Salt Lake City, located in Utah, is a vibrant and scenic city known for its stunning natural beauty, thriving economy, and outdoor recreational opportunities. If you're looking to purchase a vehicle in Salt Lake City, a Simple Promissory Note can be an essential tool to secure the transaction and protect the buyer's interests. A Simple Promissory Note for Vehicle Purchase is a legally binding agreement between a buyer (borrower) and a seller (lender) of a vehicle. It outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any additional provisions specific to the purchase. Some types of Simple Promissory Notes for Vehicle Purchase that can be used in Salt Lake City, Utah, include: 1. Fixed-Term Promissory Note: This type of promissory note specifies a set period for loan repayment, typically with equal monthly installments over a predetermined timeframe. 2. Balloon Payment Promissory Note: If the buyer intends to make lower monthly payments initially and a large final payment (balloon payment) at the end of the loan term, a Balloon Payment Promissory Note is appropriate. This allows the buyer to secure the vehicle while planning for the larger payment later. 3. Zero-Interest Promissory Note: In some cases, the buyer and seller may agree on a loan without charging interest. This can be ideal for individuals who do not want to pay additional interest expenses on their vehicle purchase. When drafting a Salt Lake City Simple Promissory Note for Vehicle Purchase, it is crucial to include the following relevant keywords to ensure clarity and enforceability: — Borrower: It refers to the individual or entity responsible for repaying the loan and purchasing the vehicle. — Lender: The party who is providing the loan and selling the vehicle. — Principal Amount: The total loan amount borrowed by the buyer to purchase the vehicle. — Interest Rate: The percentage rate at which interest is charged on the loan amount. — Repayment Schedule: The agreed-upon time frame for repayment, including monthly installments or balloon payments. — Default: The conditions under which the borrower fails to meet the terms of the promissory note, such as missed payments or violation of any provisions. — Collateral: The vehicle being purchased acts as collateral until the loan is fully repaid or satisfied. — Governing Law: The laws that will apply in case of any disputes or legal issues that may arise from the promissory note. A well-drafted Salt Lake City Simple Promissory Note for Vehicle Purchase protects both the buyer and the seller, ensuring a smooth and secure transaction for the purchase of a vehicle. It is advisable to consult with a legal professional or utilize online templates to create a comprehensive promissory note that complies with all relevant state and federal laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Pagaré Simple para Compra de Vehículo - Simple Promissory Note for Vehicle Purchase

Description

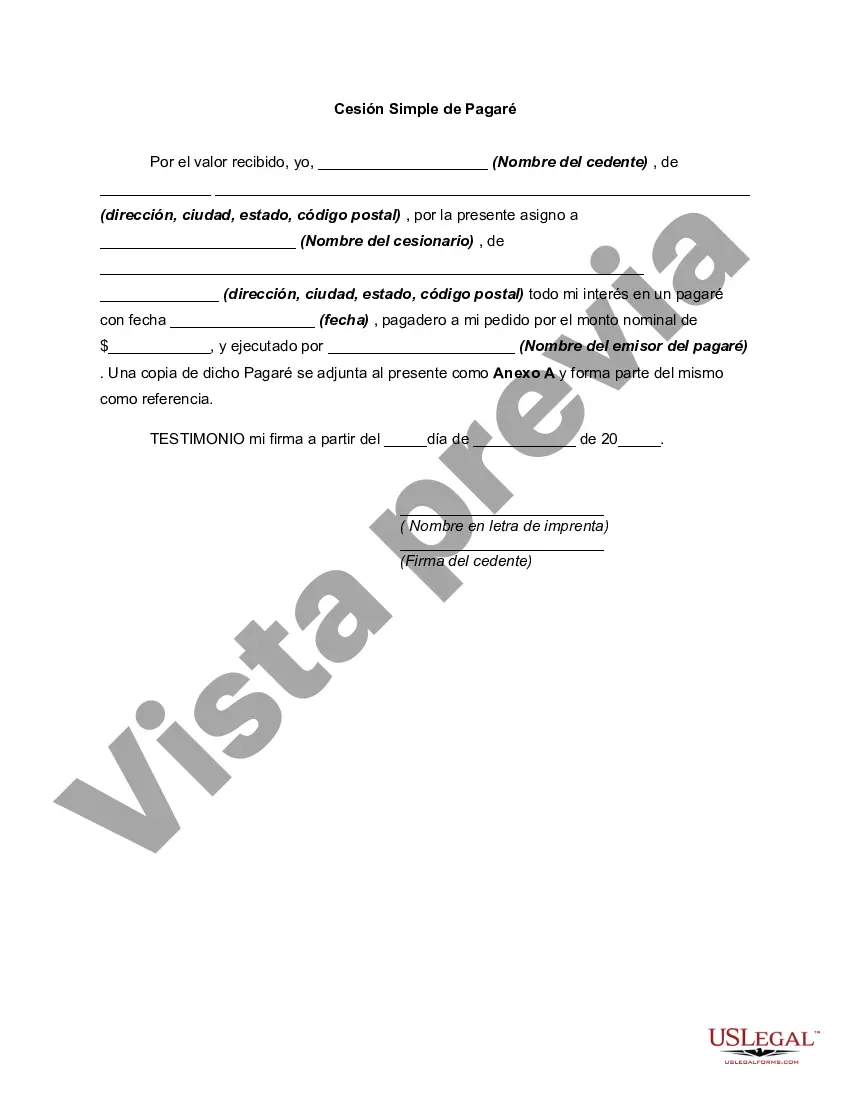

How to fill out Salt Lake Utah Pagaré Simple Para Compra De Vehículo?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Salt Lake Simple Promissory Note for Vehicle Purchase, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the current version of the Salt Lake Simple Promissory Note for Vehicle Purchase, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Simple Promissory Note for Vehicle Purchase:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Salt Lake Simple Promissory Note for Vehicle Purchase and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!