Harris Texas Assignment of Debt is a legal mechanism by which a debtor transfers the rights and obligations of the debt to a third party, known as the assignee. This process generally occurs when an individual or business owes a debt to a creditor and decides to assign that debt to someone else. In Harris County, Texas, there are a few different types of Assignment of Debt that individuals and businesses may encounter. One common type is the assignment of consumer debt, where a consumer debtor assigns their debts, such as credit card debts, personal loans, or medical bills, to a debt buyer or collection agency. This allows the assignee to collect the debt directly from the debtor and often involves negotiation of a new payment plan or settlement agreement. Another type of Assignment of Debt in Harris Texas pertains to commercial debt. This involves businesses assigning their outstanding debts, such as unpaid invoices or contractually owed payments, to other businesses or financial institutions. Commercial debt assignments can be voluntary, where the debtor agrees to the transfer, or involuntary, where a court order or judgment assigns the debt. In both cases, the assignee may seek to recover the outstanding debt owed to the original creditor. It is important to note that Harris Texas Assignment of Debt is subject to specific legal requirements and regulations. Both debtors and assignees must adhere to the Texas Debt Collection Act, which outlines how debt collection can be conducted in the state. This act protects debtors from unfair or abusive collection practices and requires assignees to provide certain notifications and disclosures to the debtor. In summary, Harris Texas Assignment of Debt is a process in which debtors transfer their obligations to third parties. Consumer debt and commercial debt assignments are the two primary types encountered in Harris County, Texas. Debtors and assignees alike must comply with the Texas Debt Collection Act to ensure fair and legal debt collection practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Cesión de Deuda - Assignment of Debt

Description

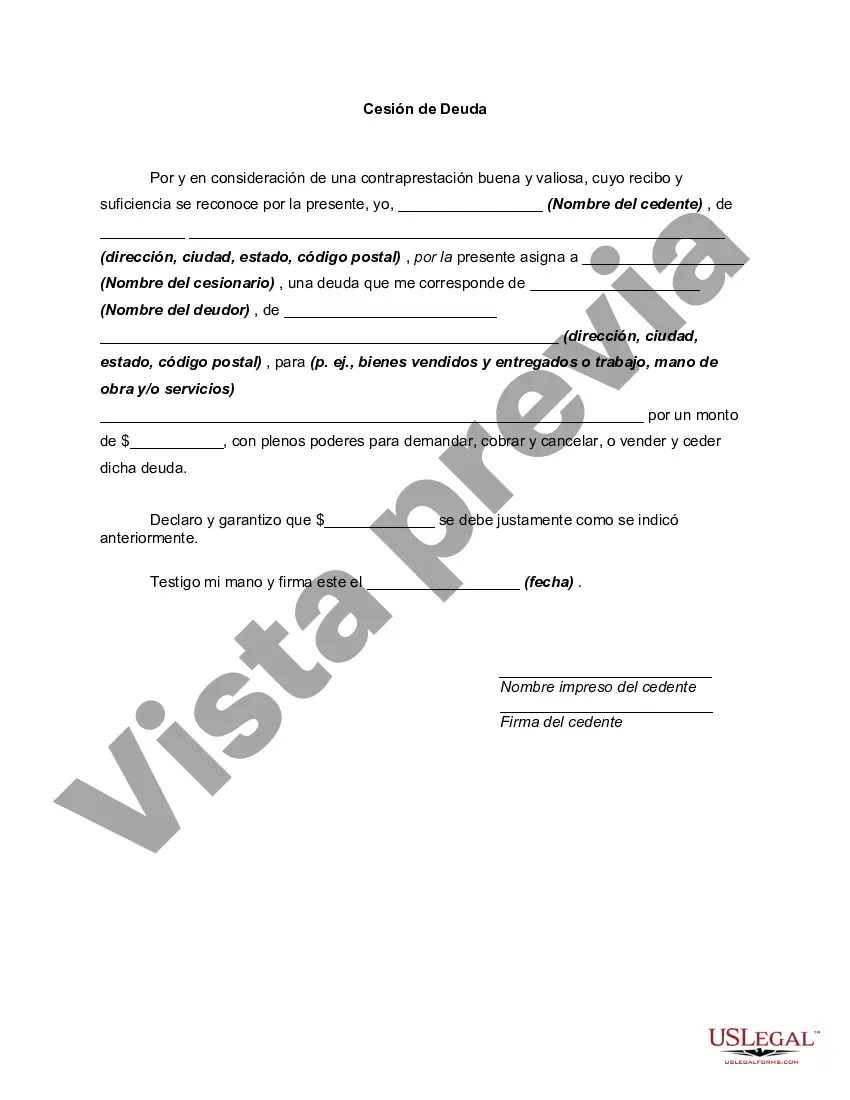

How to fill out Harris Texas Cesión De Deuda?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Harris Assignment of Debt without professional assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Harris Assignment of Debt on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Harris Assignment of Debt:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!