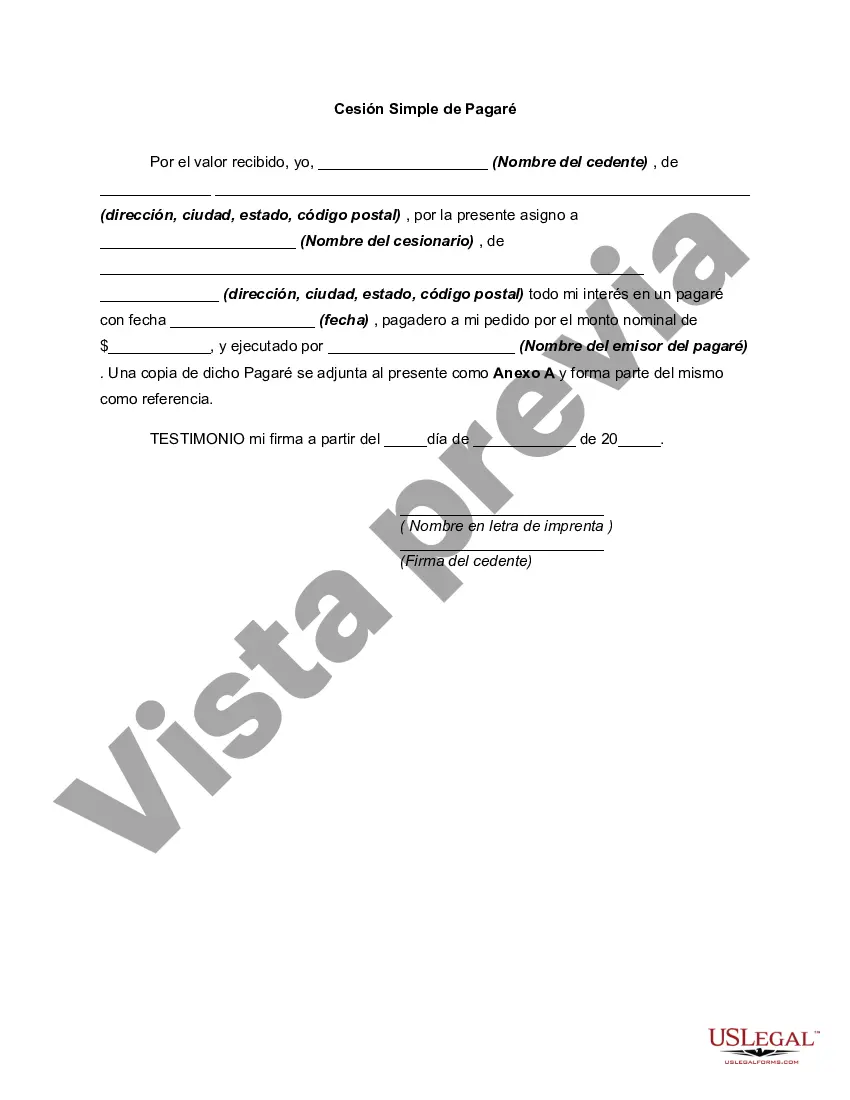

A Hennepin Minnesota Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a loan agreement between two parties in Hennepin County, Minnesota. It serves as evidence of the borrower's promise to repay a specific amount of money to the lender within a defined timeframe, along with any applicable interest or fees. Keywords: Hennepin Minnesota, Simple Promissory Note, Personal Loan, loan agreement, terms and conditions, legally binding, evidence, borrower, lender, repay, timeframe, interest, fees. In Hennepin County, there are several types of Simple Promissory Notes for Personal Loans, catering to different circumstances and preferences. Familiarizing yourself with the various types can help you choose the most suitable one for your specific needs: 1. Fixed-Term Promissory Note: This type of note specifies a predetermined repayment period, typically in months or years, during which the borrower must repay the loan in installments or as a lump sum. The interest rate and any additional charges are also set at the beginning, ensuring a structured repayment plan for both parties. 2. Revolving Line of Credit Promissory Note: Rather than a fixed repayment period, this note allows the borrower to access funds up to a certain credit limit, similar to a credit card. The borrower can withdraw and repay funds as needed, and interest is usually calculated on the outstanding balance. 3. Interest-Only Promissory Note: With this note, the borrower is required to make regular payments to the lender, covering only the accrued interest for a predetermined period. The principal amount remains unchanged until the specified period ends, at which point the borrower begins repaying both the principal and interest. 4. Balloon Promissory Note: In this type of note, the borrower makes smaller periodic payments over an agreed-upon term, but a large final payment (balloon payment) is due at the end of the term. Balloon notes provide flexibility in repayment amounts throughout the loan period but require careful planning to ensure the borrower can make the final payment. It's essential to consult with a legal professional or financial advisor to ensure that the chosen Hennepin Minnesota Simple Promissory Note for Personal Loan aligns with your specific loan requirements and complies with applicable laws and regulations. Creating a well-drafted promissory note protects both parties involved and provides clarity regarding repayment expectations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out Hennepin Minnesota Pagaré Simple Para Préstamo Personal?

Creating paperwork, like Hennepin Simple Promissory Note for Personal Loan, to take care of your legal affairs is a tough and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for a variety of cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Hennepin Simple Promissory Note for Personal Loan template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before downloading Hennepin Simple Promissory Note for Personal Loan:

- Ensure that your document is compliant with your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Hennepin Simple Promissory Note for Personal Loan isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin utilizing our website and download the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!