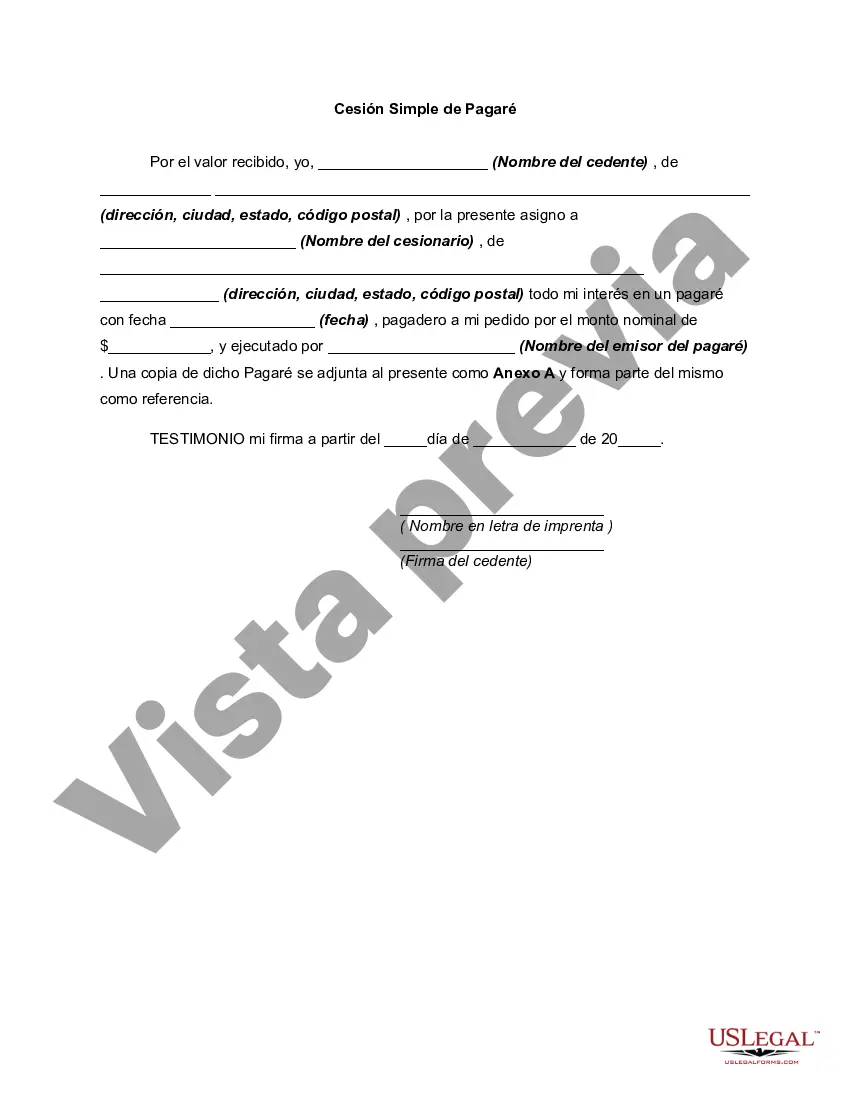

Cuyahoga County, Ohio is a vibrant region located in the state of Ohio, known for its rich history, diverse culture, and stunning natural beauty. It is home to the city of Cleveland, which serves as the county seat and is the largest city in Ohio. Cuyahoga County offers a wide range of attractions, including world-class museums, picturesque parks, bustling shopping districts, and a thriving culinary scene. A Cuyahoga Ohio Simple Promissory Note for Family Loan is a legal document that outlines the terms and conditions of a loan agreement between family members. It serves as a written agreement, ensuring the lender's rights and protecting the borrower's responsibilities for the loan. This type of promissory note is commonly used by families to document loans for various purposes, such as helping with education expenses, purchasing a home, starting a business, or covering unexpected expenses. There are various types of Cuyahoga Ohio Simple Promissory Notes for Family Loans, each serving a specific purpose. These may include: 1. Cuyahoga Ohio Simple Promissory Note for Education Loan: This promissory note is designed specifically for education-related loans, helping family members provide financial assistance for tuition fees, books, or other educational expenses. 2. Cuyahoga Ohio Simple Promissory Note for Home Loan: This type of promissory note is used when a family member lends money to another family member for the purpose of purchasing or renovating a home. 3. Cuyahoga Ohio Simple Promissory Note for Business Loan: If a family member wants to support another family member's business venture, this promissory note outlines the terms and conditions of the loan, such as the repayment schedule, interest rates, and any collateral involved. 4. Cuyahoga Ohio Simple Promissory Note for Emergency Loan: In the case of unexpected financial emergencies, family members may use this type of promissory note to provide immediate assistance, addressing urgent needs such as medical expenses, repairs, or other unforeseen circumstances. When drafting a Cuyahoga Ohio Simple Promissory Note for Family Loan, it is crucial to include essential information such as the loan amount, interest rate (if applicable), repayment terms, consequences of default, and signatures of both parties involved. It is advisable to consult with a legal professional to ensure all necessary provisions are included and adhere to any applicable state laws and regulations. In summary, Cuyahoga Ohio offers a variety of Simple Promissory Notes for Family Loans tailored for different purposes, including education, home purchases, business ventures, and emergencies. These promissory notes are vital in maintaining transparency, trust, and clarity within family loan agreements, providing a solid framework for borrowers and lenders to fulfill their financial obligations responsibly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Cuyahoga Ohio Pagaré Simple Para Préstamo Familiar?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Cuyahoga Simple Promissory Note for Family Loan, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the recent version of the Cuyahoga Simple Promissory Note for Family Loan, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Simple Promissory Note for Family Loan:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Cuyahoga Simple Promissory Note for Family Loan and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!