Salt Lake Utah Simple Promissory Note for Personal Loan is a legal document that outlines the terms and conditions of a personal loan agreement between a lender and a borrower. This note serves as evidence of the borrower's promise to repay the loan amount to the lender within a specified time frame. Keywords: Salt Lake, Utah, Simple Promissory Note, Personal Loan, legal document, terms and conditions, borrower, lender, loan agreement, repay, specified time frame. In Salt Lake City, Utah, residents can utilize a Simple Promissory Note for Personal Loan to ensure a clear and formal agreement between both parties involved in a personal loan transaction. This legal document protects the rights and obligations of the lender and the borrower and helps facilitate a smooth lending process. A Simple Promissory Note for Personal Loan typically contains important details such as the loan amount, interest rate (if applicable), repayment schedule, late payment penalties, and any additional terms agreed upon by both parties. This note provides a written record of the loan agreement and helps prevent any misunderstanding or disputes that may arise in the future. Different types of Salt Lake Utah Simple Promissory Note for Personal Loan may include: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate for the entire duration of the loan. It ensures that the borrower repays a consistent amount each period without any fluctuations in interest rates. 2. Adjustable-Rate Promissory Note: An adjustable-rate promissory note allows for changes in the interest rate over time. The interest rate can fluctuate based on market conditions or other agreed-upon criteria, potentially affecting the borrower's monthly payments. 3. Secured Promissory Note: In some cases, a lender may request a secured promissory note, which involves the borrower providing collateral to secure the loan. Collateral can be in the form of assets such as property, vehicles, or other valuable possessions. This type of note provides the lender with additional assurance in case the borrower defaults. It is crucial for both the lender and the borrower to carefully review the terms and conditions outlined in the Salt Lake Utah Simple Promissory Note for Personal Loan before signing. Seeking legal advice or assistance may be beneficial to ensure compliance with state laws and regulations. Remember, borrowing or lending money should be approached with caution and responsibility.

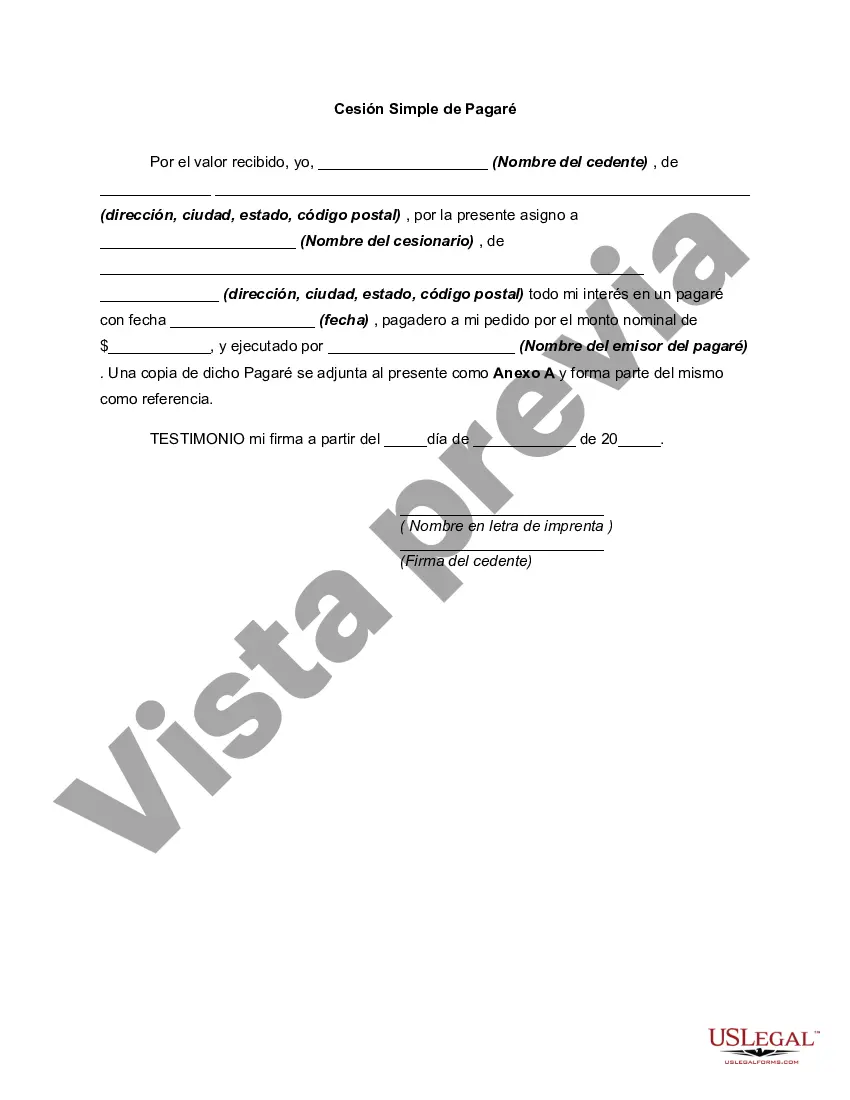

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out Salt Lake Utah Pagaré Simple Para Préstamo Personal?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Salt Lake Simple Promissory Note for Personal Loan suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Salt Lake Simple Promissory Note for Personal Loan, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Salt Lake Simple Promissory Note for Personal Loan:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Salt Lake Simple Promissory Note for Personal Loan.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!