Miami-Dade Florida Simple Promissory Note for School is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the Miami-Dade County area, specifically designed for educational purposes. This promissory note serves as a written agreement to document the loan amount, interest rate, repayment terms, and any additional provisions agreed upon by both parties involved. The Miami-Dade Florida Simple Promissory Note for School provides a clear framework for borrowing educational funds, ensuring that both the borrower and the lender are protected and aware of their respective obligations. This document is commonly used in educational institutions, such as colleges, universities, or private schools, to formalize student loans, tuition payments, or any other educational expenses that require financial assistance. Key components often included in a Miami-Dade Florida Simple Promissory Note for School consist of: 1. Parties involved: The full names and contact information of both the borrower (student) and the lender (educational institution or individual providing the loan). 2. Loan amount: The specific dollar amount being borrowed for educational purposes. 3. Interest rate: The agreed-upon interest rate, which may be fixed or variable depending on the terms set forth in the note. 4. Repayment terms: The duration and frequency of payments, whether monthly, quarterly, or another agreed-upon schedule. 5. Late fees: If applicable, the note may outline the consequences of late or missed payments, including potential penalties or fees. 6. Prepayment: The conditions under which the borrower can prepay the loan amount without incurring any additional charges. 7. Governing law: Specifically stating that the promissory note is governed by the laws of Miami-Dade County, Florida. 8. Signatures: Both the borrower and the lender should sign the document to validate their agreement and commitment to fulfilling the outlined terms. While the Miami-Dade Florida Simple Promissory Note for School generally covers basic terms, it can be customized to meet the specific requirements of different educational institutions or lending situations. Types of Miami-Dade Florida Simple Promissory Notes for Schools may include: 1. Tuition loan promissory note: This note outlines the terms for borrowing funds specifically for tuition payments, typically for students enrolled in colleges or universities within Miami-Dade County. 2. Student loan promissory note: Designed for comprehensive student loans that cover various educational expenses such as tuition, books, housing, and other related costs. 3. Emergency loan promissory note: This note may be used for short-term financial aid provided to students facing unforeseen situations or emergencies that require immediate financial assistance. It is important to consult with legal professionals or financial advisors when drafting or signing a Miami-Dade Florida Simple Promissory Note for School to ensure compliance with relevant laws and regulations, as well as to protect the rights and interests of all parties involved.

