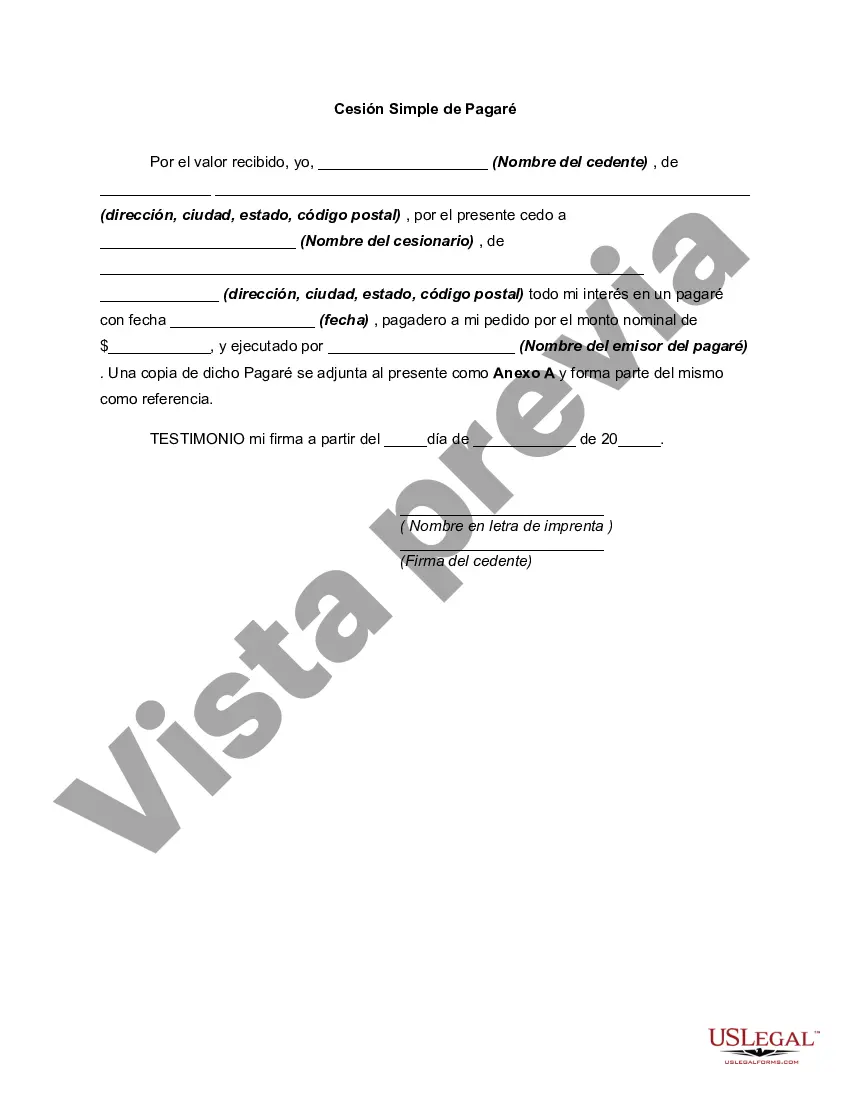

Collin Texas Simple Promissory Note for School is a legally binding document that outlines the terms and conditions of a loan agreement between two parties: the lender (usually an institution or organization) and the borrower (typically a student or their parent/guardian). This Promissory Note serves as a written evidence of the loan agreement and sets forth the obligations and responsibilities of both parties involved. The Collin Texas Simple Promissory Note for School includes essential details such as the names and contact information of the lender and borrower, the principal loan amount, the interest rate (if applicable), repayment terms, and any additional fees or charges associated with the loan. It also specifies the due dates for repayment, the agreed installment amounts, and the consequences for late or missed payments. This type of promissory note is commonly used in educational institutions within Collin County, Texas, to formalize loan agreements for students seeking financial assistance for their education. It allows for the clear communication of repayment expectations, ensuring that both parties understand their rights and obligations. By signing the promissory note, the borrower acknowledges their responsibility to repay the loan according to the agreed terms, and the lender agrees to provide the funds as specified. There may be different variations of the Collin Texas Simple Promissory Note for School to accommodate different loan types or circumstances. These variations may include: 1. Collin Texas Simple Promissory Note for Student Loans: This specific type of promissory note is designed for college or university student loans, allowing for the financing of tuition fees, textbooks, living expenses, etc. It caters to the unique needs of students pursuing higher education in the Collin County area. 2. Collin Texas Simple Promissory Note for Private School Loans: This promissory note variant is used to outline the terms and conditions for loans taken specifically to finance private school tuition or related expenses. It may differ from student loans in terms of eligibility criteria, interest rates, and repayment plans. 3. Collin Texas Simple Promissory Note for Vocational/Technical School Loans: This version of the promissory note is tailored for students attending vocational or technical schools within Collin County, Texas. It caters to the financing needs of students pursuing trade or technical education programs. It is important for borrowers and lenders to carefully review and understand the terms of the Collin Texas Simple Promissory Note for School before signing it. Seeking legal advice or consulting with an educational institution's financial aid office can provide further clarity and guidance. Compliance with the terms mentioned in the promissory note ensures a smooth loan repayment process, enabling students to pursue their education without financial burden.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out Collin Texas Pagaré Simple Para La Escuela?

Creating forms, like Collin Simple Promissory Note for School, to take care of your legal affairs is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms created for a variety of cases and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Collin Simple Promissory Note for School form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before downloading Collin Simple Promissory Note for School:

- Make sure that your template is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Collin Simple Promissory Note for School isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our website and get the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!