This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding contract specifically designed for sole proprietors looking to sell their business assets in the Travis County, Texas jurisdiction. This agreement serves as a comprehensive legal document detailing the terms and conditions of the asset purchase transaction. The Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is tailored to meet the requirements of various types of businesses and industries. Some specific types of Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements include: 1. Retail Business Asset Purchase Agreement: This type of agreement is suitable for sole proprietors operating retail businesses, such as convenience stores, boutiques, or grocery stores. 2. Restaurant Business Asset Purchase Agreement: This agreement is designed for sole proprietors looking to sell their restaurant business assets, including equipment, inventory, and intellectual property rights. 3. Service Business Asset Purchase Agreement: Sole proprietors offering services, such as consulting, event planning, or IT support, can utilize this type of agreement to sell their business assets. 4. Manufacturing Business Asset Purchase Agreement: This agreement is tailored to sole proprietors engaged in manufacturing or industrial businesses, ensuring a smooth transfer of assets like machinery, patents, and customer contracts. 5. Professional Practice Asset Purchase Agreement: Designed for sole proprietors in fields like law, accounting, or healthcare, this agreement covers the unique aspects of selling a professional practice, including client lists and goodwill. The Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement includes key elements, such as the identification and description of the assets being sold, purchase price and payment terms, representations and warranties, closing conditions, and obligations of both parties involved. It is crucial for both the buyer and seller to carefully review and negotiate the terms of the agreement to ensure a fair and mutually beneficial transaction. Seeking legal advice from an experienced attorney is highly recommended ensuring compliance with applicable laws and regulations in Travis County, Texas.Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legally binding contract specifically designed for sole proprietors looking to sell their business assets in the Travis County, Texas jurisdiction. This agreement serves as a comprehensive legal document detailing the terms and conditions of the asset purchase transaction. The Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is tailored to meet the requirements of various types of businesses and industries. Some specific types of Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreements include: 1. Retail Business Asset Purchase Agreement: This type of agreement is suitable for sole proprietors operating retail businesses, such as convenience stores, boutiques, or grocery stores. 2. Restaurant Business Asset Purchase Agreement: This agreement is designed for sole proprietors looking to sell their restaurant business assets, including equipment, inventory, and intellectual property rights. 3. Service Business Asset Purchase Agreement: Sole proprietors offering services, such as consulting, event planning, or IT support, can utilize this type of agreement to sell their business assets. 4. Manufacturing Business Asset Purchase Agreement: This agreement is tailored to sole proprietors engaged in manufacturing or industrial businesses, ensuring a smooth transfer of assets like machinery, patents, and customer contracts. 5. Professional Practice Asset Purchase Agreement: Designed for sole proprietors in fields like law, accounting, or healthcare, this agreement covers the unique aspects of selling a professional practice, including client lists and goodwill. The Travis Texas General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement includes key elements, such as the identification and description of the assets being sold, purchase price and payment terms, representations and warranties, closing conditions, and obligations of both parties involved. It is crucial for both the buyer and seller to carefully review and negotiate the terms of the agreement to ensure a fair and mutually beneficial transaction. Seeking legal advice from an experienced attorney is highly recommended ensuring compliance with applicable laws and regulations in Travis County, Texas.

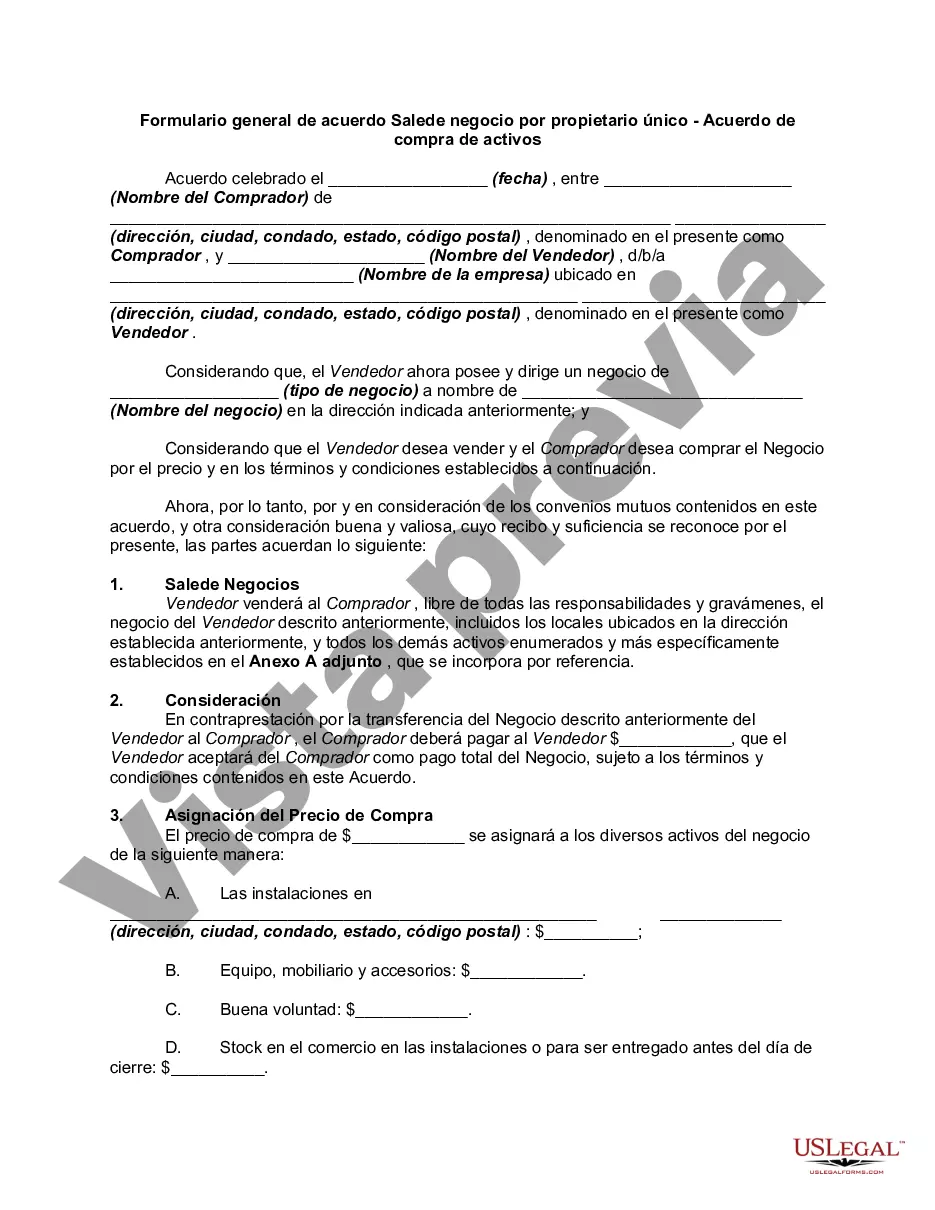

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.