A Santa Clara California Simple Promissory Note for Tuition Fee is a legal document created between two parties, typically a borrower and a lender, outlining the terms and conditions of a loan agreement specifically for educational expenses in Santa Clara, California. A Simple Promissory Note for Tuition Fee serves as a binding agreement, ensuring that the borrower will repay the lender the borrowed amount along with any accrued interest within a specified period. The keywords relevant to this topic include Santa Clara California, Simple Promissory Note, Tuition Fee, borrow, lend, loan agreement, educational expenses, legal document, terms and conditions, repay, interest, and specified period. Types of Santa Clara California Simple Promissory Note for Tuition Fee: 1. Fixed Interest Promissory Note: This type of promissory note sets a fixed interest rate that remains constant throughout the repayment period. Both the borrower and the lender agree upon a specific interest rate, ensuring a predictable repayment schedule. 2. Variable Interest Promissory Note: Unlike the fixed interest promissory note, a variable interest promissory note allows for fluctuations in the interest rate during the loan repayment period. The interest rate typically changes based on market conditions or a predetermined index. 3. Installment Promissory Note: An installment promissory note divides the total borrowed amount into equal installments, making it more manageable for the borrower to repay the loan over a specified period. This type of note outlines the schedule and amount of each installment payment. 4. Secured Promissory Note: A secured promissory note includes collateral that the borrower offers to secure the loan. If the borrower defaults on repayment, the lender has the right to claim and sell the collateral to recover the loan amount. 5. Unsecured Promissory Note: An unsecured promissory note does not require collateral as security for the loan. In this case, the lender relies solely on the borrower's creditworthiness, making it a riskier option. Higher interest rates may be charged to compensate for the lack of collateral. It is crucial for both parties involved in a Santa Clara California Simple Promissory Note for Tuition Fee to carefully consider the terms, interest rates, repayment schedule, and any additional clauses specific to their agreement. Seeking legal advice may be advisable to ensure the note complies with state laws and protects the rights of both the borrower and the lender.

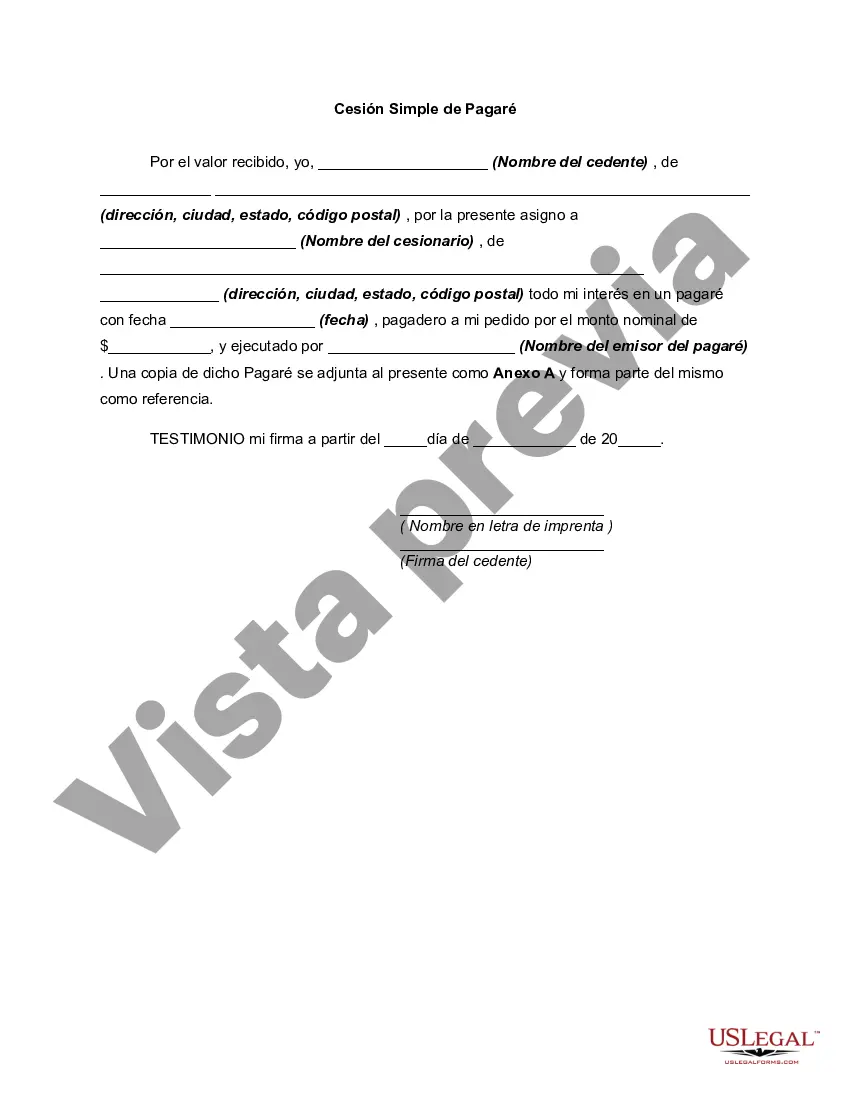

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out Santa Clara California Pagaré Simple De Matrícula?

Draftwing documents, like Santa Clara Simple Promissory Note for Tutition Fee, to take care of your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various cases and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Santa Clara Simple Promissory Note for Tutition Fee template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Santa Clara Simple Promissory Note for Tutition Fee:

- Ensure that your document is compliant with your state/county since the regulations for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Santa Clara Simple Promissory Note for Tutition Fee isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin utilizing our website and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!