Wayne, Michigan Simple Promissory Note for Family Loan: A Comprehensive Guide In Wayne, Michigan, a simple promissory note for family loan is a legally binding document that outlines the terms and conditions of a loan agreement between family members. This agreement ensures clarity and protection for both the lender and the borrower. It serves as evidence of the loan, including the amount borrowed, the repayment schedule, and any interest or collateral requirements. Here is a detailed description of what a Wayne, Michigan simple promissory note entails: 1. Parties Involved: The promissory note identifies the lender (often a family member) and the borrower, establishing their legal relationship and their consent to enter into the loan agreement. 2. Loan Amount: The note specifies the principal amount that the borrower has agreed to repay. It is crucial to clarify whether the loan is to be provided in a lump sum or in multiple installments. 3. Repayment Terms: The note outlines the repayment terms, including the schedule, frequency, and method of payment. It is essential to be clear about the start and end dates of the loan period, as well as the consequences for late or missed payments. 4. Interest Rate (if applicable): If the loan involves charging interest, the promissory note should clearly state the interest rate, whether it is fixed or variable, and how it will be calculated. It is important to note that interest rates for personal loans among family members are generally lower compared to commercial loans, but it is still crucial to follow applicable state and federal interest rate regulations. 5. Collateral (if applicable): In some cases, the lender may require collateral to secure the loan. This could be an asset such as real estate, a vehicle, or any valuable possession. If collateral is involved, its details, value, and the terms of its release should be incorporated into the promissory note. Types of Wayne, Michigan Simple Promissory Notes for Family Loans: 1. Lump Sum Repayment Note: This type of promissory note involves borrowing a fixed amount that will be repaid in a single payment on a specified date. No interest may be applicable. 2. Installment Repayment Note: This note establishes a loan where repayment will occur in fixed installments over a pre-determined period. Interest may or may not be included in this type of note. 3. Secured Promissory Note: This document includes collateral as security for the loan. If the borrower defaults, the lender has the right to seize or sell the collateral to recover their funds. 4. Unsecured Promissory Note: Unlike a secured note, this type does not involve collateral. It relies solely on the borrower's promise to repay the loan. Regardless of the type, it is crucial for both parties to carefully draft and review the promissory note, ensuring that all relevant details are included. Consulting with a legal professional is highly recommended ensuring compliance with local laws and regulations in Wayne, Michigan, and to protect the rights and interests of both the lender and the borrower.

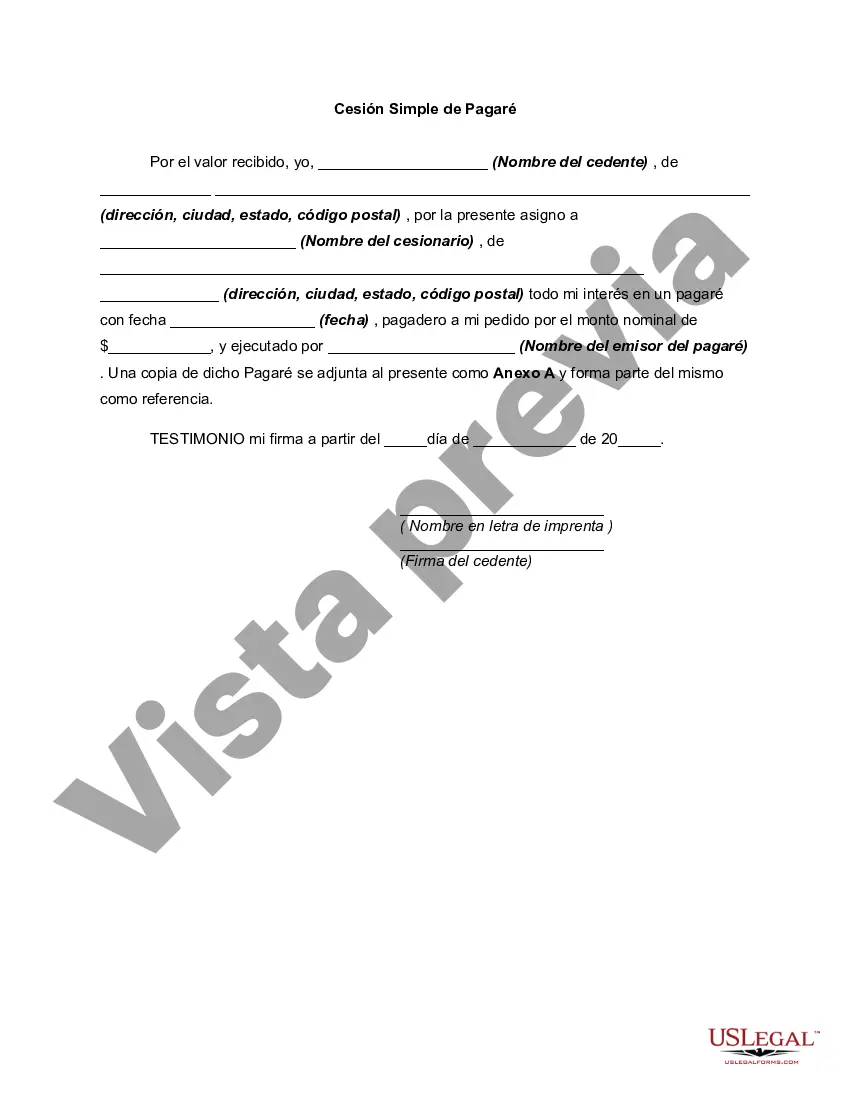

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Wayne Michigan Pagaré Simple Para Préstamo Familiar?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Wayne Simple Promissory Note for Family Loan meeting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Wayne Simple Promissory Note for Family Loan, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Wayne Simple Promissory Note for Family Loan:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Simple Promissory Note for Family Loan.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!