A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the trustor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the trustor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

A spendthrift trust is a trust that restrains the voluntary and involuntary transfer of the beneficiary's interest in the trust. They are often established when the beneficiary is too young or doesn't have the mental capacity to manage their own money. Spendthrift trusts typically contain a provision prohibiting creditors from attaching the trust fund to satisfy the beneficiary's debts. The aim of such a trust is to prevent it from being used as security to obtain credit.

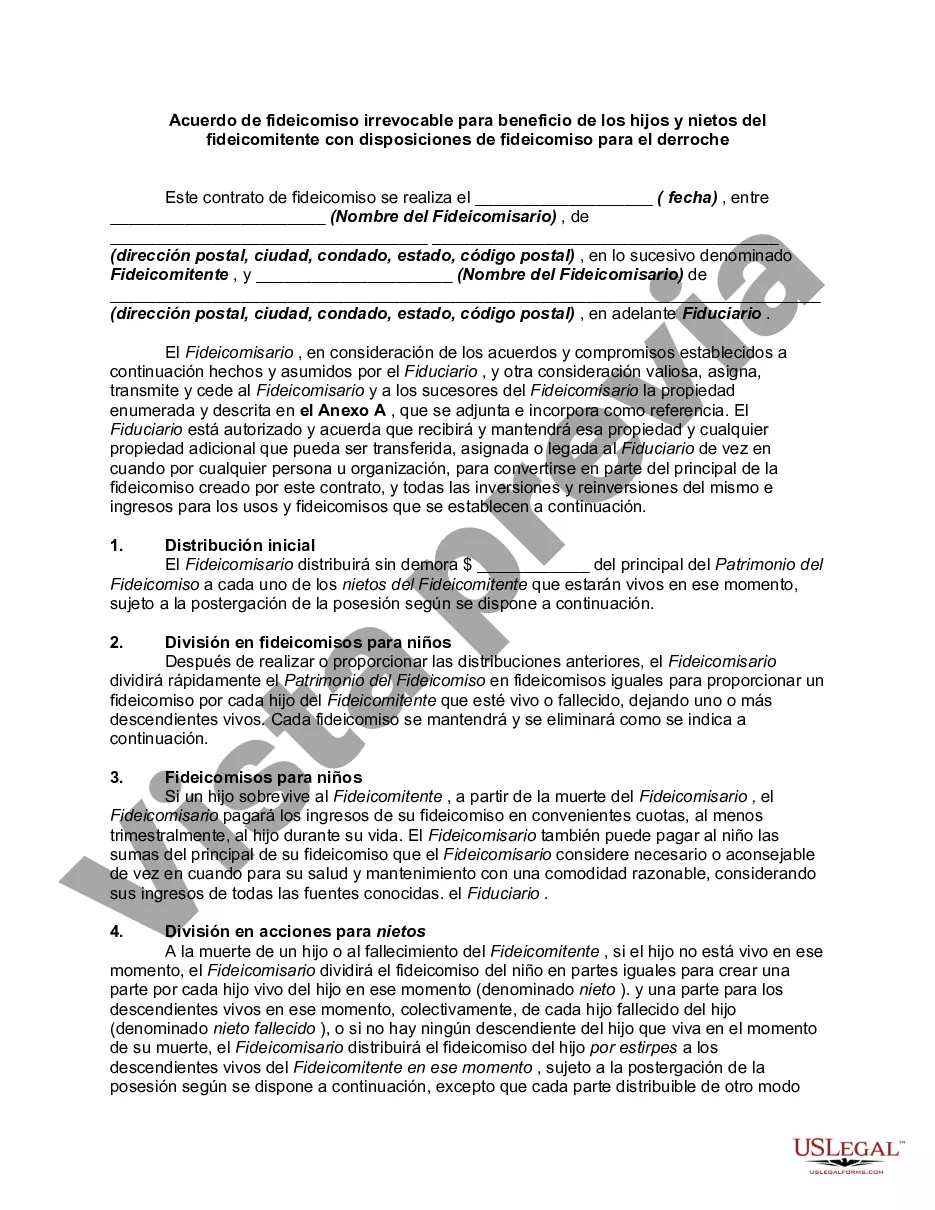

Contra Costa California Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal agreement established by a trust or (the person who creates the trust) in Contra Costa County, California. This specific trust agreement is created for the purpose of benefiting the trust or's children and grandchildren, whilst incorporating spendthrift trust provisions for enhanced protection of beneficiaries' interests. The Contra Costa California Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions offers various types depending on the specific needs and preferences of the trust or. Here are a few of the common types: 1. Revocable Irrevocable Trust: This type allows the trust or to initially establish an irrevocable trust, but retains the ability to modify or revoke the trust in the future. This flexibility enables the trust or to adapt the trust according to changing circumstances while still providing the desired benefits to their children and grandchildren. 2. Generation-Skipping Trust: A generation-skipping trust is designed to bypass the trust or's children and provide benefits directly to their grandchildren or later generations. This type of trust helps minimize estate taxes and facilitates the transfer of wealth across multiple generations. 3. Lifetime Asset Protection Trust: This trust form focuses on protecting the trust property from creditors and potential lawsuits during the lifetime of the trust or, ensuring that the assets are secure for the trust or's children and grandchildren. It provides an additional layer of protection against potential financial risks. 4. Special Needs Trust: A special needs trust is created to safeguard the financial future of a beneficiary with specific disabilities or special needs. It ensures that the beneficiary's government benefits are not compromised while offering additional financial support and care resources. 