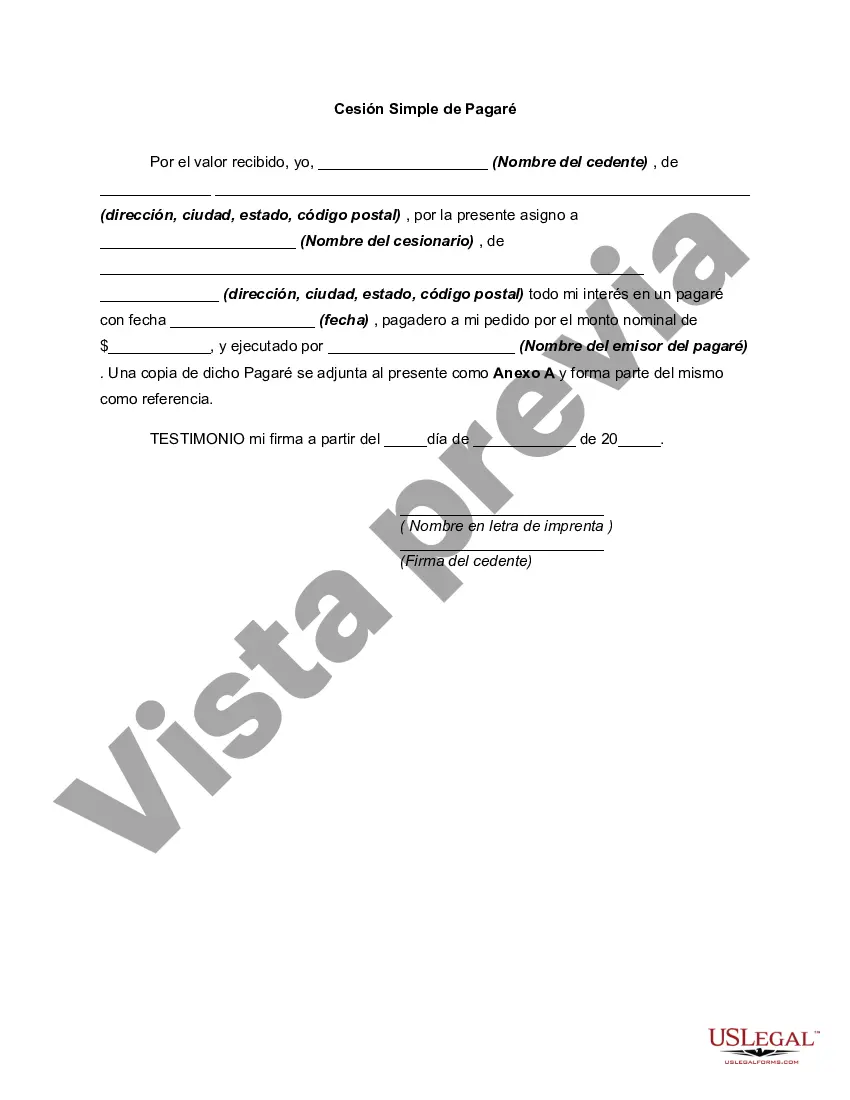

Travis Texas Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a personal loan agreement between a borrower and a lender. This note serves as evidence of the loan, ensuring both parties are aware of their rights and responsibilities. The Travis Texas Simple Promissory Note for Personal Loan typically includes essential details such as the names and addresses of the borrower and lender, the loan amount, the interest rate, the repayment schedule, and any additional fees or penalties. This written agreement provides protection to both parties in case of any disputes or misunderstandings. There are several types of Simple Promissory Note for Personal Loans available in Travis, Texas, depending on specific requirements or circumstances. These include: 1. Secured Promissory Note: This type of note requires the borrower to pledge collateral, such as a vehicle or property, as security against the loan. If the borrower fails to repay the loan, the lender can seize the collateral to recover the outstanding amount. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require any collateral. It solely relies on the borrower's creditworthiness and personal guarantee. In the case of default, the lender may have to pursue legal actions to recover the loan. 3. Demand Promissory Note: This note allows the lender to demand repayment of the loan at any time, usually without any specified repayment schedule. Such notes are often used for short-term loans or when the borrower and lender have a strong personal relationship. 4. Installment Promissory Note: This type of note outlines a fixed repayment schedule, including regular payments of principal and interest over a specified period. It provides a structured approach to loan repayment, ensuring the borrower is aware of their obligations and the lender knows when to expect payments. 5. Balloon Promissory Note: Typically used for long-term loans, a balloon note involves regular payments of interest for a set period, followed by a larger "balloon" payment of the remaining principal at the end. This allows borrowers to have lower monthly payments initially and then settle the outstanding balance in a lump sum. Travis Texas Simple Promissory Note for Personal Loan establishes clear expectations and protects the interests of both the borrower and lender. However, it is crucial to consult a legal professional or use a reliable online template to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out Travis Texas Pagaré Simple Para Préstamo Personal?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Travis Simple Promissory Note for Personal Loan meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. In addition to the Travis Simple Promissory Note for Personal Loan, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Travis Simple Promissory Note for Personal Loan:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Travis Simple Promissory Note for Personal Loan.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!