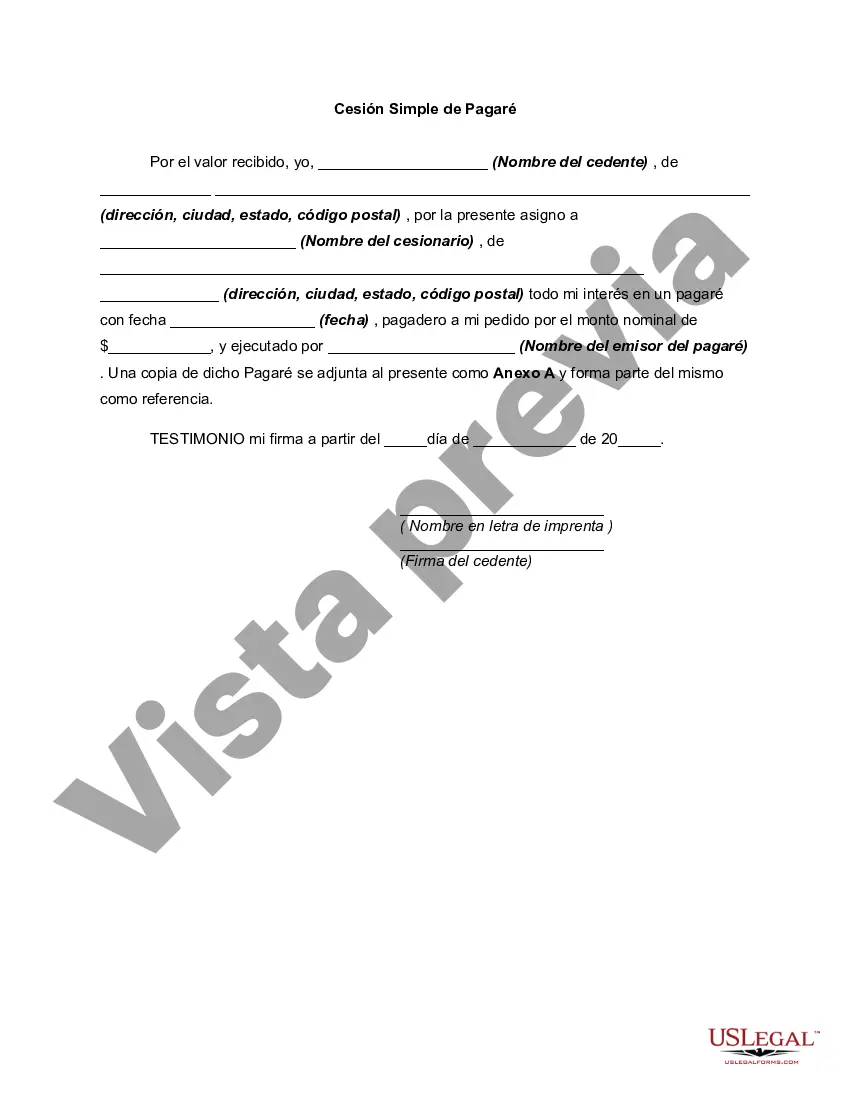

Houston, Texas Simple Promissory Note for Family Loan: A Comprehensive Guide Keywords: Houston, Texas, promissory note, family loan, simple Introduction: In Houston, Texas, a simple promissory note for a family loan is a legally binding agreement between family members outlining the terms and conditions of a loan. This document serves as proof of the loan agreement, ensuring transparency and providing a clear understanding of the expectations between both parties involved. Let's delve deeper into the specifics of a simple promissory note for a family loan in Houston, Texas. 1. Components of a Houston, Texas Simple Promissory Note: — Principal amount: Specifies the amount of money borrowed. — Interest rate: Outlines the rate at which interest will accrue on the loan. — Repayment terms: States how and when the loan will be repaid (e.g., monthly installments). — Maturity date: Indicates the date by which the loan must be fully repaid. — Late fees: Mention any penalties for late or missed payments. — Collateral: Describes any assets pledged as security for the loan (if applicable). — Signatures: Requires the borrower and lender to sign, signifying their agreement and commitment to the terms. 2. Advantages of a Houston, Texas Simple Promissory Note for Family Loan: — Trust and informality: Allows family members to obtain loans from one another based on trust and ease. — Flexibility: Borrowers and lenders can negotiate terms that suit their unique circumstances. — Lower interest rates: Often, a family loan offers lower interest rates compared to traditional lenders. — Customization: Lenders have the freedom to design terms specific to their relationship with the borrower. 3. Types of Houston, Texas Simple Promissory Note for Family Loan: — Interest-bearing family loan: This type of loan involves the borrower repaying not only the principal amount but also a pre-determined interest rate to the lender. — Non-interest-bearing family loan: In this case, the borrower repays only the principal amount, without any interest charged by the lender. 4. Steps to Create a Houston, Texas Simple Promissory Note for Family Loan: — Discuss terms: Both parties should openly communicate and agree upon the loan amount, interest rate (if applicable), repayment schedule, and any other relevant terms. — Document the agreement: Writing the agreement helps solidify the commitment and serves as a reference point for future clarifications or disputes. — Include details: Make sure to include the borrower's and lender's names, addresses, signatures, as well as the agreed-upon terms. — Consult an attorney (optional): While not legally required, seeking legal advice can provide additional protection and ensure compliance with Texas laws. Conclusion: In summary, a Houston, Texas simple promissory note for a family loan assists in establishing a clear understanding between parties involved in a familial lending arrangement. By outlining the crucial terms and conditions, this document acts as a legal safeguard, benefiting both borrowers and lenders in Houston, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Houston Texas Pagaré Simple Para Préstamo Familiar?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life situation, finding a Houston Simple Promissory Note for Family Loan meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. Aside from the Houston Simple Promissory Note for Family Loan, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Houston Simple Promissory Note for Family Loan:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Houston Simple Promissory Note for Family Loan.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!