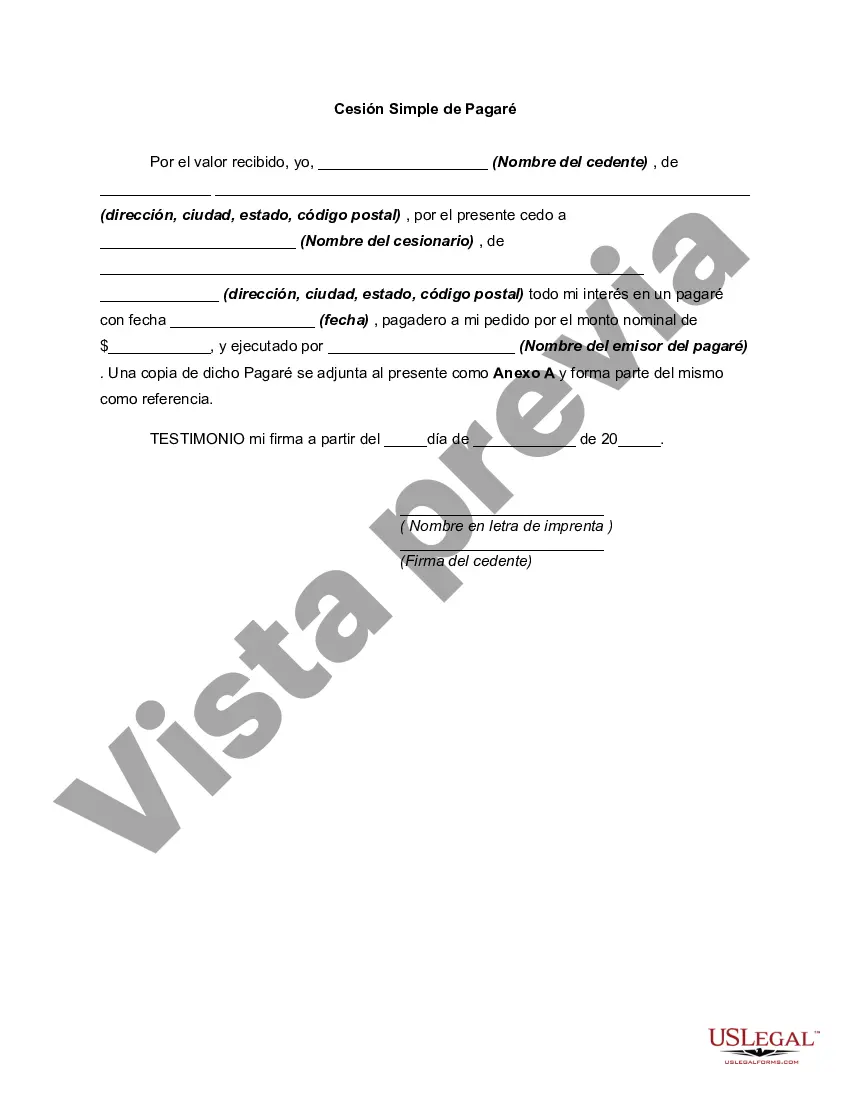

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Pagaré simple para la escuela - Simple Promissory Note for School

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02333BG-5

Format:

Word

Instant download

Description

An assignment means the transfer of a property right or title to some particular person under an agreement, usually in writing.

Miami-Dade Florida Simple Promissory Note for School is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the Miami-Dade County area, specifically designed for educational purposes. This promissory note serves as a written agreement to document the loan amount, interest rate, repayment terms, and any additional provisions agreed upon by both parties involved. The Miami-Dade Florida Simple Promissory Note for School provides a clear framework for borrowing educational funds, ensuring that both the borrower and the lender are protected and aware of their respective obligations. This document is commonly used in educational institutions, such as colleges, universities, or private schools, to formalize student loans, tuition payments, or any other educational expenses that require financial assistance. Key components often included in a Miami-Dade Florida Simple Promissory Note for School consist of: 1. Parties involved: The full names and contact information of both the borrower (student) and the lender (educational institution or individual providing the loan). 2. Loan amount: The specific dollar amount being borrowed for educational purposes. 3. Interest rate: The agreed-upon interest rate, which may be fixed or variable depending on the terms set forth in the note. 4. Repayment terms: The duration and frequency of payments, whether monthly, quarterly, or another agreed-upon schedule. 5. Late fees: If applicable, the note may outline the consequences of late or missed payments, including potential penalties or fees. 6. Prepayment: The conditions under which the borrower can prepay the loan amount without incurring any additional charges. 7. Governing law: Specifically stating that the promissory note is governed by the laws of Miami-Dade County, Florida. 8. Signatures: Both the borrower and the lender should sign the document to validate their agreement and commitment to fulfilling the outlined terms. While the Miami-Dade Florida Simple Promissory Note for School generally covers basic terms, it can be customized to meet the specific requirements of different educational institutions or lending situations. Types of Miami-Dade Florida Simple Promissory Notes for Schools may include: 1. Tuition loan promissory note: This note outlines the terms for borrowing funds specifically for tuition payments, typically for students enrolled in colleges or universities within Miami-Dade County. 2. Student loan promissory note: Designed for comprehensive student loans that cover various educational expenses such as tuition, books, housing, and other related costs. 3. Emergency loan promissory note: This note may be used for short-term financial aid provided to students facing unforeseen situations or emergencies that require immediate financial assistance. It is important to consult with legal professionals or financial advisors when drafting or signing a Miami-Dade Florida Simple Promissory Note for School to ensure compliance with relevant laws and regulations, as well as to protect the rights and interests of all parties involved.