Collin Texas Simple Promissory Note for Tuition Fee is a legally binding document that outlines the agreement between a borrower and a lender in Collin County, Texas, regarding the repayment of a student's educational expenses. This type of promissory note is commonly used by students or their guardians to borrow money from an individual or organization to cover tuition fees and related educational costs. The Collin Texas Simple Promissory Note for Tuition Fee typically includes important information such as the names and contact details of both the borrower and lender, the agreed-upon loan amount, the interest rate (if applicable), the repayment terms, and any additional conditions or provisions. There may be different variations or types of Collin Texas Simple Promissory Note for Tuition Fee, including: 1. Fixed-Rate Simple Promissory Note: This type of promissory note features a fixed interest rate for the entire duration of the loan repayment. The interest rate remains constant, ensuring a predictable repayment plan for both parties. 2. Variable-Rate Simple Promissory Note: Unlike the fixed-rate promissory note, this type includes an interest rate that can fluctuate over time. The interest rate is typically tied to an index or benchmark, and changes periodically, potentially impacting the borrower's repayment amount. 3. Acceleration Clause Simple Promissory Note: This clause allows the lender to demand immediate repayment of the entire outstanding loan balance if the borrower fails to fulfill the agreed-upon terms, such as missing multiple payments or violating the terms and conditions of the note. 4. Installment Simple Promissory Note: With this type of promissory note, the borrower agrees to repay the loan in fixed periodic installments over a specific period, typically monthly. Each installment includes a portion of the principal amount and, if applicable, the accrued interest. 5. Lump Sum Simple Promissory Note: A lump sum promissory note requires the borrower to repay the entire loan amount, including any accrued interest, in a single payment at a specified maturity date. This type is less common for tuition fees but may be used for smaller short-term loans. It is crucial to ensure that any Collin Texas Simple Promissory Note for Tuition Fee complies with applicable state and federal laws, as well as any specific requirements outlined by the lender. To avoid any legal complications, it is recommended to consult with a legal professional when drafting or signing such a promissory note.

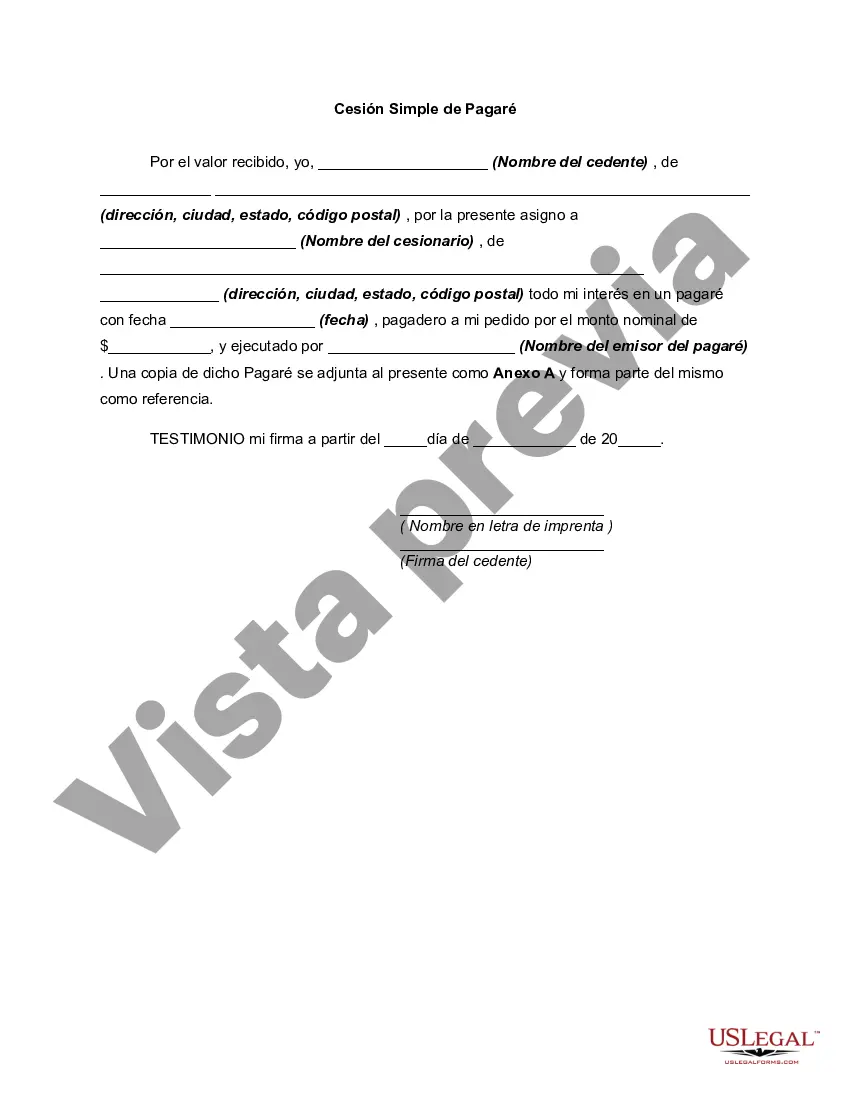

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out Collin Texas Pagaré Simple De Matrícula?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Collin Simple Promissory Note for Tutition Fee is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Collin Simple Promissory Note for Tutition Fee. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Simple Promissory Note for Tutition Fee in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!