Alameda, California is a vibrant city located in the San Francisco Bay Area. Known for its stunning views, diverse culture, and top-notch educational institutions, Alameda is an ideal place for students seeking quality education. When it comes to financing education, sometimes students require financial assistance to cover tuition fees. In such cases, a simple promissory note can be an effective solution. It is a legally binding document that outlines the terms and conditions of a loan agreement between the borrower (the student) and the lender (typically a financial institution or an individual). The Alameda, California Simple Promissory Note for Tuition Fee serves as a written agreement, ensuring both parties understand their responsibilities and the repayment terms. This document includes crucial details such as the loan amount, interest rate (if applicable), repayment schedule, and any additional fees. There may be different types of Alameda, California Simple Promissory Notes for Tuition Fee, depending on the specific requirements and agreements made between the borrower and the lender. Let's explore a few common types: 1. Fixed Interest Rate Promissory Note: This type of promissory note establishes a fixed interest rate for the loan amount. It ensures that the borrower knows exactly how much interest they will be paying over the repayment period, providing certainty and stability. 2. Variable Interest Rate Promissory Note: In contrast, a variable interest rate promissory note allows for fluctuations in the interest rate over time. The interest rate is typically tied to a benchmark rate (e.g., the prime rate) and can change periodically. This type of promissory note allows for potential interest rate adjustments during the repayment period. 3. Installment Promissory Note: An installment promissory note breaks down the loan repayment into a series of fixed installments. This structure provides a clear repayment plan, specifying the amount and frequency of payments. It simplifies budgeting for the borrower and ensures regular repayment. 4. Balloon Promissory Note: A balloon promissory note involves smaller periodic payments over time, with a larger payment due at the end of the loan term. This type of note may be suitable for borrowers anticipating increased financial capacity in the future, enabling them to meet the final lump-sum payment. It is essential for both parties involved in a promissory note to seek legal advice to ensure compliance with federal and state laws, as well as to protect their interests. This brief guide provides an overview of the Alameda, California Simple Promissory Note for Tuition Fee and the various types that may be available.

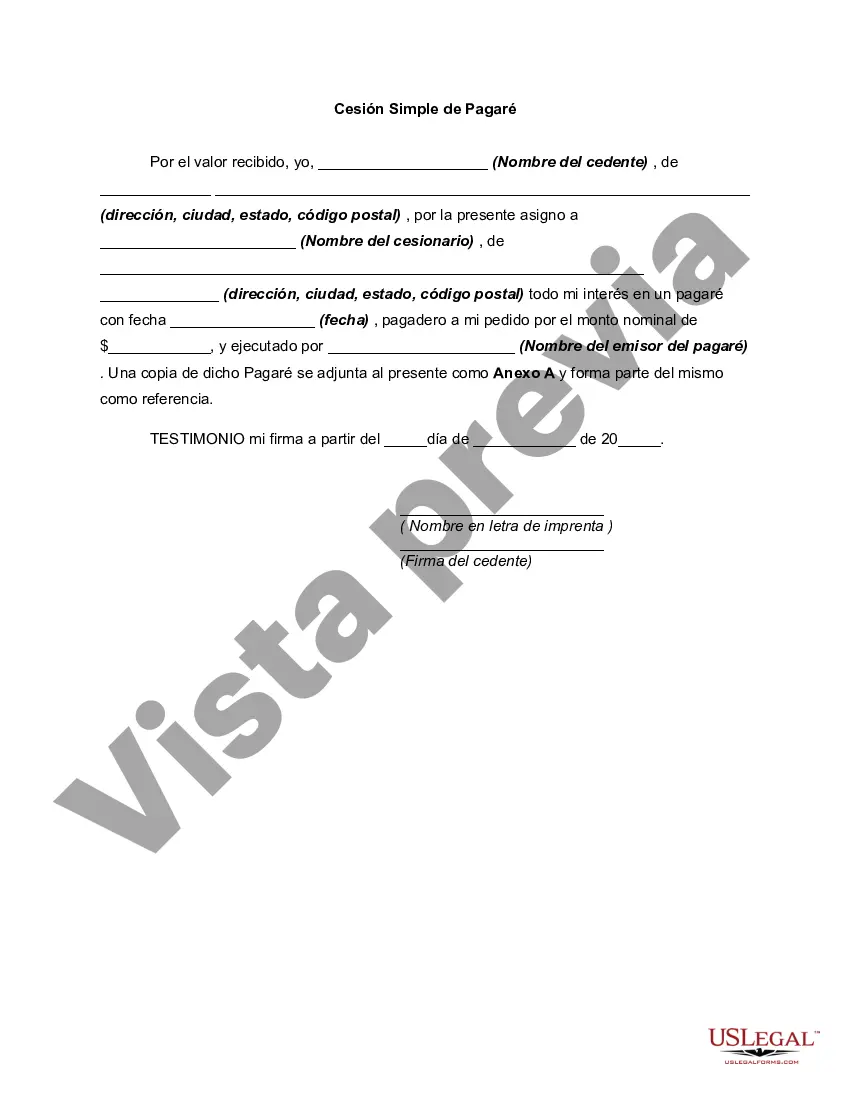

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out Alameda California Pagaré Simple De Matrícula?

If you need to find a trustworthy legal paperwork supplier to get the Alameda Simple Promissory Note for Tutition Fee, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support team make it simple to get and complete various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Alameda Simple Promissory Note for Tutition Fee, either by a keyword or by the state/county the document is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Alameda Simple Promissory Note for Tutition Fee template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less costly and more affordable. Create your first business, organize your advance care planning, draft a real estate agreement, or complete the Alameda Simple Promissory Note for Tutition Fee - all from the comfort of your home.

Join US Legal Forms now!