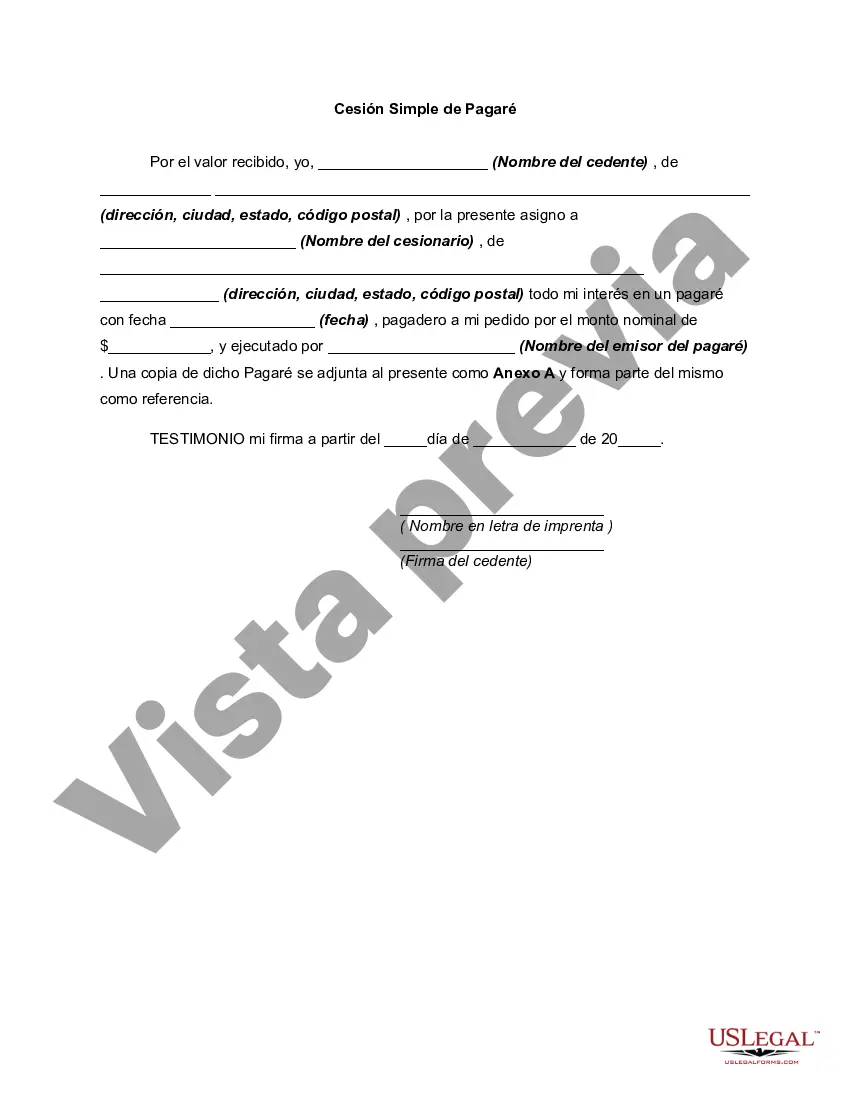

A Clark Nevada Simple Promissory Note for Family Loan is a legally binding agreement between family members in the state of Nevada, which outlines the terms and conditions of a loan made within the family. This type of promissory note is often used when a family member lends money to another family member and aims to establish clear expectations, repayment conditions, and protect the interests of both parties involved. The main purpose of a Clark Nevada Simple Promissory Note for Family Loan is to provide a written record of the loan terms, including the amount borrowed, interest rate (if applicable), repayment schedule, and any additional terms agreed upon. By having this document in place, it helps ensure transparency and prevents any misunderstandings or disputes in the future. A Clark Nevada Simple Promissory Note for Family Loan includes various key components. Firstly, it identifies the parties involved, stating the names and addresses of the lender (also referred to as the "Payee") and the borrower (also known as the "Maker"). Additionally, it specifies the principal amount borrowed, which serves as the starting point for calculating interest or any other applicable charges. Furthermore, the promissory note outlines the repayment terms, indicating the agreed-upon schedule, installment amounts, and the due date of each payment. It may also outline any penalties or late fees that the borrower may incur in case of default or late payments. Regarding interest rates, the Clark Nevada Simple Promissory Note for Family Loan may mention whether the loan bears interest or if it is an interest-free loan. If interest is stipulated, the document will specify the interest rate, whether it is a fixed or variable rate, and how it will be calculated (e.g. simple interest or compound interest). Considering different types of Clark Nevada Simple Promissory Note for Family Loan, variations can exist depending on the specific needs and agreement between the family members involved. Some individuals may opt for a secured promissory note, where the borrower offers collateral (such as property or assets) as security for the loan. Others may choose an unsecured promissory note, which does not require any collateral but may involve a higher interest rate to compensate for the increased risk to the lender. In summary, a Clark Nevada Simple Promissory Note for Family Loan is a legally binding agreement that establishes the terms and conditions of a loan made among family members. It safeguards the interests of both lender and borrower by clearly defining the loan amount, repayment schedule, interest rate (if applicable), and any additional terms agreed upon. Different types of promissory notes may vary depending on whether they are secured or unsecured loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Clark Nevada Pagaré Simple Para Préstamo Familiar?

If you need to find a reliable legal document supplier to obtain the Clark Simple Promissory Note for Family Loan, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support make it simple to locate and execute different papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to search or browse Clark Simple Promissory Note for Family Loan, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Clark Simple Promissory Note for Family Loan template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less expensive and more affordable. Set up your first business, arrange your advance care planning, draft a real estate agreement, or complete the Clark Simple Promissory Note for Family Loan - all from the comfort of your sofa.

Sign up for US Legal Forms now!