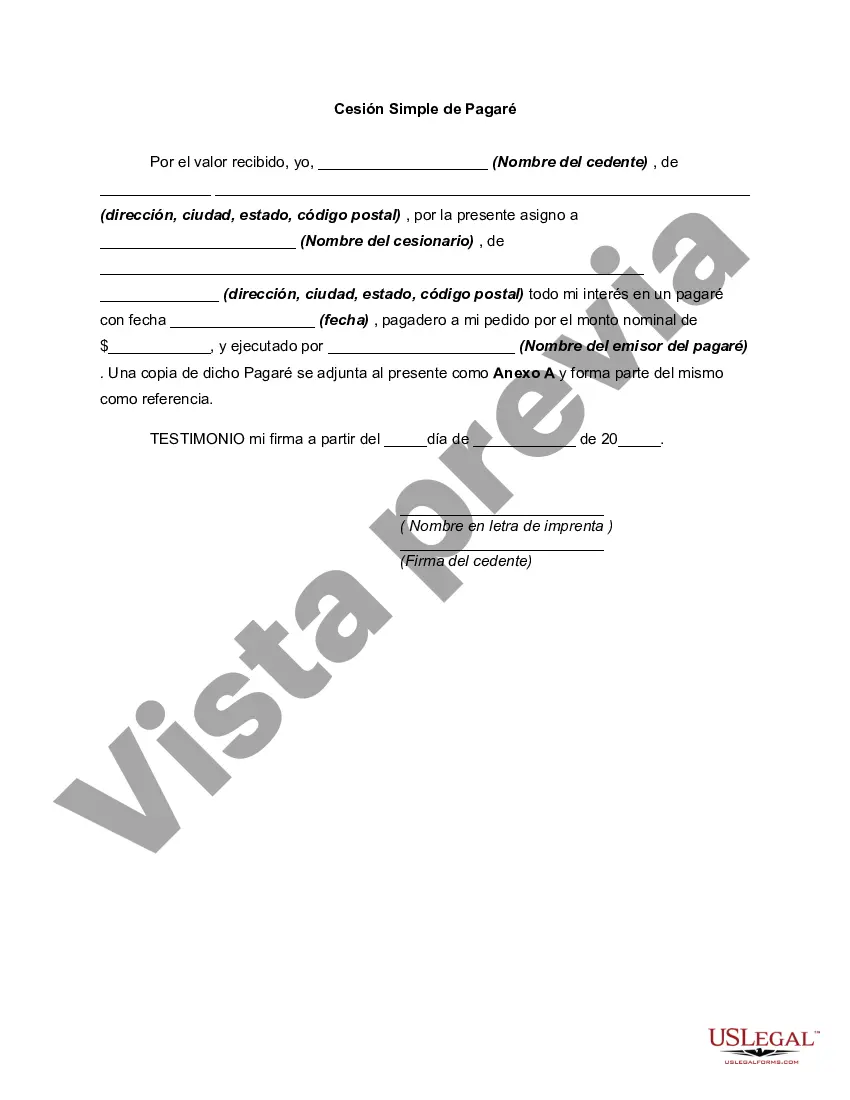

Cuyahoga Ohio Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a personal loan agreement between a lender and borrower in Cuyahoga County, Ohio. This promissory note serves as proof of the loan and includes important information such as loan amount, interest rate, repayment schedule, and consequences for non-payment. The Cuyahoga Ohio Simple Promissory Note for Personal Loan is commonly used by individuals or businesses in Cuyahoga County looking to lend money to friends, family members, or acquaintances while ensuring a clear repayment agreement. This note helps protect both parties by establishing a formal contract that defines the borrower's obligation to repay the loan and the lender's rights in case of default. While there may be variations in the template, depending on specific requirements, the Cuyahoga Ohio Simple Promissory Note for Personal Loan typically includes several essential elements. These may consist of: 1. Loan Amount: The predetermined sum of money that the lender is providing to the borrower. 2. Interest Rate: The agreed-upon percentage that the borrower must pay on top of the loan amount as compensation for borrowing. 3. Repayment Schedule: The timeline for the repayment, including the frequency and total number of installments. 4. Late Payment Penalties: Any additional fees or charges imposed on the borrower for late or missed payments. 5. Default Clause: A section specifying the actions the lender can take if the borrower fails to fulfill their obligations, such as initiating legal action or acceleration of the loan. 6. Governing Law: The note indicates that the agreement is subject to the laws and regulations of Cuyahoga County, Ohio. While there may not be different types of Cuyahoga Ohio Simple Promissory Note for Personal Loan specifically, variations can arise based on the specific terms agreed upon by the lender and borrower. These variances may include different interest rates, repayment terms, or conditions tailored to fit the unique needs of the parties involved. In conclusion, the Cuyahoga Ohio Simple Promissory Note for Personal Loan is a legal instrument that facilitates secure lending transactions in Cuyahoga County. It provides structure and clarity to personal loan agreements and ensures both the lender's and borrower's rights are protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out Cuyahoga Ohio Pagaré Simple Para Préstamo Personal?

Do you need to quickly create a legally-binding Cuyahoga Simple Promissory Note for Personal Loan or maybe any other form to take control of your own or corporate affairs? You can go with two options: contact a legal advisor to draft a valid paper for you or create it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant form templates, including Cuyahoga Simple Promissory Note for Personal Loan and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, carefully verify if the Cuyahoga Simple Promissory Note for Personal Loan is adapted to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Cuyahoga Simple Promissory Note for Personal Loan template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the documents we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!