5. Charitable Trust: A charitable trust allows the trust or to allocate a portion of their assets for charitable purposes while still providing benefits for their children and grandchildren. This type of trust allows for philanthropic endeavors to continue for generations, making a lasting impact on the community. The Contra Costa California Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions acts as a powerful estate planning tool that allows individuals to secure their assets, protect their beneficiaries' interests, and allocate their wealth according to their wishes. By incorporating spendthrift trust provisions, the trust agreement adds an extra layer of protection against potential threats, such as creditors or mismanagement of funds.Contra Costa California Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal agreement established by a trust or (the person who creates the trust) in Contra Costa County, California. This specific trust agreement is created for the purpose of benefiting the trust or's children and grandchildren, whilst incorporating spendthrift trust provisions for enhanced protection of beneficiaries' interests. The Contra Costa California Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions offers various types depending on the specific needs and preferences of the trust or. Here are a few of the common types: 1. Revocable Irrevocable Trust: This type allows the trust or to initially establish an irrevocable trust, but retains the ability to modify or revoke the trust in the future. This flexibility enables the trust or to adapt the trust according to changing circumstances while still providing the desired benefits to their children and grandchildren. 2. Generation-Skipping Trust: A generation-skipping trust is designed to bypass the trust or's children and provide benefits directly to their grandchildren or later generations. This type of trust helps minimize estate taxes and facilitates the transfer of wealth across multiple generations. 3. Lifetime Asset Protection Trust: This trust form focuses on protecting the trust property from creditors and potential lawsuits during the lifetime of the trust or, ensuring that the assets are secure for the trust or's children and grandchildren. It provides an additional layer of protection against potential financial risks. 4. Special Needs Trust: A special needs trust is created to safeguard the financial future of a beneficiary with specific disabilities or special needs. It ensures that the beneficiary's government benefits are not compromised while offering additional financial support and care resources. 5. Charitable Trust: A charitable trust allows the trust or to allocate a portion of their assets for charitable purposes while still providing benefits for their children and grandchildren. This type of trust allows for philanthropic endeavors to continue for generations, making a lasting impact on the community. The Contra Costa California Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions acts as a powerful estate planning tool that allows individuals to secure their assets, protect their beneficiaries' interests, and allocate their wealth according to their wishes. By incorporating spendthrift trust provisions, the trust agreement adds an extra layer of protection against potential threats, such as creditors or mismanagement of funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.