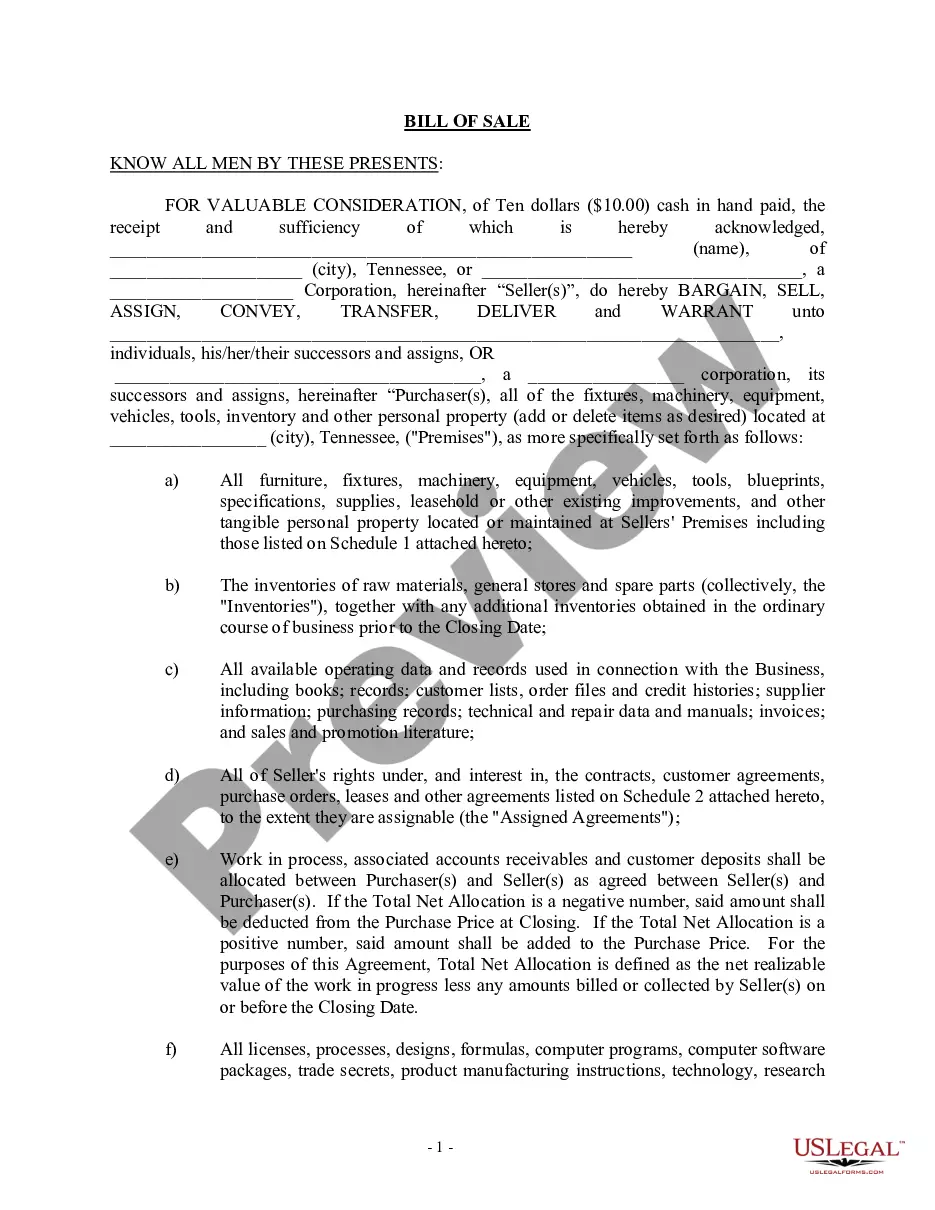

Allegheny Pennsylvania Simple Promissory Note for Personal Loan is a legal document that outlines the terms and conditions of a loan granted by a lender to a borrower in Allegheny County, Pennsylvania. It serves as a written agreement between the parties involved and helps protect their rights and interests. In this promissory note, the borrower promises to repay the principal loan amount plus any agreed-upon interest within a specified time frame. The note typically includes important details such as the loan amount, interest rate, repayment schedule, late fees, and any collateral or security provided by the borrower. There are various types of Allegheny Pennsylvania Simple Promissory Notes for Personal Loan that can be distinguished based on specific loan characteristics. These may include: 1. Fixed Interest Rate Promissory Note: This type of promissory note establishes a predetermined interest rate that remains fixed throughout the loan term. It provides both the lender and borrower with clear expectations of repayment amounts and helps avoid unexpected changes in interest rates. 2. Variable Interest Rate Promissory Note: Unlike a fixed interest rate note, this type of promissory note allows for an adjustable interest rate over the loan's lifetime. The interest rate is typically tied to an index, such as the prime rate, and may change periodically according to market fluctuations. 3. Secured Promissory Note: This promissory note includes a provision that requires the borrower to provide collateral as a form of security for the loan. If the borrower fails to repay the loan as agreed, the lender can seize the collateral to recover the outstanding amount. 4. Unsecured Promissory Note: In contrast to a secured promissory note, an unsecured note does not require the borrower to provide collateral. This type of note often carries a higher interest rate as it poses a higher risk to the lender. 5. Installment Promissory Note: This note establishes a specific repayment schedule where the borrower repays the loan in regular installments (monthly, quarterly, or annually) over a set period of time. It ensures a structured repayment plan and provides clarity on the borrower's obligations. Regardless of the type of Allegheny Pennsylvania Simple Promissory Note for Personal Loan, it is crucial for both parties to thoroughly review and understand the terms before signing. Seeking legal advice is recommended to ensure compliance with state laws and protect the interests of both the borrower and lender.

