Phoenix, Arizona Assignment of Debt: What it is and its Various Types In Phoenix, Arizona, a common legal practice pertaining to debt involves an "Assignment of Debt." This refers to the transfer of a debt obligation from an original creditor to a third-party entity. Usually, financial institutions, such as banks and credit card companies, employ this mechanism to expedite debt recovery processes or to consolidate their balance sheets. The Assignment of Debt process ensures that the third-party entity assumes the rights and responsibilities originally held by the initial creditor. There are various types of Assignment of Debt practices recognized in Phoenix, Arizona. Here are a few significant ones: 1. Secured Debt Assignment: This type of Assignment of Debt relates to debts secured by collateral or assets, such as mortgages or car loans. When a debtor fails to fulfill their repayment obligations, the original creditor may assign the debt to another party, often a debt collection agency. The new assignee assumes the rights of the original creditor and can pursue debt recovery, potentially leading to foreclosure or repossession of the secured asset. 2. Unsecured Debt Assignment: In contrast to secured debts, unsecured debts lack collateral. Credit card debts, personal loans, and medical bills frequently fall under this category. If a debtor defaults on an unsecured debt, the original creditor may assign the debt to a collection agency or a buying company. Typically, these assignments are sold at a discounted value, allowing the purchasing entity to profit from potential debt recovery efforts. 3. Commercial Debt Assignment: This category encompasses debts owed by businesses or commercial entities. Both secured and unsecured debt assignments can apply to this type of debt. Creditors, such as suppliers or vendors, may assign their outstanding debts to third-party collection agencies or specialized debt buyers. Commercial debt assignments often involve more complex legal processes, as they can entail significant sums and have broader financial implications for the parties involved. 4. Medical Debt Assignment: This type of assignment pertains explicitly to medical debts incurred by individuals seeking healthcare services. Hospitals, clinics, or medical practitioners often transfer unpaid medical bills to collection agencies. These agencies may then engage in debt collection activities, aiming to recover the outstanding amounts from the debtor. Understanding the various types of Assignment of Debt practices in Phoenix, Arizona is crucial for both debtors and creditors. Debtors should keep track of their financial obligations to avoid potential assignment scenarios, which can complicate debt repayment. On the other hand, creditors may pursue Assignment of Debt to recover outstanding amounts efficiently and mitigate potential losses. Disclaimer: The information provided above is for informational purposes only and should not be considered legal advice. It is advisable to consult with a qualified attorney for specific guidance regarding Assignment of Debt in Phoenix, Arizona.

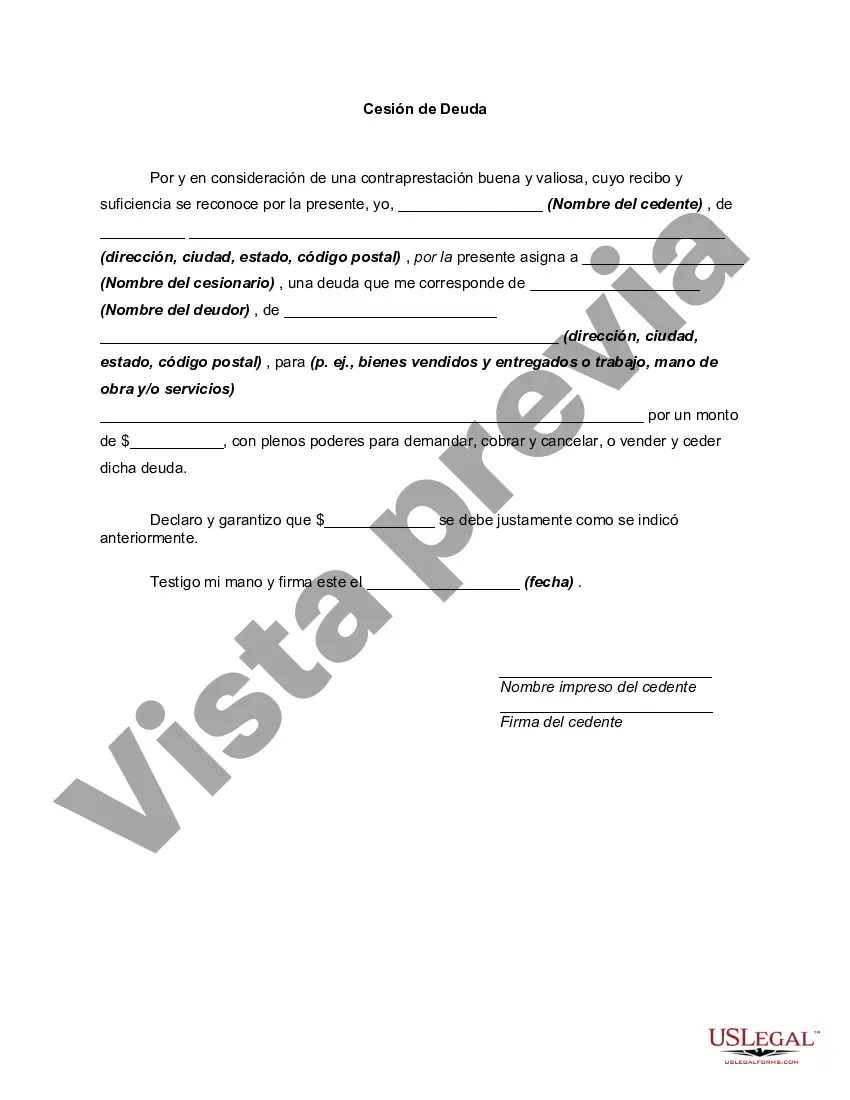

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Cesión de Deuda - Assignment of Debt

Description

How to fill out Phoenix Arizona Cesión De Deuda?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Phoenix Assignment of Debt, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how to find and download Phoenix Assignment of Debt.

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the related document templates or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Phoenix Assignment of Debt.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Phoenix Assignment of Debt, log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you have to cope with an extremely complicated situation, we advise getting an attorney to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and purchase your state-specific paperwork effortlessly!