Houston Texas Simple Promissory Note for Car Loan is a legal document that outlines the agreement between a lender and a borrower for a car loan transaction in the city of Houston, Texas. It serves as a record of the loan amount, repayment terms, and the rights and responsibilities of both parties involved. In a Houston Texas Simple Promissory Note for Car Loan, the lender provides the borrower with a specific amount of money to purchase a vehicle. The borrower, in return, agrees to repay the loan amount along with any applicable interest within a specified timeframe. This document is legally binding and protects the interests of both the lender and the borrower. Some essential details included in a Houston Texas Simple Promissory Note for Car Loan are: 1. Loan Amount: The exact amount of money being lent to the borrower for the car purchase. 2. Interest Rate: The agreed-upon interest rate that the borrower must pay on the loan. 3. Repayment Period: The duration within which the borrower is required to repay the loan, usually in monthly installments. 4. Installment Amount: The fixed amount the borrower must pay each month towards loan repayment. 5. Late Payment Clause: Terms and penalties associated with late payment or default on the loan. 6. Security Agreement: Details regarding any collateral or security the lender may have against the loan in case of default. 7. Governing Law: The legal jurisdiction governing the promissory note, typically specified as the state of Texas. 8. Signatures: Both the lender and the borrower must sign the promissory note to make it legally valid. Different types of Houston Texas Simple Promissory Notes for Car Loan may include variations in terms, interest rates, repayment schedules, or the presence of a co-signer. Additionally, there could be different templates or formats available for the promissory note, depending on the lender or institution providing the document. In summary, a Houston Texas Simple Promissory Note for Car Loan is a crucial legal document that outlines the terms and conditions of a car loan between a lender and a borrower in Houston, Texas. It ensures transparency, clarity, and protection for both parties involved in the loan transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Pagaré simple para préstamo de automóvil - Simple Promissory Note for Car Loan

Description

How to fill out Houston Texas Pagaré Simple Para Préstamo De Automóvil?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Houston Simple Promissory Note for Car Loan, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the recent version of the Houston Simple Promissory Note for Car Loan, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Simple Promissory Note for Car Loan:

- Look through the page and verify there is a sample for your region.

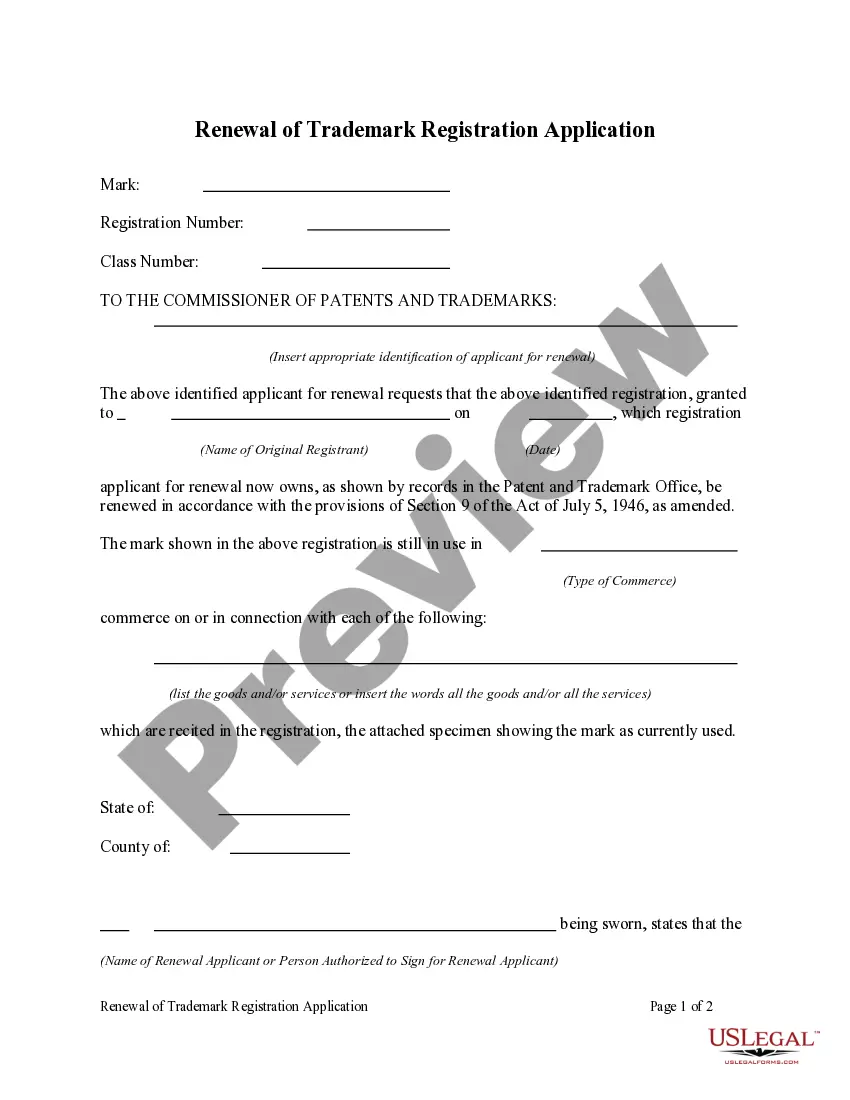

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Houston Simple Promissory Note for Car Loan and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!