Miami-Dade Florida Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a loan between an individual lender and borrower in Miami-Dade County, Florida. This promissory note serves as evidence of the loan agreement and helps ensure both parties are aware of their rights and responsibilities. The Miami-Dade Florida Simple Promissory Note for Personal Loan includes essential information such as the loan amount, interest rate, repayment schedule, and any late fees or penalties. It also states the consequences in the event of default or breach of the loan agreement. This note safeguards the interests of both the lender and the borrower and sets clear expectations for repayment. Certain types of Miami-Dade Florida Simple Promissory Notes for Personal Loan can be categorized based on specific terms or conditions: 1. Fixed-Rate Miami-Dade Florida Simple Promissory Note for Personal Loan: This type of promissory note stipulates a fixed interest rate throughout the entire loan term. Borrowers can calculate and plan their repayment budget accordingly, as the interest rate remains constant. 2. Variable-Rate Miami-Dade Florida Simple Promissory Note for Personal Loan: In contrast to fixed-rate notes, this type of promissory note involves an interest rate that can fluctuate over time. The interest rate is often tied to an index, such as the prime lending rate, and may change periodically. Borrowers should be prepared for potential fluctuations in their monthly payments as a result of changing interest rates. 3. Secured Miami-Dade Florida Simple Promissory Note for Personal Loan: This note includes collateral to secure the loan, such as a car, property, or other valuable assets. If the borrower defaults on the loan, the lender has the right to take possession of the collateral to recover their funds. 4. Unsecured Miami-Dade Florida Simple Promissory Note for Personal Loan: This note does not require any collateral, making it riskier for the lender. In case of default, the lender must pursue legal action to recover the loaned amount. 5. Demand Miami-Dade Florida Simple Promissory Note for Personal Loan: Unlike traditional promissory notes with a defined term, a demand note allows the lender to demand repayment at any time they see fit. This type of note can be useful for short-term loans or when the lender wants flexibility in repayment. In conclusion, a Miami-Dade Florida Simple Promissory Note for Personal Loan is an essential legal document that outlines the terms and conditions of a loan in Miami-Dade County. Different types of promissory notes are available to suit the specific needs of lenders and borrowers, including fixed-rate, variable-rate, secured, unsecured, and demand notes. It is crucial for both parties involved to thoroughly understand the terms and conditions outlined in the promissory note before entering into a loan agreement.

