Title: Montgomery Maryland Simple Promissory Note for School — Types and Detailed Description Introduction: A Montgomery Maryland Simple Promissory Note for School is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This article will provide a detailed description of what this type of promissory note entails, including its purpose, structure, and the different variations available in Montgomery, Maryland. Key Keywords: Montgomery Maryland, Simple Promissory Note, School, types 1. What is a Montgomery Maryland Simple Promissory Note for School? A Montgomery Maryland Simple Promissory Note for School is a written contract that outlines how a borrower promises to repay a loan within a defined time frame for educational purposes. It specifies the amount borrowed, interest rates, repayment terms, and any consequences for default. 2. Purpose of Montgomery Maryland Simple Promissory Note for School: The main purpose of a Montgomery Maryland Simple Promissory Note for School is to establish a clear agreement between the lender and the borrower regarding the terms of the loan. It protects the lender's interests and ensures borrowers have a legal obligation to repay the borrowed amount. 3. Structure of Montgomery Maryland Simple Promissory Note for School: The structure of a Montgomery Maryland Simple Promissory Note for School typically includes the following elements: — Parties involved: Clearly identifies the lender (often an educational institution) and the borrower (student or parent). — Loan amount: Specifies the total amount borrowed by the borrower. — Repayment terms: Outlines the terms, frequency, and duration of repayment, including any interest rates or penalties for late payments. — Signatures: Both the lender and the borrower must sign and date the promissory note to make it legally binding. 4. Types of Montgomery Maryland Simple Promissory Note for School: a) Fixed Interest Rate Promissory Note: This type of promissory note maintains a consistent interest rate throughout the loan term, ensuring predictable payment amounts for the borrower. b) Variable Interest Rate Promissory Note: In contrast to the fixed-rate note, a variable interest rate promissory note allows the lender to adjust the interest rate periodically based on market conditions. This may result in fluctuating monthly payments for the borrower. c) Unsecured Promissory Note: An unsecured promissory note does not require collateral from the borrower. However, if the borrower defaults, the lender may have limited options for debt recovery. d) Secured Promissory Note: In this type, the borrower pledges collateral, such as real estate or a vehicle, against the loan. If the borrower fails to repay, the lender can seize the specified asset to recoup the outstanding debt. Conclusion: Montgomery Maryland Simple Promissory Notes for School are essential documents for students and parents seeking educational loans. By understanding the purpose, structure, and types of promissory notes available, borrowers can make informed decisions while pursuing educational financial assistance in Montgomery, Maryland.

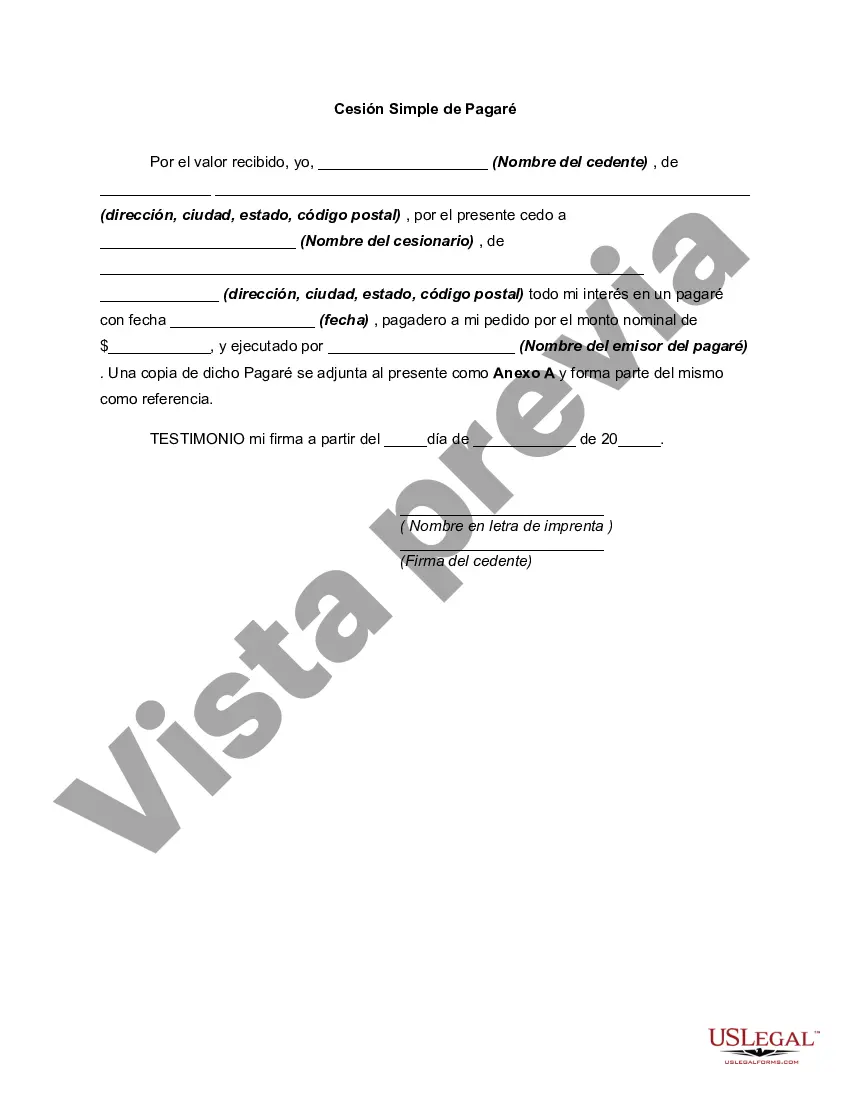

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out Montgomery Maryland Pagaré Simple Para La Escuela?

Are you looking to quickly draft a legally-binding Montgomery Simple Promissory Note for School or maybe any other form to handle your personal or business matters? You can go with two options: contact a professional to write a legal document for you or create it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific form templates, including Montgomery Simple Promissory Note for School and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, double-check if the Montgomery Simple Promissory Note for School is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Montgomery Simple Promissory Note for School template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!