This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wayne County, Michigan, offers a General Form of Agreement for the Sale of Business by a Sole Proprietor — Asset Purchase Agreement to facilitate the transfer of a business from one owner to another. This agreement serves as a legally binding document that outlines the terms and conditions of the sale. The Wayne Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a comprehensive agreement that covers various important aspects related to the sale of a business. It addresses the transfer of assets, liabilities, contracts, and other essential components. Keywords: Wayne Michigan, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement, transfer of assets, liabilities, contracts. Different Types of Wayne Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Contract-Specific Asset Purchase Agreement: — This type of agreement is drafted to suit the specific requirements of a particular business sale. It takes into account the unique assets, liabilities, and contracts involved in the transaction. 2. Standardized Asset Purchase Agreement: — This type of agreement follows a standardized format that is commonly used for most general business sales. It covers the standard clauses and provisions required for an asset purchase agreement, providing a reliable and widely accepted framework. 3. Confidentiality and Non-Disclosure Agreement (NDA): — Although not strictly an asset purchase agreement, an NDA is often an essential document included as part of the sale process. It ensures that both the buyer and seller maintain confidentiality regarding sensitive business information. 4. Letter of Intent (LOI): — While not a legally binding agreement, a Letter of Intent is used to express the parties' intention to proceed with the sale. It outlines the basic terms and conditions that are expected to be included in the final asset purchase agreement. 5. Due Diligence Checklist: — This checklist contains a list of documents and information that the buyer needs to review and analyze before finalizing the sale. It helps ensure that the buyer has a clear understanding of the business's financial, operational, and legal aspects. Keywords: Contract-Specific, Standardized, Confidentiality and Non-Disclosure Agreement, Letter of Intent, Due Diligence Checklist.Wayne County, Michigan, offers a General Form of Agreement for the Sale of Business by a Sole Proprietor — Asset Purchase Agreement to facilitate the transfer of a business from one owner to another. This agreement serves as a legally binding document that outlines the terms and conditions of the sale. The Wayne Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a comprehensive agreement that covers various important aspects related to the sale of a business. It addresses the transfer of assets, liabilities, contracts, and other essential components. Keywords: Wayne Michigan, General Form of Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement, transfer of assets, liabilities, contracts. Different Types of Wayne Michigan General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement: 1. Contract-Specific Asset Purchase Agreement: — This type of agreement is drafted to suit the specific requirements of a particular business sale. It takes into account the unique assets, liabilities, and contracts involved in the transaction. 2. Standardized Asset Purchase Agreement: — This type of agreement follows a standardized format that is commonly used for most general business sales. It covers the standard clauses and provisions required for an asset purchase agreement, providing a reliable and widely accepted framework. 3. Confidentiality and Non-Disclosure Agreement (NDA): — Although not strictly an asset purchase agreement, an NDA is often an essential document included as part of the sale process. It ensures that both the buyer and seller maintain confidentiality regarding sensitive business information. 4. Letter of Intent (LOI): — While not a legally binding agreement, a Letter of Intent is used to express the parties' intention to proceed with the sale. It outlines the basic terms and conditions that are expected to be included in the final asset purchase agreement. 5. Due Diligence Checklist: — This checklist contains a list of documents and information that the buyer needs to review and analyze before finalizing the sale. It helps ensure that the buyer has a clear understanding of the business's financial, operational, and legal aspects. Keywords: Contract-Specific, Standardized, Confidentiality and Non-Disclosure Agreement, Letter of Intent, Due Diligence Checklist.

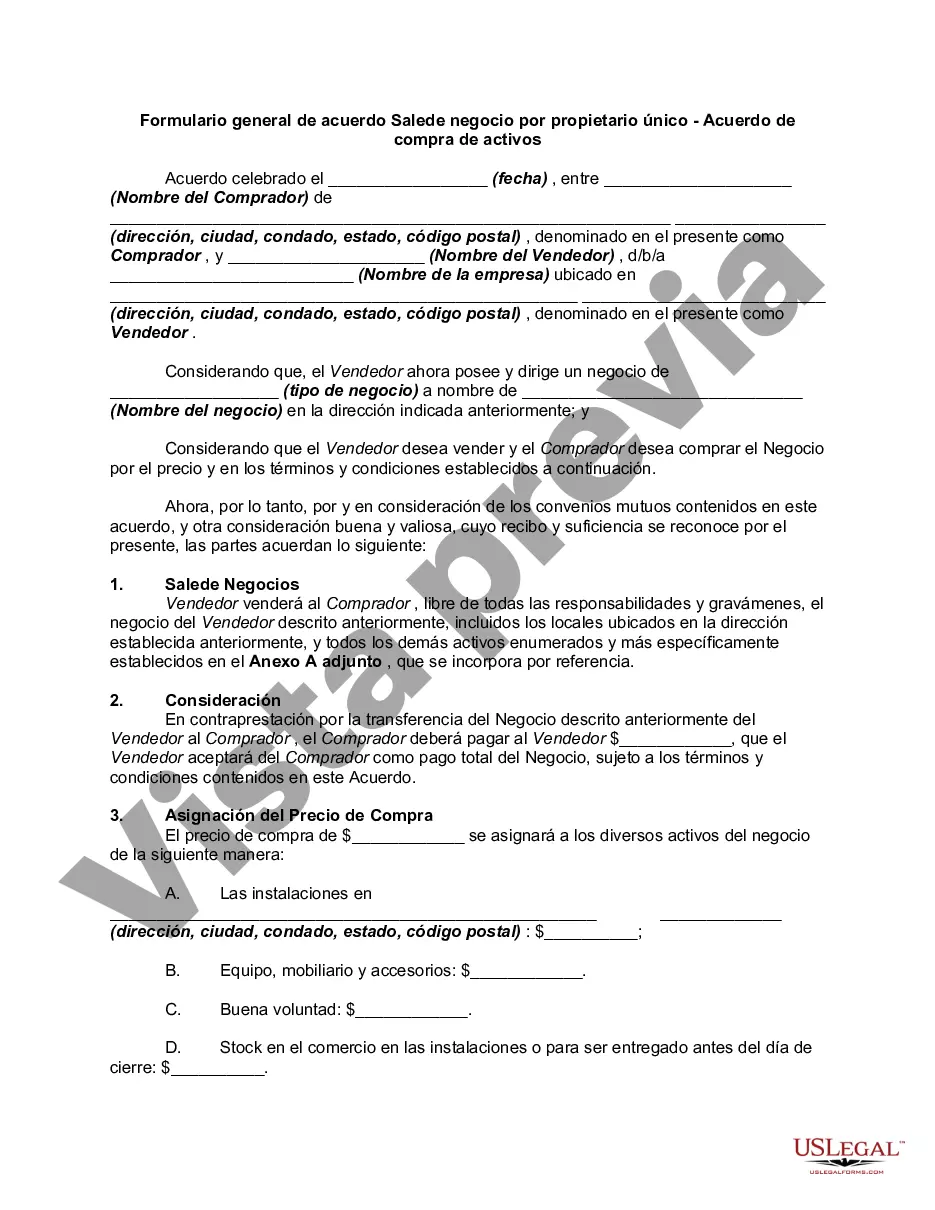

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.