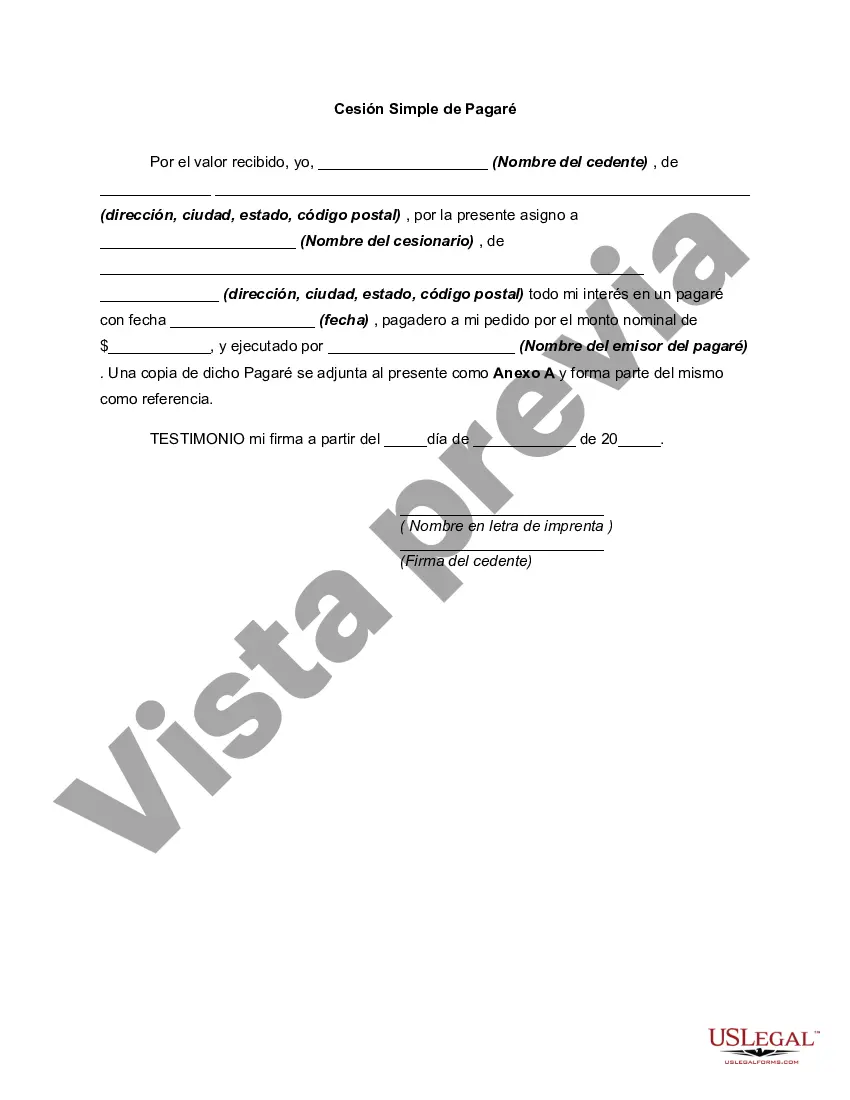

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02333BG-1

Format:

Word

Instant download

Description

An assignment means the transfer of a property right or title to some particular person under an agreement, usually in writing.

Miami-Dade Florida Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a loan between an individual lender and borrower in Miami-Dade County, Florida. This promissory note serves as evidence of the loan agreement and helps ensure both parties are aware of their rights and responsibilities. The Miami-Dade Florida Simple Promissory Note for Personal Loan includes essential information such as the loan amount, interest rate, repayment schedule, and any late fees or penalties. It also states the consequences in the event of default or breach of the loan agreement. This note safeguards the interests of both the lender and the borrower and sets clear expectations for repayment. Certain types of Miami-Dade Florida Simple Promissory Notes for Personal Loan can be categorized based on specific terms or conditions: 1. Fixed-Rate Miami-Dade Florida Simple Promissory Note for Personal Loan: This type of promissory note stipulates a fixed interest rate throughout the entire loan term. Borrowers can calculate and plan their repayment budget accordingly, as the interest rate remains constant. 2. Variable-Rate Miami-Dade Florida Simple Promissory Note for Personal Loan: In contrast to fixed-rate notes, this type of promissory note involves an interest rate that can fluctuate over time. The interest rate is often tied to an index, such as the prime lending rate, and may change periodically. Borrowers should be prepared for potential fluctuations in their monthly payments as a result of changing interest rates. 3. Secured Miami-Dade Florida Simple Promissory Note for Personal Loan: This note includes collateral to secure the loan, such as a car, property, or other valuable assets. If the borrower defaults on the loan, the lender has the right to take possession of the collateral to recover their funds. 4. Unsecured Miami-Dade Florida Simple Promissory Note for Personal Loan: This note does not require any collateral, making it riskier for the lender. In case of default, the lender must pursue legal action to recover the loaned amount. 5. Demand Miami-Dade Florida Simple Promissory Note for Personal Loan: Unlike traditional promissory notes with a defined term, a demand note allows the lender to demand repayment at any time they see fit. This type of note can be useful for short-term loans or when the lender wants flexibility in repayment. In conclusion, a Miami-Dade Florida Simple Promissory Note for Personal Loan is an essential legal document that outlines the terms and conditions of a loan in Miami-Dade County. Different types of promissory notes are available to suit the specific needs of lenders and borrowers, including fixed-rate, variable-rate, secured, unsecured, and demand notes. It is crucial for both parties involved to thoroughly understand the terms and conditions outlined in the promissory note before entering into a loan agreement.