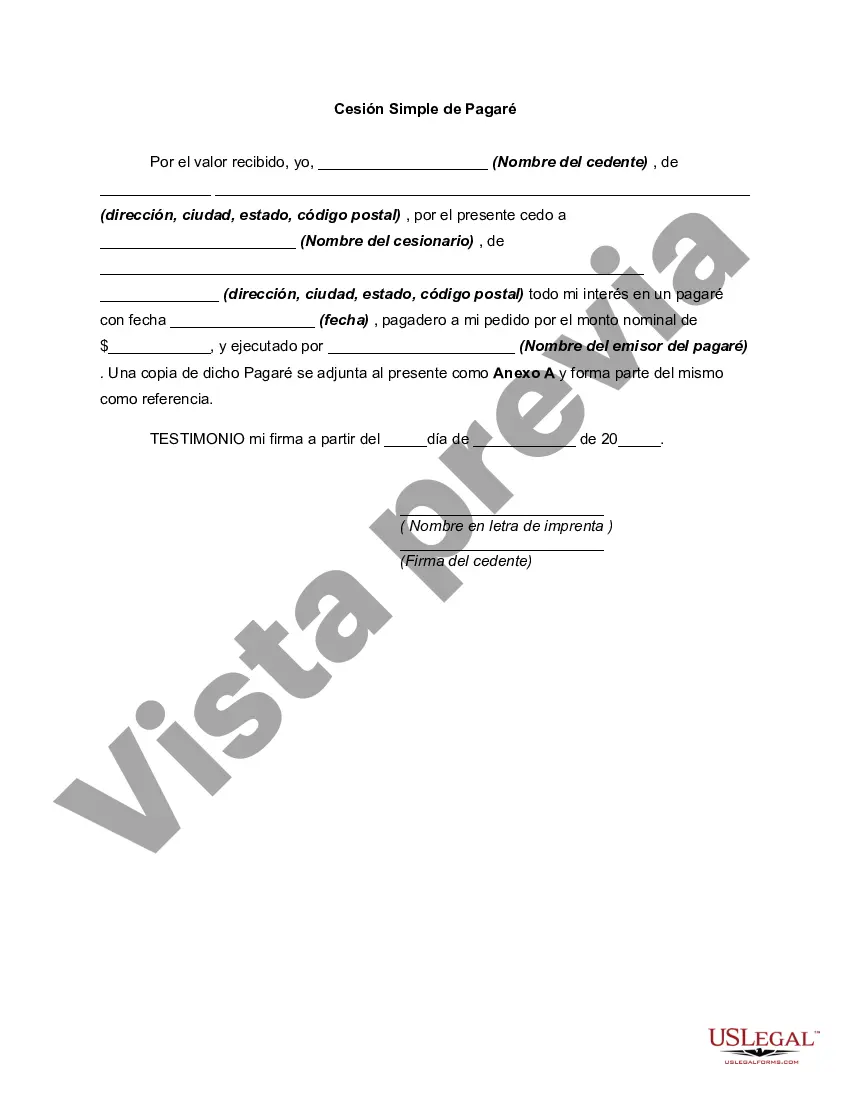

Mecklenburg County in North Carolina offers a Simple Promissory Note for School, which is designed to outline a formal agreement between a borrower and a lender. This legal document serves as evidence of a loan's existence and the borrower's promise to repay the borrowed amount within a specified timeframe. The Mecklenburg North Carolina Simple Promissory Note for School facilitates financial transactions related to educational expenses, enabling students to secure loans from educational institutions, banks, or even private individuals. By using this specific note, both the lender and the borrower can have a clear understanding of their obligations and rights. This type of promissory note typically involves the following key elements: 1. Principal Amount: The total sum of money borrowed by the student for educational purposes, which is expected to be repaid. 2. Interest Rate: The predetermined rate at which interest will accrue on the borrowed amount. The interest may be fixed or variable, depending on the agreement. 3. Repayment Terms: The specific repayment schedule, including the frequency and timing of payments. This may involve monthly, quarterly, or annual installments, and can span over a predetermined number of years. 4. Late Payment Consequences: Any penalties or consequences in case the borrower fails to make timely repayments. This may include additional interest charges, late fees, or potential legal actions. 5. Security/Collateral: In some cases, the lender may request collateral to secure the loan. This can be an asset or property that the borrower pledges as a guarantee for repayment. Types of Mecklenburg North Carolina Simple Promissory Notes for School: 1. Private School Promissory Note: This type of promissory note applies to loans provided by private educational institutions to their students. It often includes provisions that align with the particular policies and requirements of the school offering the loan. 2. Institutional Promissory Note: This note is commonly used when students borrow funds directly from their educational institution. It outlines the terms and conditions set forth by the institution and may include provisions unique to that specific school. 3. Student Loan Promissory Note: This variant is employed when students secure loans from external lenders, such as banks, credit unions, or dedicated student loan agencies. It adheres to both federal and state regulations, providing a standardized template for loan agreements. By utilizing the Mecklenburg North Carolina Simple Promissory Note for School, borrowers and lenders can establish a legally binding agreement that safeguards their respective interests. This document ensures transparency, offering clarity on loan terms, interest rates, repayment schedules, and potential consequences for non-compliance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out Mecklenburg North Carolina Pagaré Simple Para La Escuela?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Mecklenburg Simple Promissory Note for School, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any tasks related to paperwork execution simple.

Here's how to locate and download Mecklenburg Simple Promissory Note for School.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Mecklenburg Simple Promissory Note for School.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Mecklenburg Simple Promissory Note for School, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to deal with an exceptionally difficult case, we recommend getting an attorney to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant documents with ease!