A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the trustor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the trustor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

A spendthrift trust is a trust that restrains the voluntary and involuntary transfer of the beneficiary's interest in the trust. They are often established when the beneficiary is too young or doesn't have the mental capacity to manage their own money. Spendthrift trusts typically contain a provision prohibiting creditors from attaching the trust fund to satisfy the beneficiary's debts. The aim of such a trust is to prevent it from being used as security to obtain credit.

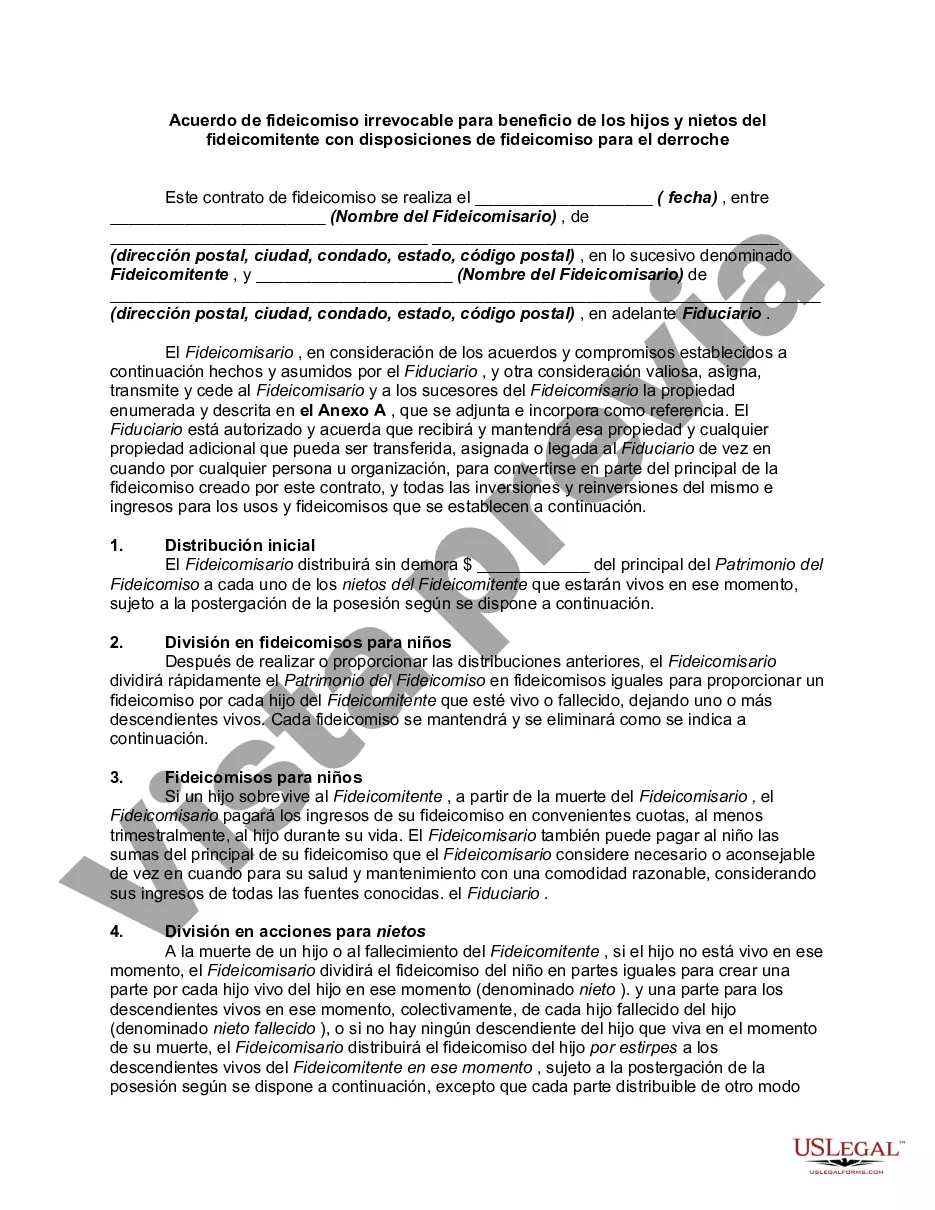

Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legally binding document that outlines the specific provisions and provisions for the distribution of assets and wealth for the benefit of the trust or's children and grandchildren. This type of trust agreement is designed to protect the assets from being squandered or misused by the beneficiaries while also providing them with financial support and security. The Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a popular choice among individuals who wish to safeguard their assets and ensure a lasting legacy for their future generations. This trust agreement offers various benefits and provisions that can be tailored to meet the unique needs and goals of the trust or and their beneficiaries. Key provisions often included in the Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions include: 1. Spendthrift Trust Provisions: This provision restricts the beneficiary's ability to transfer or borrow against their future interests in the trust. It protects the trust assets from being accessed by creditors or potentially irresponsible financial decisions of the beneficiaries. 2. Distribution Schedule: The trust agreement outlines a detailed plan for the distribution of assets to the trust or's children and grandchildren. This schedule can be customized based on the trust or's wishes and the needs of the beneficiaries. 3. Trustee Appointment: The trust agreement appoints a trustee who will manage and administer the trust assets on behalf of the beneficiaries. The trustee is responsible for ensuring that the provisions of the trust agreement are followed and that the beneficiaries receive the designated distributions. 4. Generation-Skipping Transfer Tax Planning: This provision allows the trust or to minimize or potentially eliminate taxes imposed on the transfer of wealth from one generation to another. It offers a tax-efficient method of preserving and transferring assets to future generations. There can be different types of Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions, tailored to individual circumstances and objectives. For example: 1. Irrevocable Life Insurance Trust (IIT): This type of trust agreement is specifically created to own life insurance policies on the trust or's life. It provides a tax-efficient method to pass on the insurance benefits to the trust or's children and grandchildren while protecting the assets from potential creditors. 2. Charitable Remainder Trust (CRT): This trust agreement allows the trust or to designate a portion of their assets to a charitable organization while providing income for the trust or's children and grandchildren. It offers potential tax advantages while supporting charitable causes. 3. Dynasty Trust: A dynasty trust is designed to provide long-term wealth and asset protection for multiple generations. It operates under the same principles as the Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions but with a specific focus on preserving wealth and minimizing estate taxes over several generations. In conclusion, the Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a versatile legal document that provides a range of benefits for the trust or and their beneficiaries. By utilizing this trust agreement, individuals can protect their assets, provide financial security for their loved ones, and establish a lasting legacy for future generations.Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legally binding document that outlines the specific provisions and provisions for the distribution of assets and wealth for the benefit of the trust or's children and grandchildren. This type of trust agreement is designed to protect the assets from being squandered or misused by the beneficiaries while also providing them with financial support and security. The Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a popular choice among individuals who wish to safeguard their assets and ensure a lasting legacy for their future generations. This trust agreement offers various benefits and provisions that can be tailored to meet the unique needs and goals of the trust or and their beneficiaries. Key provisions often included in the Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions include: 1. Spendthrift Trust Provisions: This provision restricts the beneficiary's ability to transfer or borrow against their future interests in the trust. It protects the trust assets from being accessed by creditors or potentially irresponsible financial decisions of the beneficiaries. 2. Distribution Schedule: The trust agreement outlines a detailed plan for the distribution of assets to the trust or's children and grandchildren. This schedule can be customized based on the trust or's wishes and the needs of the beneficiaries. 3. Trustee Appointment: The trust agreement appoints a trustee who will manage and administer the trust assets on behalf of the beneficiaries. The trustee is responsible for ensuring that the provisions of the trust agreement are followed and that the beneficiaries receive the designated distributions. 4. Generation-Skipping Transfer Tax Planning: This provision allows the trust or to minimize or potentially eliminate taxes imposed on the transfer of wealth from one generation to another. It offers a tax-efficient method of preserving and transferring assets to future generations. There can be different types of Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions, tailored to individual circumstances and objectives. For example: 1. Irrevocable Life Insurance Trust (IIT): This type of trust agreement is specifically created to own life insurance policies on the trust or's life. It provides a tax-efficient method to pass on the insurance benefits to the trust or's children and grandchildren while protecting the assets from potential creditors. 2. Charitable Remainder Trust (CRT): This trust agreement allows the trust or to designate a portion of their assets to a charitable organization while providing income for the trust or's children and grandchildren. It offers potential tax advantages while supporting charitable causes. 3. Dynasty Trust: A dynasty trust is designed to provide long-term wealth and asset protection for multiple generations. It operates under the same principles as the Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions but with a specific focus on preserving wealth and minimizing estate taxes over several generations. In conclusion, the Travis Texas Irrevocable Trust Agreement for Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a versatile legal document that provides a range of benefits for the trust or and their beneficiaries. By utilizing this trust agreement, individuals can protect their assets, provide financial security for their loved ones, and establish a lasting legacy for future generations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.