A Miami-Dade Florida Simple Promissory Note for Vehicle Purchase is a legally binding document that outlines the terms and conditions of a loan made between a buyer and a seller for the purchase of a vehicle in Miami-Dade County, Florida. This promissory note serves as evidence of the agreement and the repayment terms agreed upon by both parties. The promissory note contains essential details such as the names, addresses, and contact information of both the buyer and the seller. It also includes a detailed description of the vehicle being purchased, including its make, model, year, and identification number. The document outlines the agreement regarding the purchase price of the vehicle, stating both the total amount to be paid and the method of payment (e.g., cash, check, or bank transfer). It specifies the due date for the full payment and any installment plans agreed upon by the parties involved. Interest rates and late payment penalties, if applicable, are also stated in the promissory note. Both the buyer and the seller need to agree upon these terms before signing the document. In addition to the general Miami-Dade Florida Simple Promissory Note for Vehicle Purchase, there can be variations or specific types based on the unique circumstances of the transaction: 1. Secured Promissory Note: This type of promissory note includes provisions for collateral or security against the loan. The vehicle being purchased might serve as collateral, meaning that if the buyer fails to repay the loan as agreed, the seller has the right to repossess the vehicle. 2. Balloon Promissory Note: In this case, the repayment terms involve periodic installments, but with a large final payment or "balloon" payment due at the end of the loan term. This option might be suitable for buyers who expect a substantial amount of money to become available near the end of the loan. 3. Adjustable-Rate Promissory Note: Unlike a fixed-rate promissory note, this type of agreement allows for fluctuating interest rates. The interest rates can change periodically based on predetermined market indexes, adding flexibility to the loan terms. It is crucial when drafting or signing a Miami-Dade Florida Simple Promissory Note for Vehicle Purchase to consult with legal counsel or utilize a reputable promissory note template to ensure compliance with relevant state laws and regulations. This document serves to protect the rights and responsibilities of both the buyer and the seller, providing a clear and legally binding agreement for the purchase of a vehicle in Miami-Dade County, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Pagaré Simple para Compra de Vehículo - Simple Promissory Note for Vehicle Purchase

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02333BG-4

Format:

Word

Instant download

Description

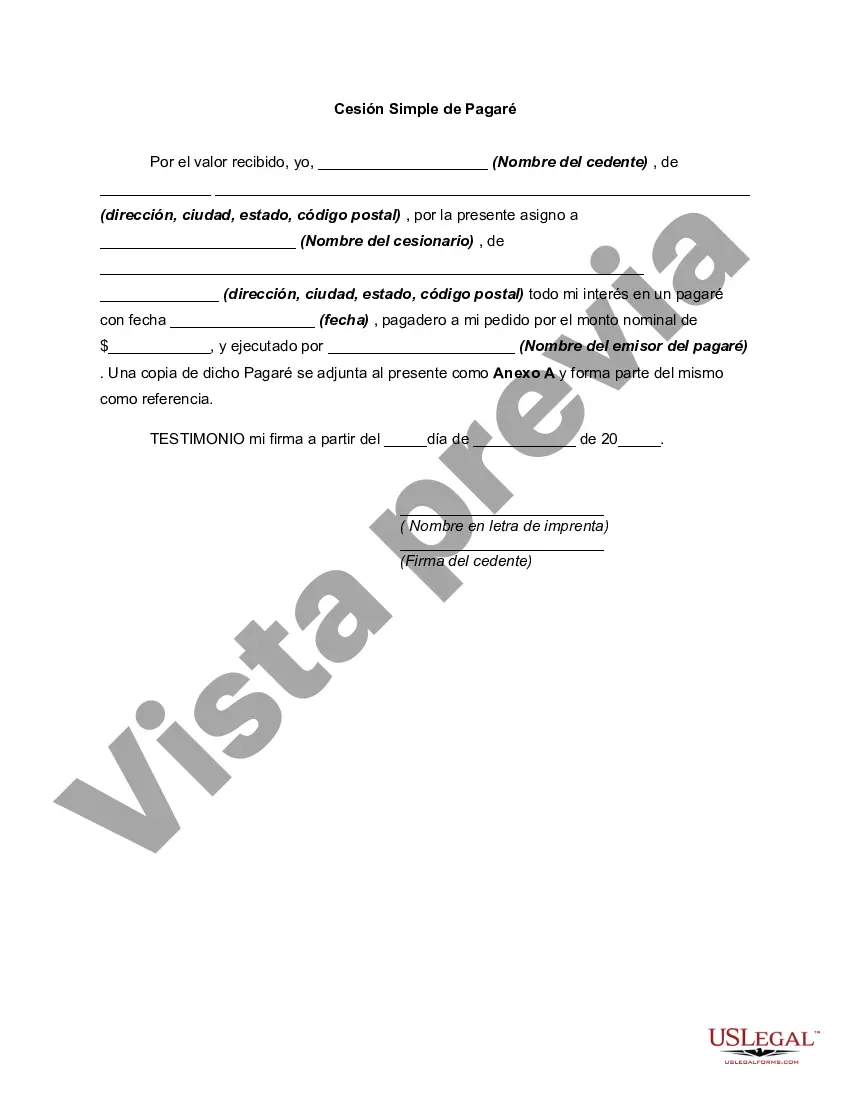

An assignment means the transfer of a property right or title to some particular person under an agreement, usually in writing.

A Miami-Dade Florida Simple Promissory Note for Vehicle Purchase is a legally binding document that outlines the terms and conditions of a loan made between a buyer and a seller for the purchase of a vehicle in Miami-Dade County, Florida. This promissory note serves as evidence of the agreement and the repayment terms agreed upon by both parties. The promissory note contains essential details such as the names, addresses, and contact information of both the buyer and the seller. It also includes a detailed description of the vehicle being purchased, including its make, model, year, and identification number. The document outlines the agreement regarding the purchase price of the vehicle, stating both the total amount to be paid and the method of payment (e.g., cash, check, or bank transfer). It specifies the due date for the full payment and any installment plans agreed upon by the parties involved. Interest rates and late payment penalties, if applicable, are also stated in the promissory note. Both the buyer and the seller need to agree upon these terms before signing the document. In addition to the general Miami-Dade Florida Simple Promissory Note for Vehicle Purchase, there can be variations or specific types based on the unique circumstances of the transaction: 1. Secured Promissory Note: This type of promissory note includes provisions for collateral or security against the loan. The vehicle being purchased might serve as collateral, meaning that if the buyer fails to repay the loan as agreed, the seller has the right to repossess the vehicle. 2. Balloon Promissory Note: In this case, the repayment terms involve periodic installments, but with a large final payment or "balloon" payment due at the end of the loan term. This option might be suitable for buyers who expect a substantial amount of money to become available near the end of the loan. 3. Adjustable-Rate Promissory Note: Unlike a fixed-rate promissory note, this type of agreement allows for fluctuating interest rates. The interest rates can change periodically based on predetermined market indexes, adding flexibility to the loan terms. It is crucial when drafting or signing a Miami-Dade Florida Simple Promissory Note for Vehicle Purchase to consult with legal counsel or utilize a reputable promissory note template to ensure compliance with relevant state laws and regulations. This document serves to protect the rights and responsibilities of both the buyer and the seller, providing a clear and legally binding agreement for the purchase of a vehicle in Miami-Dade County, Florida.