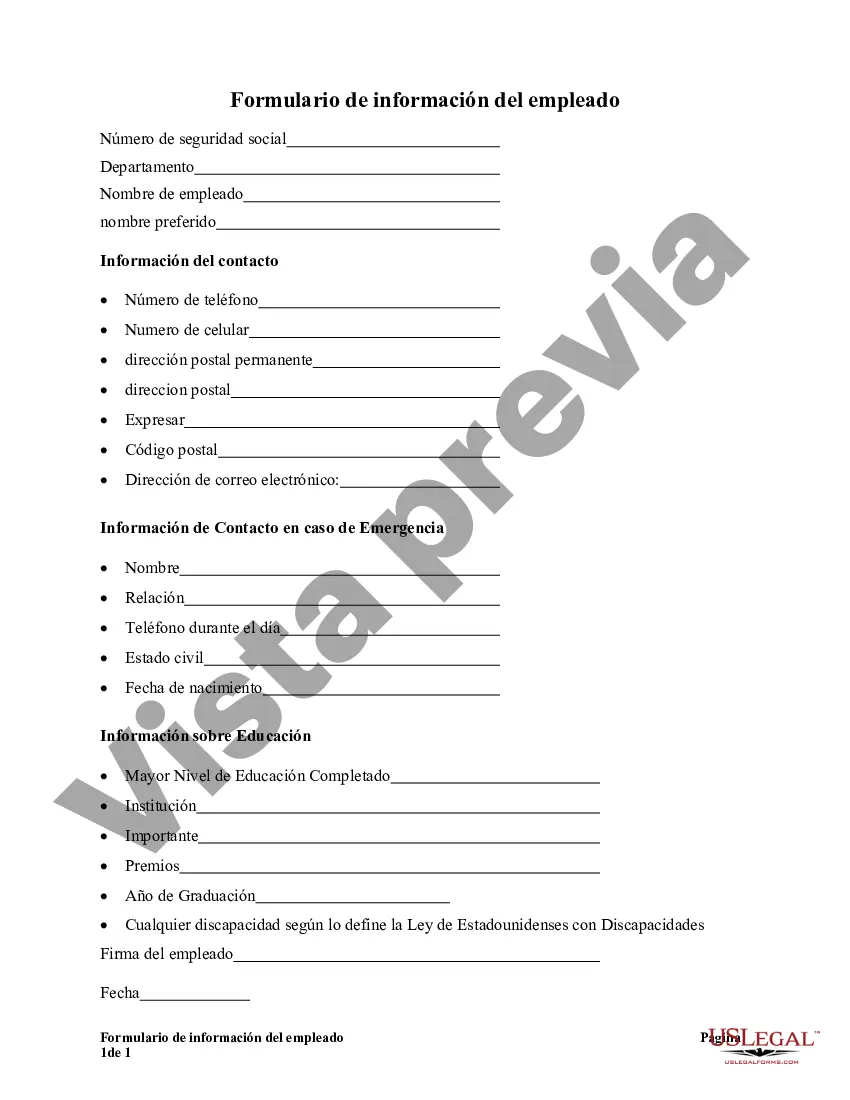

Chicago Illinois Employee Information Form is a vital document used by employers in the city of Chicago, Illinois to collect important information from their employees. This form ensures that employers have accurate and up-to-date data necessary for various employment purposes, including payroll, HR records, benefits, and legal compliance. It helps both small and large organizations streamline their administrative processes and maintain efficient employee management. The Chicago Illinois Employee Information Form typically includes the following relevant fields and keywords: 1. Personal Information: This section collects essential details about the employee, such as full name, address, contact information, social security number, date of birth, and emergency contact details. 2. Employment Information: Here, employers gather information related to the employee's job, such as job title, department, hire date, employment status (full-time, part-time, temporary), and work location. This section may also include fields for employee identification numbers, job description, and managerial information. 3. Compensation and Benefits: This section gathers details about the employee's compensation structure, including salary, hourly wage, pay frequency, and any additional compensation components like bonuses or commissions. It may also include fields for information related to benefits, such as health insurance, retirement plans, vacation days, and other employee benefits offered by the employer. 4. Tax Information: Employers must collect specific tax-related information from employees, including their social security number, federal withholding allowances, state tax withholding preferences, and any other relevant taxation details required for payroll processing and tax filing purposes. 5. Banking Information: This section requires the employee's bank account details (account number and routing number) for direct deposit purposes. This ensures that employers can conveniently transfer employee salaries directly into their bank accounts. 6. Employment Eligibility Verification: In line with federal law (Form I-9), employers in Chicago, Illinois, must collect and verify an employee's eligibility to work in the United States. This section typically requires employees to provide identification documents to establish their identity and employment authorization, such as a passport, Social Security card, driver's license, or permanent resident card. 7. Consent and Disclosures: In compliance with legal requirements, employers often include a section where employees acknowledge their consent and understanding of certain policies, such as drug testing, background checks, confidential information, and equal employment opportunity. This section may also include statements regarding at-will employment and employee handbook acknowledgment. Different types of Chicago Illinois Employee Information Forms could include specific variations based on the needs of different industries or organizations. For example, healthcare organizations may have additional sections related to healthcare and medical information, while government agencies may require more extensive background check disclosures and clearances. Overall, the Chicago Illinois Employee Information Form is a fundamental document that assists employers in gathering comprehensive employee data, ensuring legal compliance, and maintaining accurate employee records. It streamlines various administrative processes and serves as a valuable resource for human resources departments and payroll management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de información del empleado - Employee Information Form

Description

How to fill out Chicago Illinois Formulario De Información Del Empleado?

Draftwing documents, like Chicago Employee Information Form, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for a variety of scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Chicago Employee Information Form template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Chicago Employee Information Form:

- Make sure that your template is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Chicago Employee Information Form isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and get the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!