This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

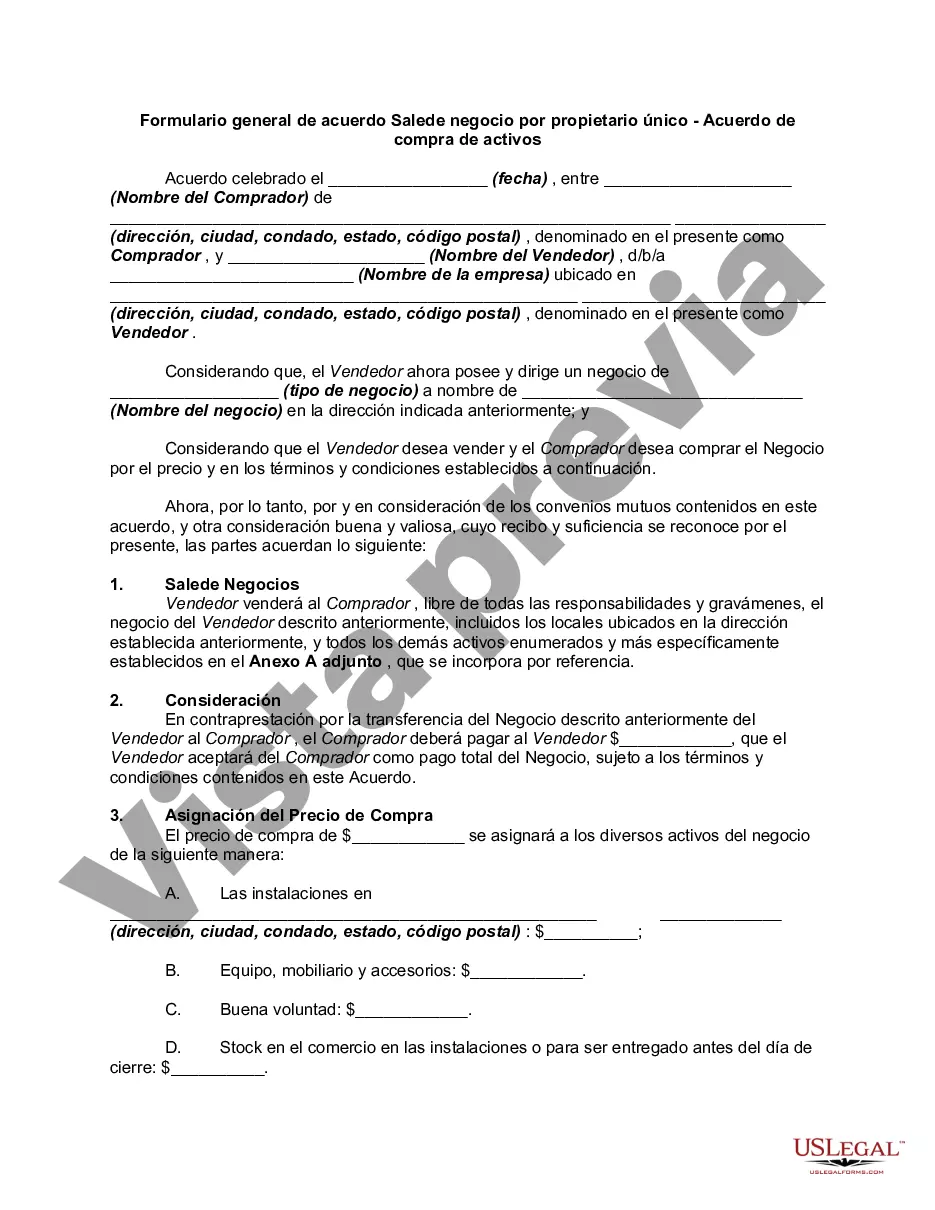

San Diego, California, is a vibrant city located on the Pacific Coast of the United States. Known for its pristine beaches, delightful climate, and diverse culture, San Diego offers a wide range of opportunities for residents and visitors alike. Besides being a top tourist destination, the city also presents favorable conditions for business growth and investment. The San Diego California General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding document used when a sole proprietor is selling their business assets to another party. This agreement governs the transaction and outlines the terms and conditions under which the sale will take place. The Asset Purchase Agreement includes several essential components and relevant keywords that ensure both parties are protected and understand their responsibilities. These may include: 1. Buyer and Seller Information: This section details the contact information and legal identification of both the buyer and seller involved in the transaction. 2. Business Description: It provides a comprehensive description of the business being sold, including its nature, type, assets, and any included inventory or goodwill. 3. Purchase Price and Payment Terms: The agreement outlines the purchase price for the assets and how it will be paid, whether through a lump sum or installment payments. 4. Asset List: This section identifies and enumerates the specific assets being sold. These can include tangible assets (such as equipment, inventory, and fixtures) and intangible assets (like intellectual property, customer lists, or proprietary software). 5. Liabilities: The agreement specifies the liabilities that will be assumed by the buyer, usually excluding debts or obligations not explicitly mentioned in the agreement. 6. Conditions and Contingencies: This covers any conditions that need to be met before completing the purchase, such as obtaining necessary licenses or permits, or securing financing. It may also address contingencies for unforeseen events that might affect the sale. 7. Representations and Warranties: Both parties typically provide warranties and representations related to the accuracy and completeness of the information provided, the lawfulness of the business operation, and the absence of undisclosed liabilities or legal disputes. 8. Indemnification: This section outlines the responsibilities of each party if one party breaches the agreement, including provisions for indemnification and potential legal remedies. 9. Confidentiality and Non-Compete: If applicable, the agreement may include clauses regarding the protection of confidential information and non-compete agreements to safeguard the buyer's investment from the seller's future competition. Different types of San Diego California General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement can include variations in specific terms and additional clauses based on the unique circumstances of each transaction. These agreements may address factors such as seller financing, escrow arrangements, or specific warranties related to the business being sold. It's crucial to consult with a qualified legal professional when drafting or reviewing any agreement to ensure compliance with local laws and the inclusion of relevant clauses specific to the San Diego area.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.