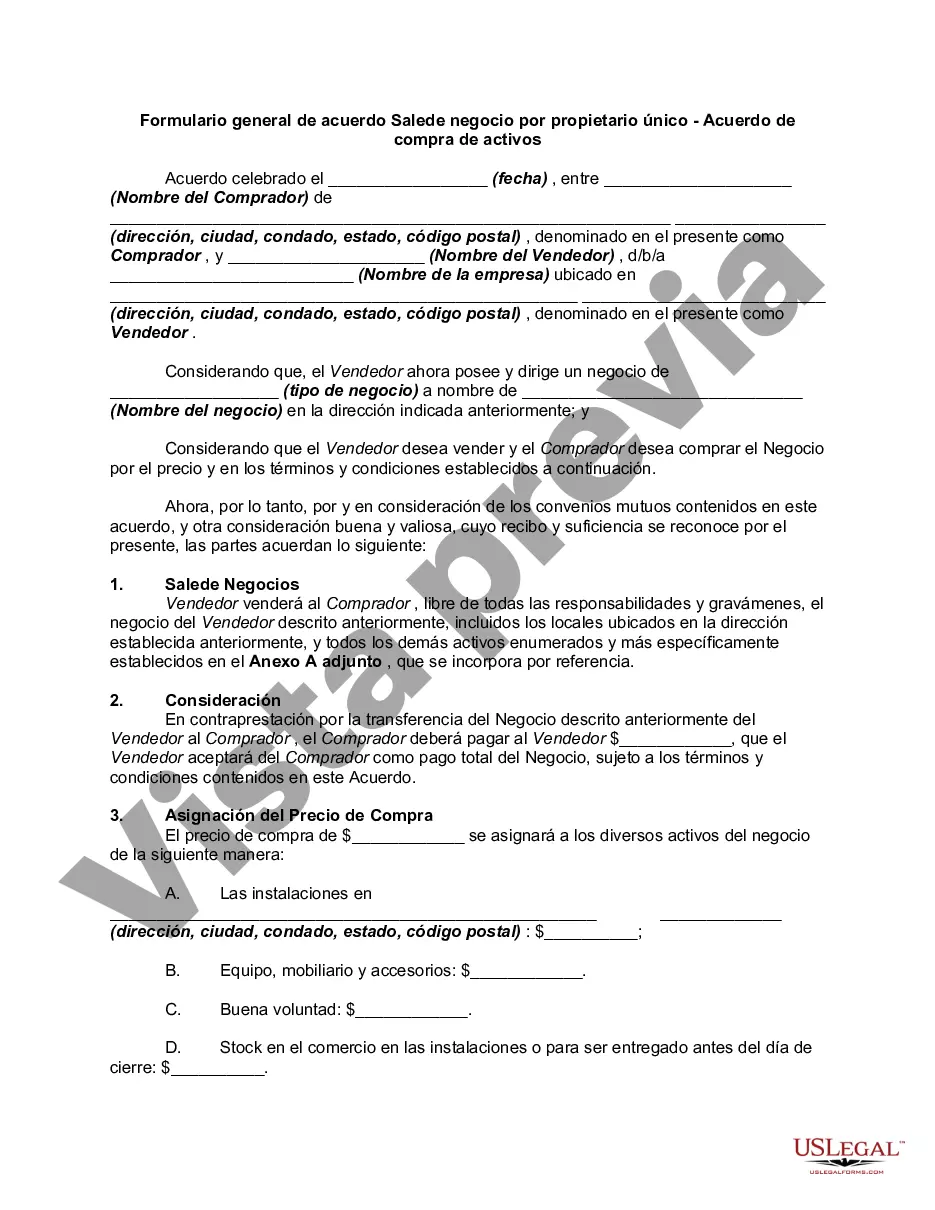

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.