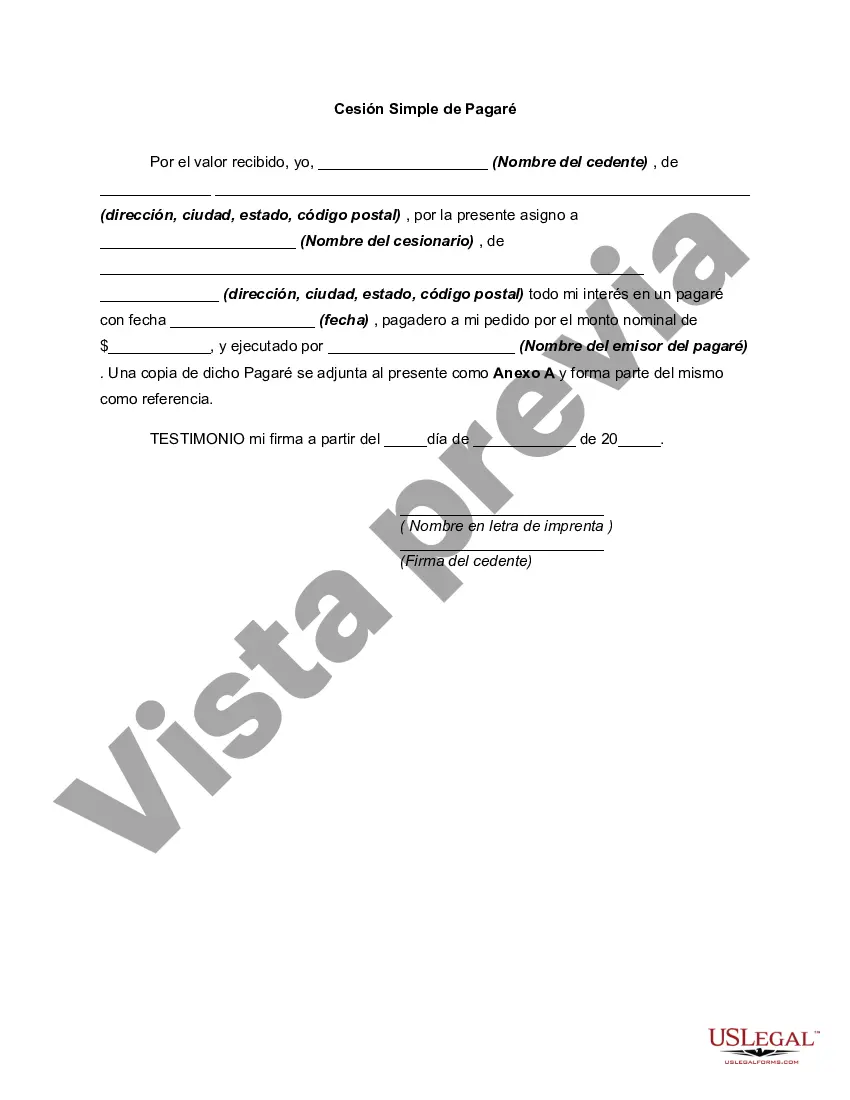

Chicago, Illinois is a vibrant city located in the heart of the Midwest region. Known as the "Windy City," it boasts a rich cultural heritage, breathtaking architecture, and a bustling urban atmosphere. As one of the largest metropolitan areas in the United States, Chicago is a sought-after destination for both residents and tourists alike. When it comes to personal finances, Chicago residents may find themselves in need of financial assistance, which is where a Simple Promissory Note for Personal Loan can come into play. A Simple Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement made between a lender (often an individual or an organization) and a borrower. In Chicago, there are several types of Simple Promissory Notes for Personal Loans that individuals may encounter. These include: 1. Traditional Simple Promissory Note: This is the most common type of promissory note and encompasses a straightforward agreement between the lender and borrower. It outlines details such as the principal loan amount, interest rate, repayment schedule, and any additional terms or conditions. 2. Secured Simple Promissory Note: In this type of note, the borrower pledges collateral, such as property or assets, to secure the loan. This provides an added layer of security for the lender, as they have recourse to the collateral if the borrower fails to repay the loan. 3. Unsecured Simple Promissory Note: Unlike the secured note, this type does not require any collateral. It is solely based on the borrower's creditworthiness and their ability to repay the loan based on their income, assets, and credit history. 4. Installment Simple Promissory Note: This note breaks down the loan repayment into smaller, regular installments, making it easier for the borrower to manage their finances. Each installment includes both the principal loan amount and the interest accrued. 5. Balloon Simple Promissory Note: With this type of note, the borrower makes smaller regular payments throughout the loan's term, but there is a lump sum payment (balloon payment) due at the end of the loan period. The balloon payment typically represents the remaining loan balance or a large portion of it. It is important for individuals in Chicago, Illinois, who are considering a Simple Promissory Note for Personal Loan, to carefully review and understand the terms and conditions before signing. Consulting with a legal professional or financial advisor is highly recommended ensuring compliance with local laws and to protect both the lender's and borrower's interests. In conclusion, Chicago, Illinois offers a diverse range of Simple Promissory Notes for Personal Loans, catering to the financial needs of its residents. Whether it's a traditional, secured, unsecured, installment, or balloon note, individuals should approach these agreements responsibly, seeking professional advice when necessary, to ensure a smooth borrowing experience in the Windy City.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

