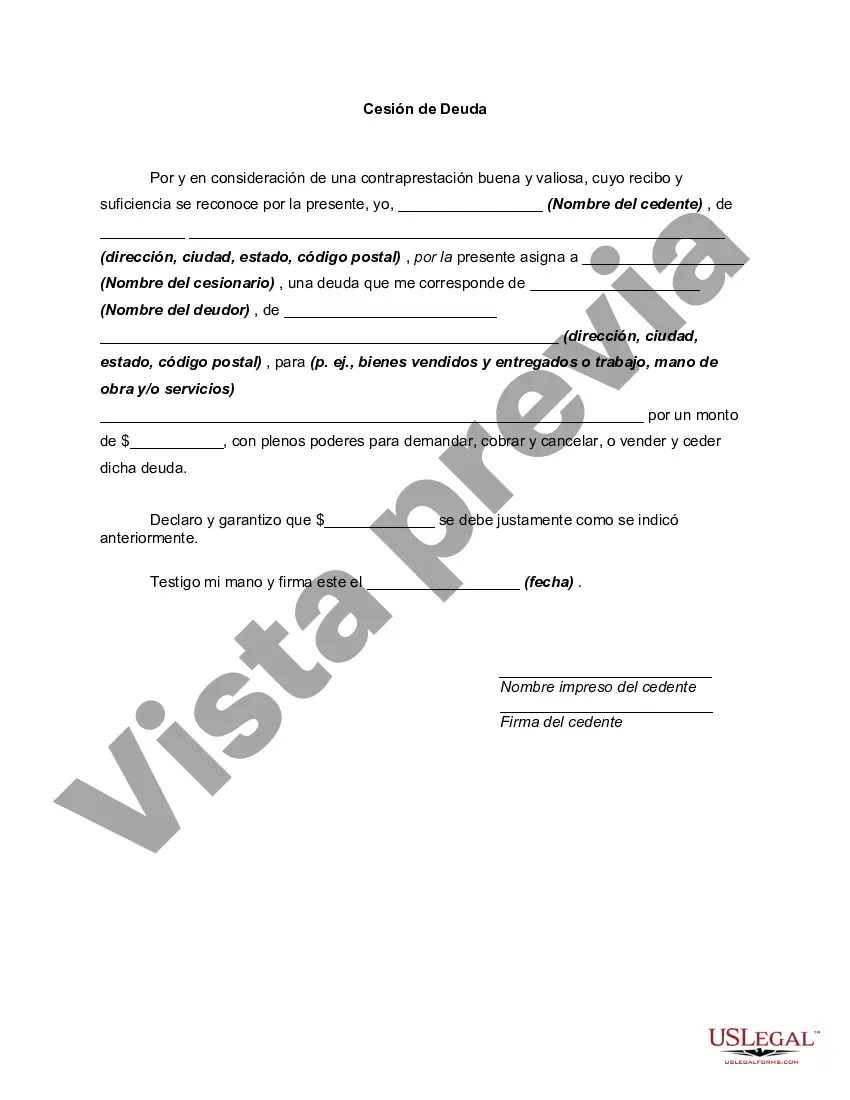

Bexar Texas Assignment of Debt is a legal process whereby the rights and obligations of a debt are transferred from one party to another. This document plays a vital role in the debt collection process, allowing creditors to assign unpaid debts to collection agencies or other entities for further pursuit. In Bexar County, Texas, there are several types of Assignment of Debt that exist, including: 1. Voluntary Assignment: This type of assignment occurs when a debtor willingly transfers their debt to another party. This usually happens when the original creditor sells the debt to a third-party buyer, often at a discounted price. 2. Involuntary Assignment: In some cases, a debt can be involuntarily assigned when the court orders the transfer of debt from one party to another. This can occur in situations such as divorce, bankruptcy, or legal judgments. 3. Real Estate Assignment: Bexar Texas allows for the assignment of debts related to real estate transactions. This type of assignment is commonly seen in mortgage agreements, where the mortgage lender may transfer the right to collect monthly mortgage payments to another financial institution. 4. Business Debt Assignment: Businesses in Bexar County, Texas, often engage in the assignment of debt to manage their financial obligations. This could include transferring outstanding invoices, unpaid loans, or credit lines to another company or debt collection agency. 5. Medical Debt Assignment: Healthcare providers in Bexar County can assign unpaid medical bills to specialized medical debt collection agencies. These agencies take over the collection process on behalf of the healthcare provider, allowing them to focus on patient care. 6. Consumer Debt Assignment: This type of assignment pertains to debts owed by individuals for personal expenses, such as credit cards, personal loans, or student loans. Original creditors might assign these debts to collection agencies to recover the outstanding balance. Regardless of the type, the Bexar Texas Assignment of Debt is a legally binding document that outlines the specifics of the transfer, including the original debt amount, contact information, rights and responsibilities of both parties, and any applicable terms and conditions. The document serves as evidence of the transfer, ensuring transparency and protection for all involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Cesión de Deuda - Assignment of Debt

Description

How to fill out Bexar Texas Cesión De Deuda?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a Bexar Assignment of Debt meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Bexar Assignment of Debt, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Bexar Assignment of Debt:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Bexar Assignment of Debt.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!