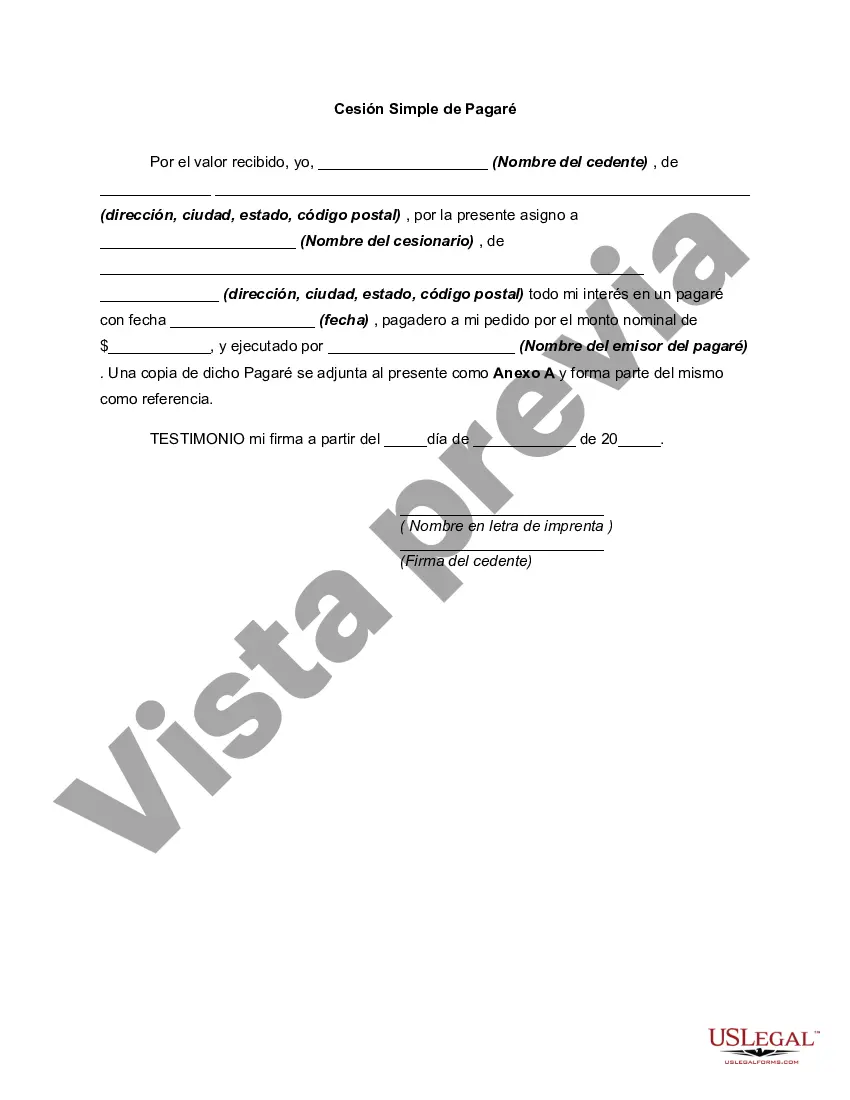

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out Allegheny Pennsylvania Pagaré Simple Para Préstamo Personal?

Creating paperwork, like Allegheny Simple Promissory Note for Personal Loan, to manage your legal affairs is a challenging and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms intended for various scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Allegheny Simple Promissory Note for Personal Loan template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Allegheny Simple Promissory Note for Personal Loan:

- Make sure that your template is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Allegheny Simple Promissory Note for Personal Loan isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and download the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Un pagare es un acuerdo escrito para devolver dinero a una persona o a un negocio. El pagare debe detallar cuando y como se paga el dinero, si la cantidad que es debida tiene interes, y que pasara si no devuelve el dinero. Los pagares tambien son conocidos como las cuentas por pagar o los titulos negociables.

Formato y partes de un pagare El nombre de la persona natural, juridica o empresa que cobrara el pagare. La cantidad del importe a pagar escrita tanto en letras como en numeros. Fecha y lugar donde se emitio el documento. Los datos bancarios y/o el numero de cuenta del emisor para que reciba el dinero del pagare.

Normalmente un pagare se utiliza como instrumento de pago, estableciendo una fecha de vencimiento a partir de la cual se puede acudir al banco a cobrar el dinero o ingresar en nuestra cuenta el documento. A diferencia del cheque, hasta la fecha pactada no se puede cobrar.

