A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the trustor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the trustor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

A spendthrift trust is a trust that restrains the voluntary and involuntary transfer of the beneficiary's interest in the trust. They are often established when the beneficiary is too young or doesn't have the mental capacity to manage their own money. Spendthrift trusts typically contain a provision prohibiting creditors from attaching the trust fund to satisfy the beneficiary's debts. The aim of such a trust is to prevent it from being used as security to obtain credit.

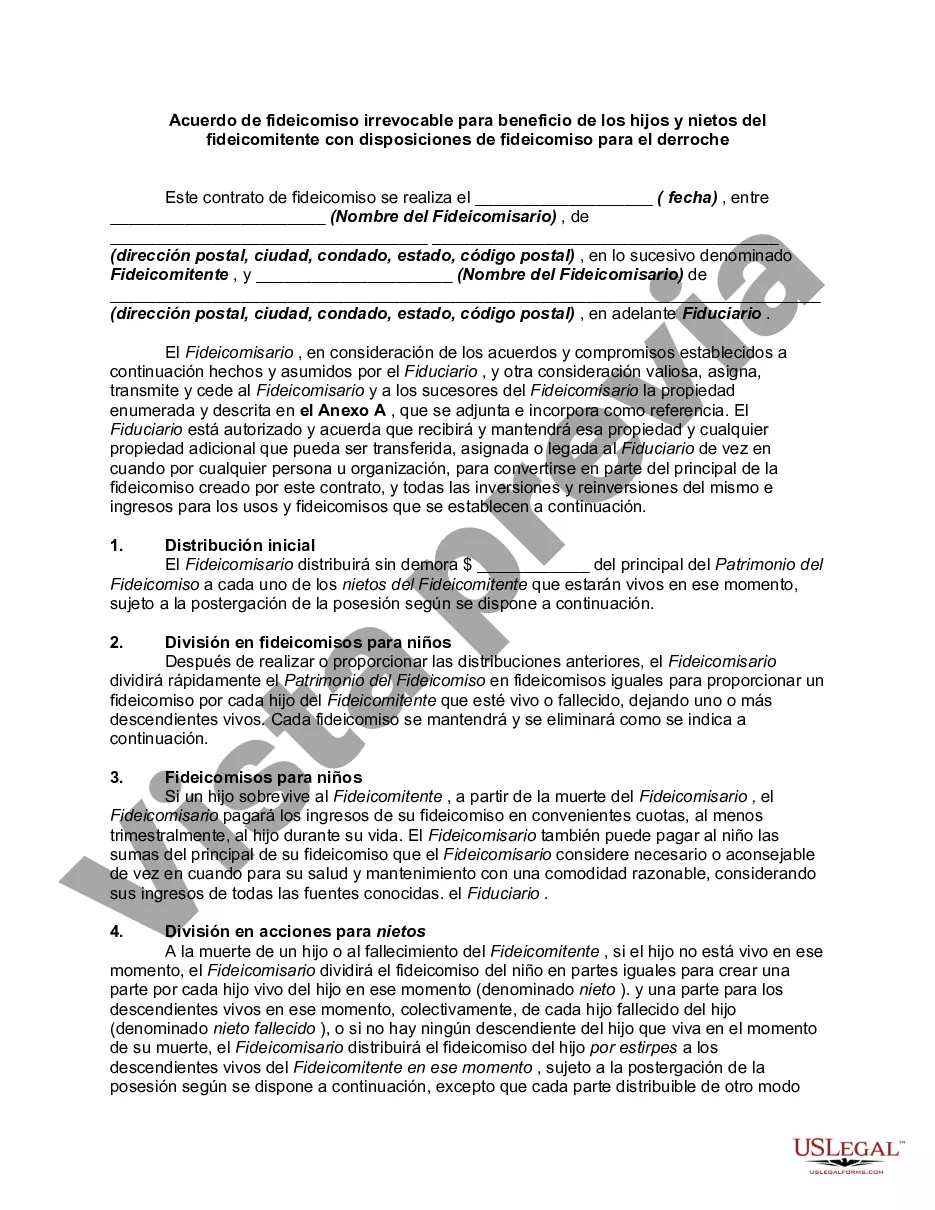

A Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal document that outlines specific instructions for managing and distributing assets held in trust for the benefit of the trust or's children and grandchildren. This type of trust provides protection and safeguards against potential financial mismanagement or creditors' claims. The Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is designed to ensure that the trust assets are utilized wisely and preserved for the intended beneficiaries. By creating an irrevocable trust, the trust or transfers ownership and control of assets permanently to the trust, which offers additional protection against changes in circumstances or undue influence. One of the key features of this trust agreement is the inclusion of spendthrift provisions. These provisions restrict the beneficiaries' access to trust assets and protect the assets from potential creditors, ensuring the assets are used responsibly and provide long-term financial security. By placing limitations on the distribution of assets, the trust provides ongoing financial support while safeguarding against impulsive or irresponsible spending. Additionally, there may be variations of the Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions, such as: 1. Fixed-Term Trust: This type of trust has a defined duration, after which the trust assets are distributed to the beneficiaries. It allows for a specific period of management and ultimately provides for the beneficiaries' financial needs and well-being after the trust term expires. 2. Discretionary Trust: A discretionary trust grants the trustee discretion regarding the distributions and timing of trust assets to the beneficiaries. This allows the trustee to consider various factors, such as financial needs, beneficiary circumstances, and external influences, to make informed decisions about distributions. 3. Education Trust: An education trust is specifically established to provide funds for the beneficiaries' education-related expenses, such as tuition fees, books, and living costs. This type of trust ensures that the beneficiaries have the financial means to pursue their educational goals. 