Houston Texas Assignment of Debt is a legal process where a debtor transfers his or her debt obligations to another party. This transfer ensures that the new party becomes the legal owner of the debt and assumes the responsibility of collecting the outstanding amount. Houston, Texas, being a major city in the United States, follows specific rules and regulations when it comes to Assignment of Debt. There are various types of Assignment of Debt in Houston, Texas, including: 1. Voluntary Assignment of Debt: This type of Assignment of Debt occurs when a debtor willingly transfers his or her debt obligations to another party. The debtor and the new party enter into an agreement, usually called an assignment agreement, which outlines the terms and conditions of the transfer. 2. Involuntary Assignment of Debt: In some cases, a debtor may face legal actions, such as lawsuits or judgments, which can result in the involuntary assignment of debt. This occurs when a court orders the transfer of the debt to a new party as part of a legal proceeding. 3. Assignment of Debt in Business Transactions: Businesses in Houston, Texas, often engage in Assignment of Debt as part of their operations. This can happen when one company sells its outstanding debts to another company, often referred to as a debt buyer. The debt buyer then assumes the responsibility of collecting the debts from the original debtors. 4. Medical Debt Assignment: In the healthcare industry, medical facilities and practitioners may assign their unpaid medical bills to a third-party collection agency. This ensures that the medical facility can focus on patient care, while the collection agency takes over the responsibility of recovering the outstanding debt from the patients. 5. Mortgage Debt Assignment: In real estate transactions, mortgage lenders may assign their mortgage loans to another financial institution or investor. This type of assignment allows the original lender to free up capital to fund new loans, while the new lender or investor becomes the new holder of the mortgage note and collects future payments from the borrower. Overall, Assignment of Debt in Houston, Texas, involves the transfer of debt obligations from one party to another through either voluntary or involuntary means. This legal process helps debtors and creditors manage their financial obligations while ensuring that the assigned party assumes the responsibility of collecting the outstanding amount.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Cesión de Deuda - Assignment of Debt

Description

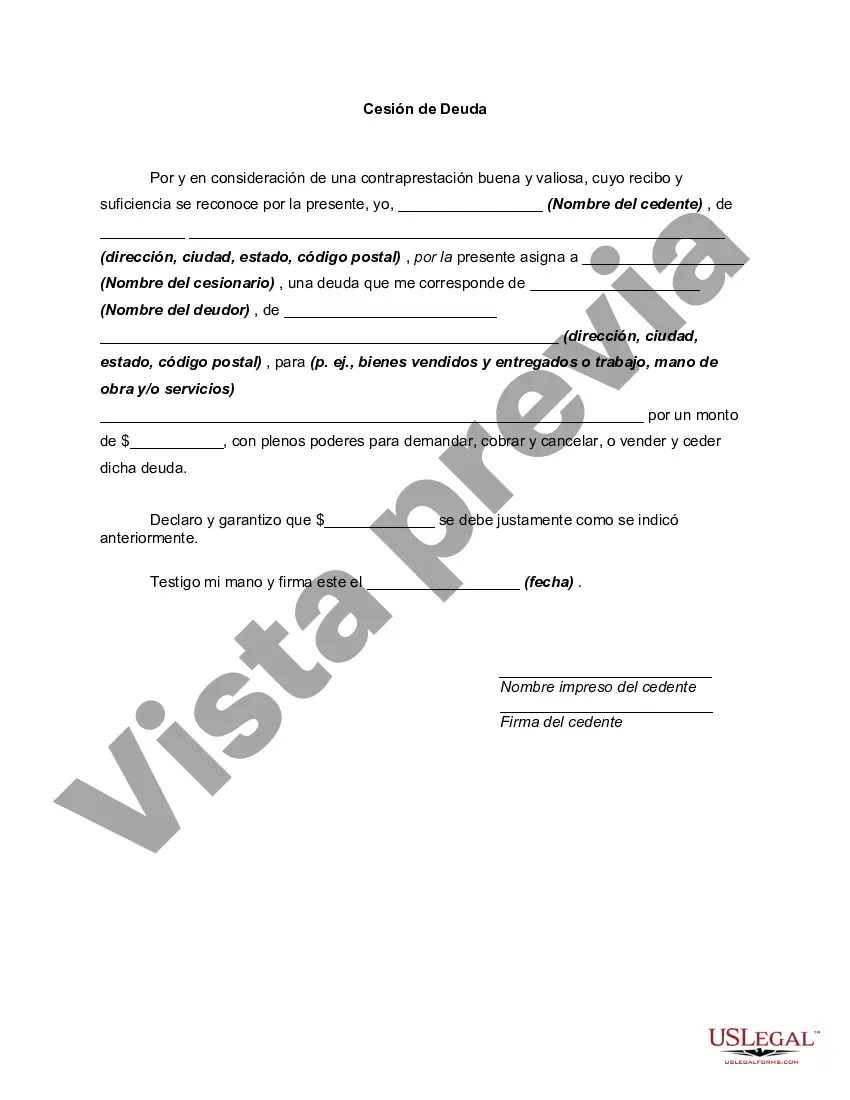

How to fill out Houston Texas Cesión De Deuda?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Assignment of Debt, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the current version of the Houston Assignment of Debt, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Assignment of Debt:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Houston Assignment of Debt and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!