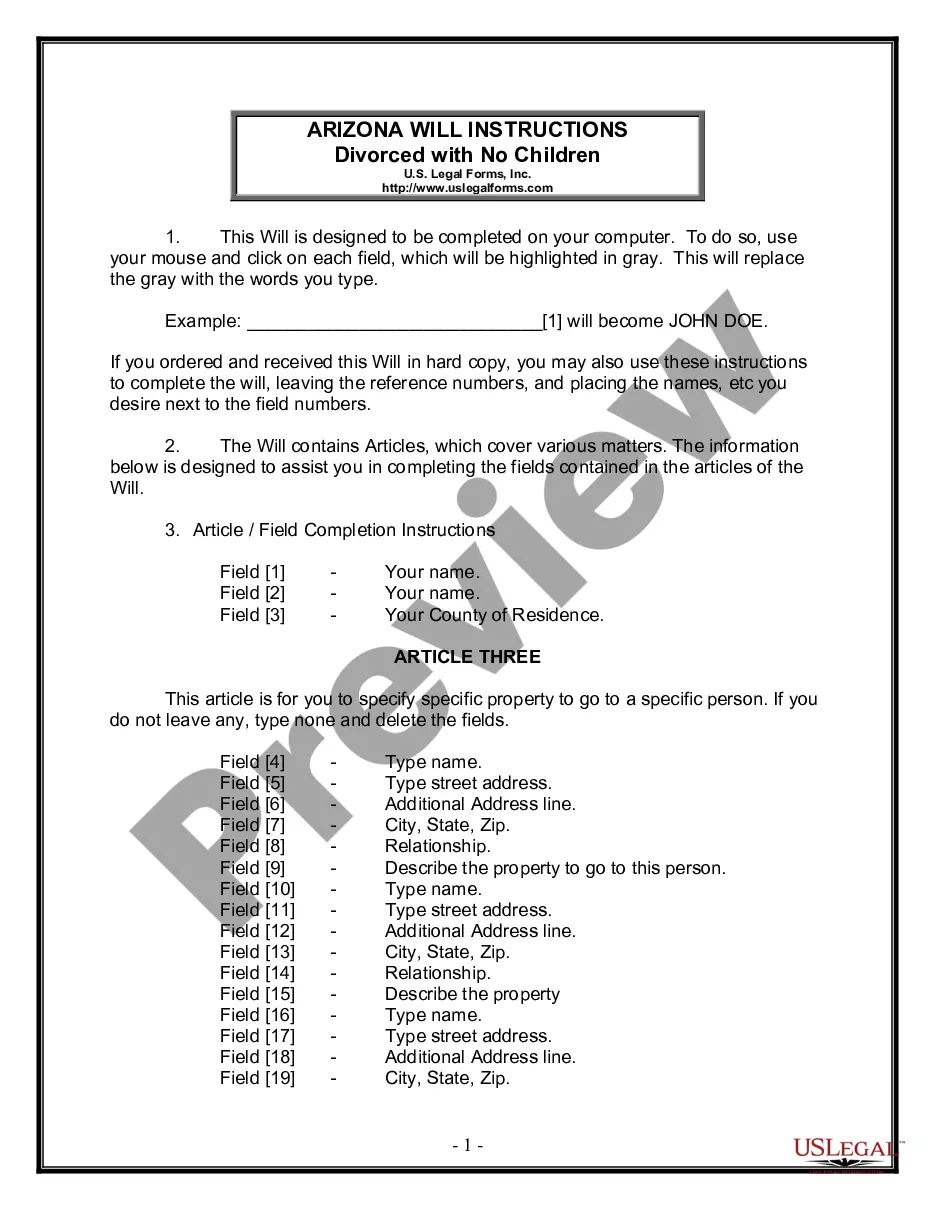

How to fill out Chicago Illinois Pagaré Simple Para Préstamo Personal?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Chicago Simple Promissory Note for Personal Loan, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks associated with document execution straightforward.

Here's how to purchase and download Chicago Simple Promissory Note for Personal Loan.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the legality of some records.

- Check the similar document templates or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and purchase Chicago Simple Promissory Note for Personal Loan.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Chicago Simple Promissory Note for Personal Loan, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you need to deal with an exceptionally difficult case, we recommend getting an attorney to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!