4. Special Needs Trust: A special needs trust is designed to provide ongoing financial support to a beneficiary with special needs while preserving eligibility for government benefits. It allows for the management of assets without disqualifying the beneficiary from receiving essential assistance programs. Overall, a Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a comprehensive legal document that aims to protect and preserve assets for future generations while ensuring responsible and controlled distribution. It offers peace of mind for the trust or, knowing that their hard-earned assets will provide long-term benefits to their children and grandchildren.A Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal document that outlines specific instructions for managing and distributing assets held in trust for the benefit of the trust or's children and grandchildren. This type of trust provides protection and safeguards against potential financial mismanagement or creditors' claims. The Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is designed to ensure that the trust assets are utilized wisely and preserved for the intended beneficiaries. By creating an irrevocable trust, the trust or transfers ownership and control of assets permanently to the trust, which offers additional protection against changes in circumstances or undue influence. One of the key features of this trust agreement is the inclusion of spendthrift provisions. These provisions restrict the beneficiaries' access to trust assets and protect the assets from potential creditors, ensuring the assets are used responsibly and provide long-term financial security. By placing limitations on the distribution of assets, the trust provides ongoing financial support while safeguarding against impulsive or irresponsible spending. Additionally, there may be variations of the Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions, such as: 1. Fixed-Term Trust: This type of trust has a defined duration, after which the trust assets are distributed to the beneficiaries. It allows for a specific period of management and ultimately provides for the beneficiaries' financial needs and well-being after the trust term expires. 2. Discretionary Trust: A discretionary trust grants the trustee discretion regarding the distributions and timing of trust assets to the beneficiaries. This allows the trustee to consider various factors, such as financial needs, beneficiary circumstances, and external influences, to make informed decisions about distributions. 3. Education Trust: An education trust is specifically established to provide funds for the beneficiaries' education-related expenses, such as tuition fees, books, and living costs. This type of trust ensures that the beneficiaries have the financial means to pursue their educational goals. 4. Special Needs Trust: A special needs trust is designed to provide ongoing financial support to a beneficiary with special needs while preserving eligibility for government benefits. It allows for the management of assets without disqualifying the beneficiary from receiving essential assistance programs. Overall, a Santa Clara California Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a comprehensive legal document that aims to protect and preserve assets for future generations while ensuring responsible and controlled distribution. It offers peace of mind for the trust or, knowing that their hard-earned assets will provide long-term benefits to their children and grandchildren.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.