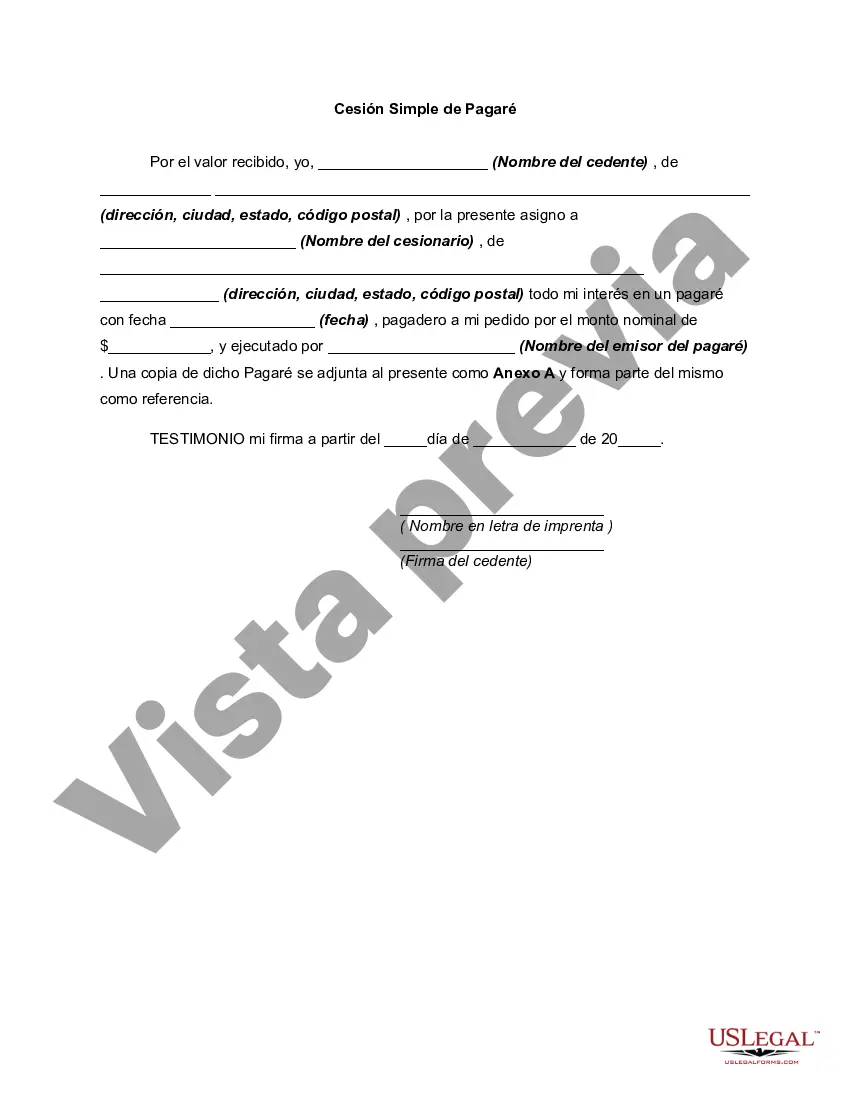

Hennepin County, Minnesota, is the most populous county in the state and home to the bustling city of Minneapolis. It offers a diverse range of attractions, including cultural landmarks, recreational opportunities, and a thriving economy. When it comes to financial matters, individuals often turn to legal documents like a Simple Promissory Note for Family Loan to ensure clarity and security in their personal lending arrangements. A Hennepin Minnesota Simple Promissory Note for Family Loan is a legal agreement drafted between family members residing in Hennepin County. It outlines the terms and conditions of a loan between individuals, ensuring that both parties understand their rights and responsibilities. This document can be useful in situations where financial assistance is needed for various purposes, such as educational expenses, medical bills, or starting a business. Different types of Simple Promissory Notes for Family Loan, specific to Hennepin Minnesota, may include: 1. Hennepin Minnesota Simple Promissory Note for College Loan: This type of promissory note is specifically tailored for individuals seeking financial assistance for their higher education expenses. It outlines the terms of repayment, interest rates, and any conditions that need to be met for the loan to be considered fulfilled. 2. Hennepin Minnesota Simple Promissory Note for Medical Loan: This promissory note is designed for family members who wish to provide financial aid to cover medical bills or related healthcare expenses. It specifies the repayment plan, interest rates, and any collateral, if applicable. 3. Hennepin Minnesota Simple Promissory Note for Entrepreneurial Loan: This promissory note caters to individuals looking to borrow money from family members in order to start or expand a business. It includes clauses discussing the terms of repayment, profit-sharing agreements, and repayment schedules based on the success of the business. Regardless of the specific type, a Hennepin Minnesota Simple Promissory Note for Family Loan typically covers essential information, such as the loan amount, interest rates, repayment plan, any collateral involved, and consequences of default. It is essential for both parties to thoroughly understand the terms stated within the document, as it serves as legal protection and can prevent misunderstandings or disputes in the future. When drafting a Hennepin Minnesota Simple Promissory Note for Family Loan, it is recommended to consult with a legal professional to ensure compliance with state laws and to tailor the document to address the unique circumstances of the loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Hennepin Minnesota Pagaré Simple Para Préstamo Familiar?

Are you looking to quickly draft a legally-binding Hennepin Simple Promissory Note for Family Loan or maybe any other form to take control of your own or business matters? You can select one of the two options: contact a professional to draft a legal document for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive neatly written legal papers without paying unreasonable fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including Hennepin Simple Promissory Note for Family Loan and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the Hennepin Simple Promissory Note for Family Loan is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the document isn’t what you were hoping to find by using the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Hennepin Simple Promissory Note for Family Loan template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the documents we provide are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!