Todo pagare debe reunir los siguientes requisitos: Fecha y lugar en los que se elaboro el documento. La mencion de ser pagare inserta en el texto.La promesa incondicional de pagar una suma determinada de dinero.El nombre de la persona a quien debe hacerse el pago, es decir, el beneficiario o acreedor.

¿Como llenar el pagare de un prestamo? Escribe el monto en numeros en la parte superior del pagare y luego la fecha exacta. Se describe el lugar de pago, por ejemplo, estado y ciudad aunque en algunos casos se especifica la direccion exacta.

El pagare permite al que lo emite establecer una fecha futura de pago y, al que lo recibe, descontar su importe en su entidad bancaria antes de su vencimiento. Por ello, es adecuado para el trafico mercantil y poco habitual entre particulares.

El pagare es un documento por medio del cual la persona natural o juridica que lo firma (suscriptor o deudor) promete pagar a otra persona (beneficiario) una cantidad de dinero determinada o determinable. En ningun caso el pago prometido puede estar sujeto a una condicion, lo que significa que siempre debe pagarse.

Contenido de un pagare: I. -La mencion de ser pagare, inserta en el texto del documento; II. -La promesa incondicional de pagar una suma determinada de dinero; III. -EL nombre de la persona a quien ha de hacerse el pago; IV. -LA epoca y el lugar del pago; V. -La fecha y el lugar en que se subscribe el documento; y. VI.

El pagare debe contener: La mencion de ser pagare, inserta en el texto del documento; La promesa incondicional de pagar una suma determinada de dinero; El nombre de la persona a quien ha de hacerse el pago; La epoca y el lugar del pago; La fecha y el lugar en que se subscriba el documento; y.