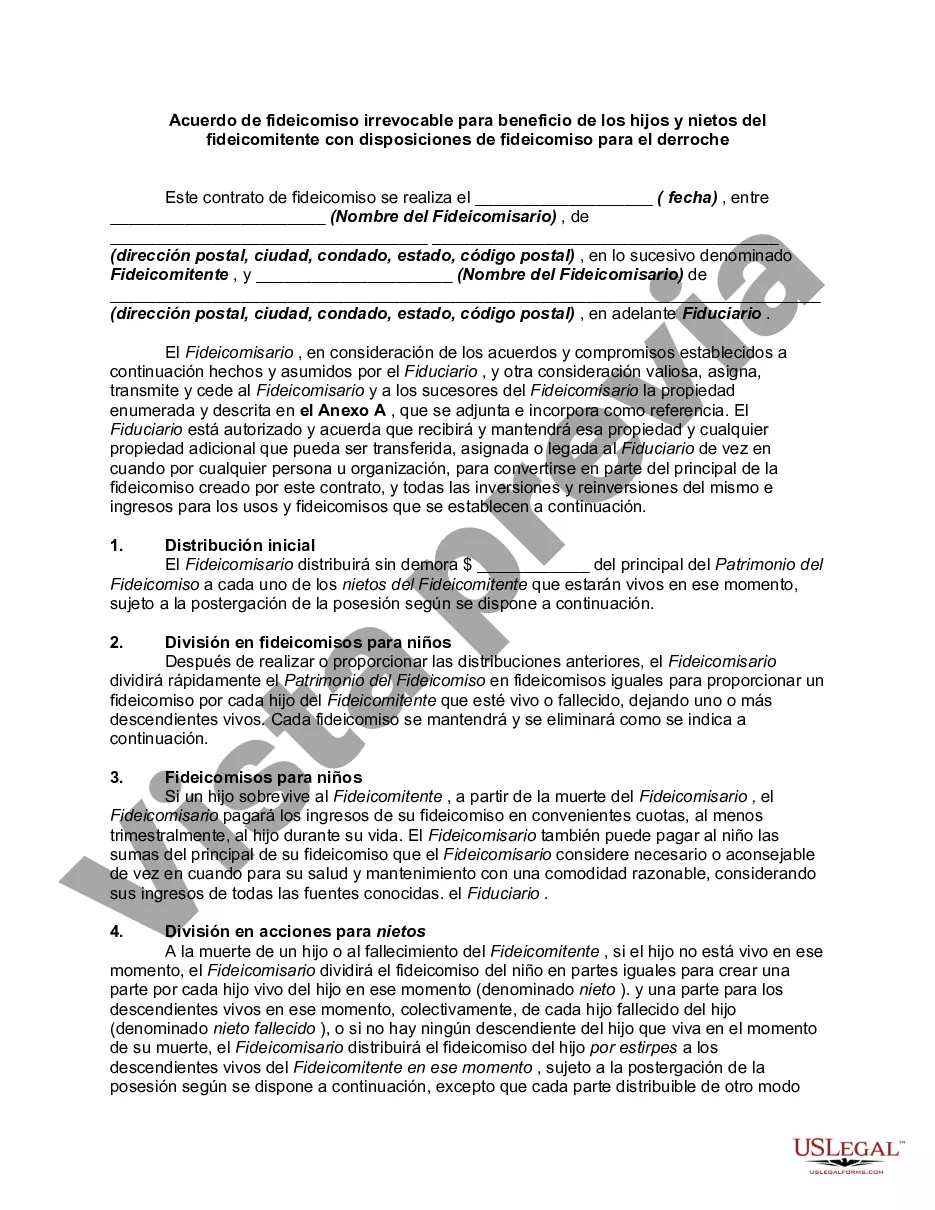

A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the trustor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the trustor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

A spendthrift trust is a trust that restrains the voluntary and involuntary transfer of the beneficiary's interest in the trust. They are often established when the beneficiary is too young or doesn't have the mental capacity to manage their own money. Spendthrift trusts typically contain a provision prohibiting creditors from attaching the trust fund to satisfy the beneficiary's debts. The aim of such a trust is to prevent it from being used as security to obtain credit.

The Suffolk New York Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal framework that provides specific provisions to protect the assets and interests of beneficiaries. Tailored to the unique needs and circumstances of individuals in Suffolk County, New York, this trust agreement ensures the financial well-being and security of future generations. With Spendthrift Trust Provisions, this agreement curtails reckless spending and safeguards the trust assets from creditors and potential risks. By implementing these protective measures, the trust or can rest assured that their hard-earned wealth will be managed appropriately and will have a lasting impact on their descendants. Different types of Suffolk New York Irrevocable Trust Agreements for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions may include: 1. Life Insurance Trust Agreement: This type of trust agreement focuses on using life insurance policies as a means to fund the trust. The proceeds from the policies are then disbursed to the children and grandchildren, providing them with financial stability in the event of the trust or's passing. 2. Charitable Remainder Trust Agreement: In this trust agreement, a portion of the assets is set aside for charitable causes, while the remaining balance benefits the trust or's children and grandchildren. This arrangement not only allows for the preservation of family wealth but also supports philanthropic endeavors in the Suffolk County community. 3. Dynasty Trust Agreement: With a focus on long-term generational wealth preservation, the Dynasty Trust Agreement ensures that the trust assets endure for multiple generations. By minimizing estate taxes and providing ongoing financial support, this agreement allows beneficiaries to enjoy the advantages of the trust throughout their lifetimes. 4. Special Needs Trust Agreement: Designed to protect the interests of trust beneficiaries with special needs or disabilities, this agreement establishes guidelines for managing the assets without affecting their eligibility for public benefits and assistance programs. Each of these variations of the Suffolk New York Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions caters to specific preferences and requirements, enabling individuals to create a comprehensive estate plan that aligns with their goals and aspirations.The Suffolk New York Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal framework that provides specific provisions to protect the assets and interests of beneficiaries. Tailored to the unique needs and circumstances of individuals in Suffolk County, New York, this trust agreement ensures the financial well-being and security of future generations. With Spendthrift Trust Provisions, this agreement curtails reckless spending and safeguards the trust assets from creditors and potential risks. By implementing these protective measures, the trust or can rest assured that their hard-earned wealth will be managed appropriately and will have a lasting impact on their descendants. Different types of Suffolk New York Irrevocable Trust Agreements for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions may include: 1. Life Insurance Trust Agreement: This type of trust agreement focuses on using life insurance policies as a means to fund the trust. The proceeds from the policies are then disbursed to the children and grandchildren, providing them with financial stability in the event of the trust or's passing. 2. Charitable Remainder Trust Agreement: In this trust agreement, a portion of the assets is set aside for charitable causes, while the remaining balance benefits the trust or's children and grandchildren. This arrangement not only allows for the preservation of family wealth but also supports philanthropic endeavors in the Suffolk County community. 3. Dynasty Trust Agreement: With a focus on long-term generational wealth preservation, the Dynasty Trust Agreement ensures that the trust assets endure for multiple generations. By minimizing estate taxes and providing ongoing financial support, this agreement allows beneficiaries to enjoy the advantages of the trust throughout their lifetimes. 4. Special Needs Trust Agreement: Designed to protect the interests of trust beneficiaries with special needs or disabilities, this agreement establishes guidelines for managing the assets without affecting their eligibility for public benefits and assistance programs. Each of these variations of the Suffolk New York Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions caters to specific preferences and requirements, enabling individuals to create a comprehensive estate plan that aligns with their goals and aspirations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.